Bitget TradFi User Guide: How to Trade Gold, Crude Oil, Forex, and More on Bitget

We're excited to announce the official launch of Bitget TradFi. This product brings traditional financial assets—such as forex, gold, and stock CFDs—onto Bitget, allowing you to trade global traditional markets directly with a single account and USDT as margin. Whether you're looking to diversify beyond crypto or take leveraged positions in traditional markets, Bitget TradFi offers a one-stop solution with advanced tools and ultra-low fees. This guide walks you through getting started, the assets available for trading, and how to place trades—all without needing any third-party applications.

What is Bitget TradFi?

Bitget TradFi is a leading cross-market trading platform that seamlessly integrates traditional financial assets (such as forex, gold, and stock CFDs) with cryptocurrency. With just one account and USDT as margin, you can trade directly in global traditional financial markets—no fiat deposits or withdrawals needed, no switching platforms, and no physical asset ownership required.

How Bitget TradFi solves user pain points

You no longer need multiple trading apps. With just the Bitget app, you can access a full suite of global financial products. Bitget TradFi makes it easy for crypto users to enter traditional markets while maintaining the same user-first philosophy behind our crypto products—bridging digital assets with real-world finance.

| Pain points |

Bitget TradFi solutions |

| Complex cross-market operations (difficult fiat deposits or withdrawals) |

One-stop USDT trading; no fiat conversion needed |

| Low leverage and poor liquidity for traditional assets |

Up to 500x leverage + deep order books |

| Difficult for beginners to enter traditional markets |

Smart copy trading + demo trading |

| Cumbersome multi-account management |

Use a single account to manage all assets |

| Small or unknown traditional exchanges with rug-pull risk |

Bitget's strong global reputation and trustworthiness |

Key features and highlights of Bitget TradFi

Bitget TradFi is a powerful platform for one-stop trading across cryptocurrencies, forex, gold, crude oil, stocks. Using USDT as margin, you can seamlessly switch between asset classes without changing apps or accounts. Enjoy a fast and intuitive experience built for crypto-native users looking to explore traditional markets with institutional-grade tools and leverage.

| Features |

Notes |

| Multi-asset support |

Forex (EUR/USD, USD/JPY), gold (XAU/USD), crude oil (WTI), global stocks (S&P 500, NASDAQ 100), and more |

| Leverage |

Up to 500x (forex/gold) |

| CFD trading |

Trade without holding the underlying asset, lowering the entry barrier |

| Smart copy trading |

Replicate elite traders' strategies—ideal for beginners |

| MT5 auto trading |

Supports Expert Advisors (EAs) for automated/programmatic trading |

| Compliance and security |

FSC license + Bitget Protection Fund + segregated hot/cold wallets |

Bitget TradFi usage guide

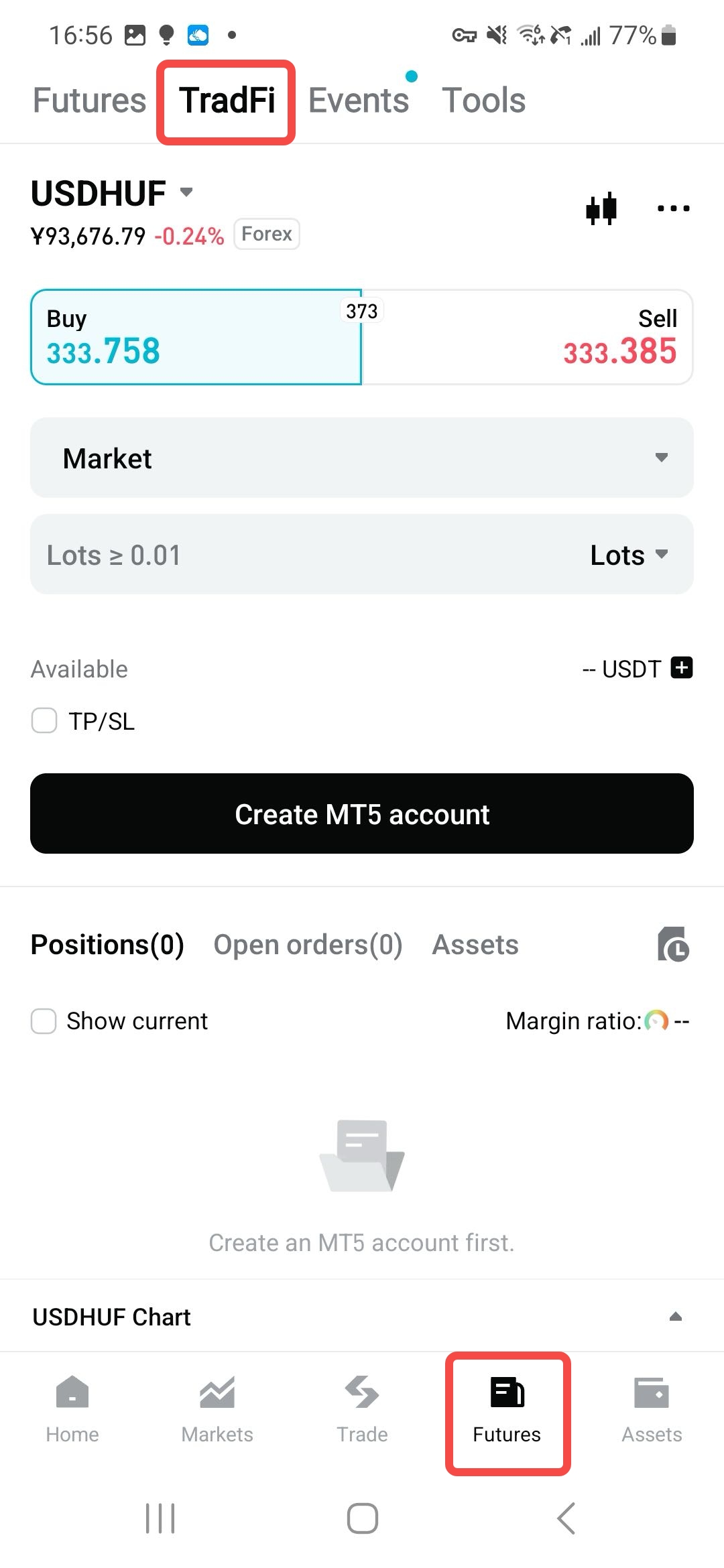

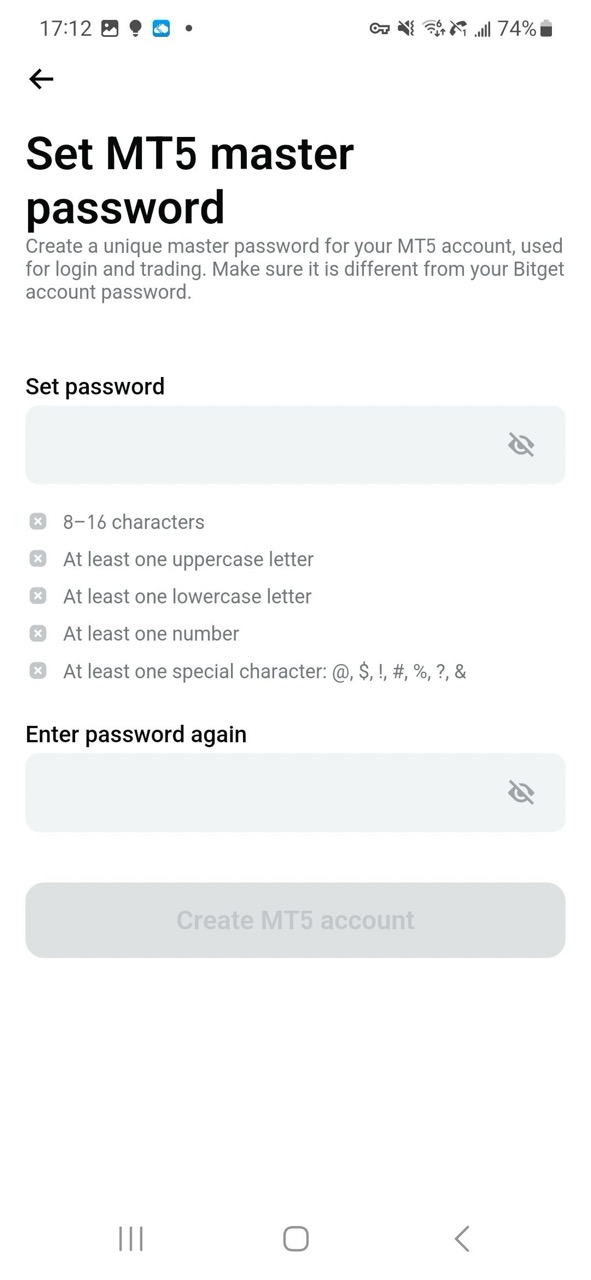

Step 1: Open your TradFi Account

1. Log in to the Bitget website or Bitget app.

2. Go to Futures > TradFi.

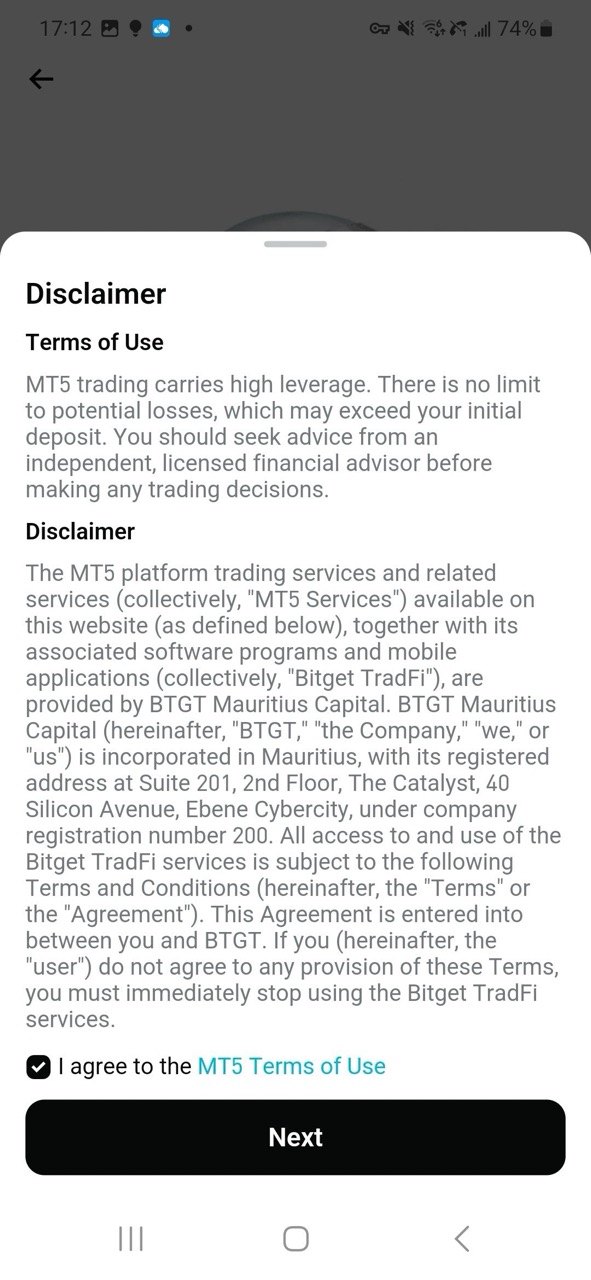

3. Select Create MT5 Account and follow the instructions to complete the setup.

|

|

|

Note: Ensure your main Bitget account has completed identity verification.

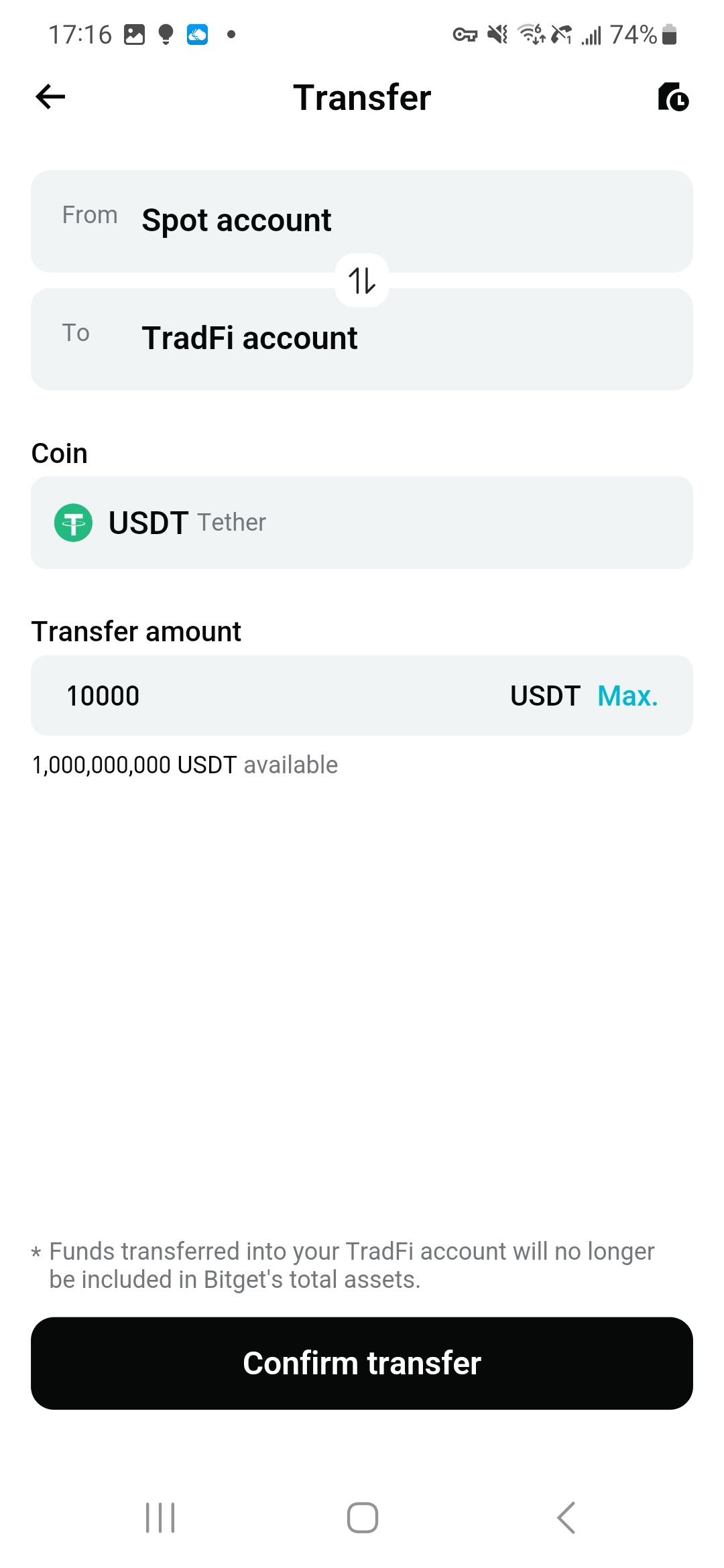

Step 2: Transfer USDT to your TradFi account

After creating your MT5 account, select Transfer Funds, or go to your profile > Assets > Transfer. Enter the amount of USDT you want to transfer and select Confirm Transfer. Transfers are instant.

Important: Bitget TradFi currently supports USDT only as margin. Other assets such as BTC and ETH are not supported.

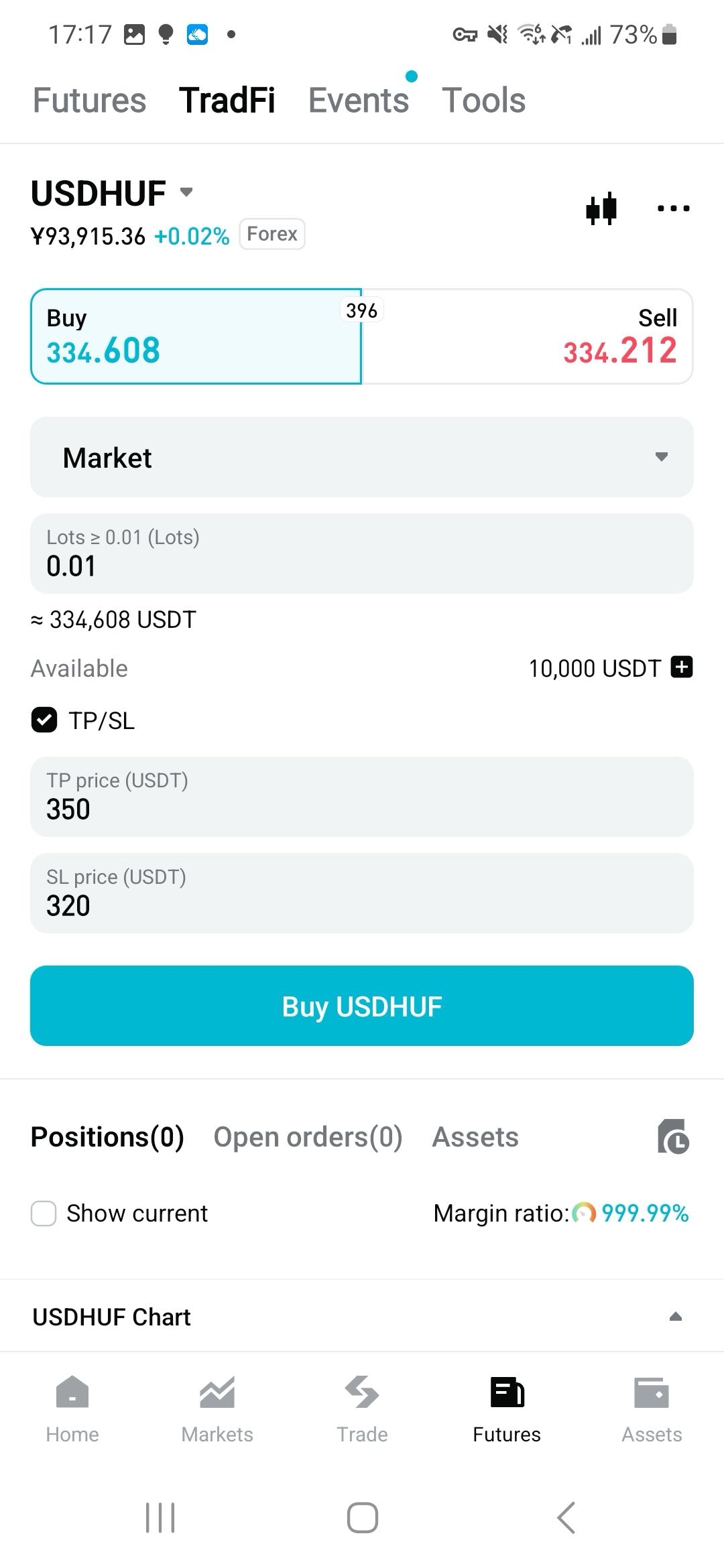

Step 3: Start trading on TradFi (using USD/HUF as an example)

1. After transferring funds, return to the TradFi page and select a trading pair. We'll use USD/HUF as the example.

2. Select the USD/HUF pair to access the trading parameters. You can set the lot size (start small), leverage (set to maximum by default, but you can reduce it manually), and TP/SL (strongly recommended).

3. Tap Buy or Sell to place your order.

Step 4: Manage orders

You can view your orders from the Assets tab on the trading page, or return to the homepage, tap Assets at the bottom-right of the navigation bar, and locate the TradFi section.

FAQ

1. Is identity verification required for Bitget TradFi trading?

Yes. Users must complete identity verification to trade, including submitting a valid proof of address. After activating your TradFi account, you will have a 30-day grace period. If proof of address is not submitted within this period, opening new positions will be restricted in accordance with compliance requirements.

2. Does TradFi support sub-accounts?

No, Bitget TradFi does not support sub-accounts. Only your main Bitget account can activate a TradFi (MT5) account.

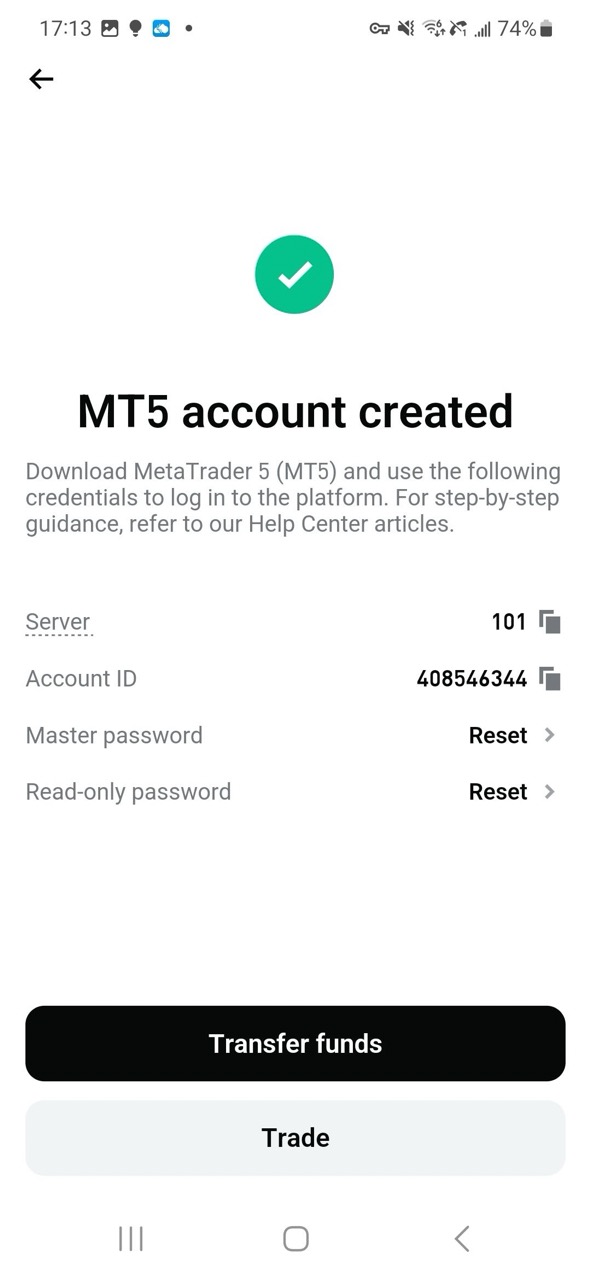

3. How can I find my TradFi login ID?

Your TradFi login username and password are different from your Bitget account credentials. After successfully activating your TradFi account, a pop-up window will display your login details.

If you forget your TradFi account ID, go to the TradFi assets page, where your login ID is displayed at the top.

4. What time zone does Bitget TradFi use, and how can I change it?

By default, Bitget TradFi displays all times in UTC+2. This setting cannot be changed. During daylight saving time, the system automatically shifts to UTC+3.

5. Are there any margin requirements for trading on Bitget TradFi?

Each Bitget TradFi futures has leverage and margin ratios set by Bitget, with a maximum of 500x.

6. How are CFDs (Contracts for Difference) settled on TradFi?

All CFD products are settled in USD, while deposits are made in USDT. During CFD trading, the system automatically exchanges between USDT and USD.

7. What leverages are available on Bitget TradFi? Can I change the leverage?

Each futures on Bitget TradFi has its own default leverage setting. Forex, precious metals, oil, and stocks support up to 500x. Leverage settings are fixed and cannot be changed manually.

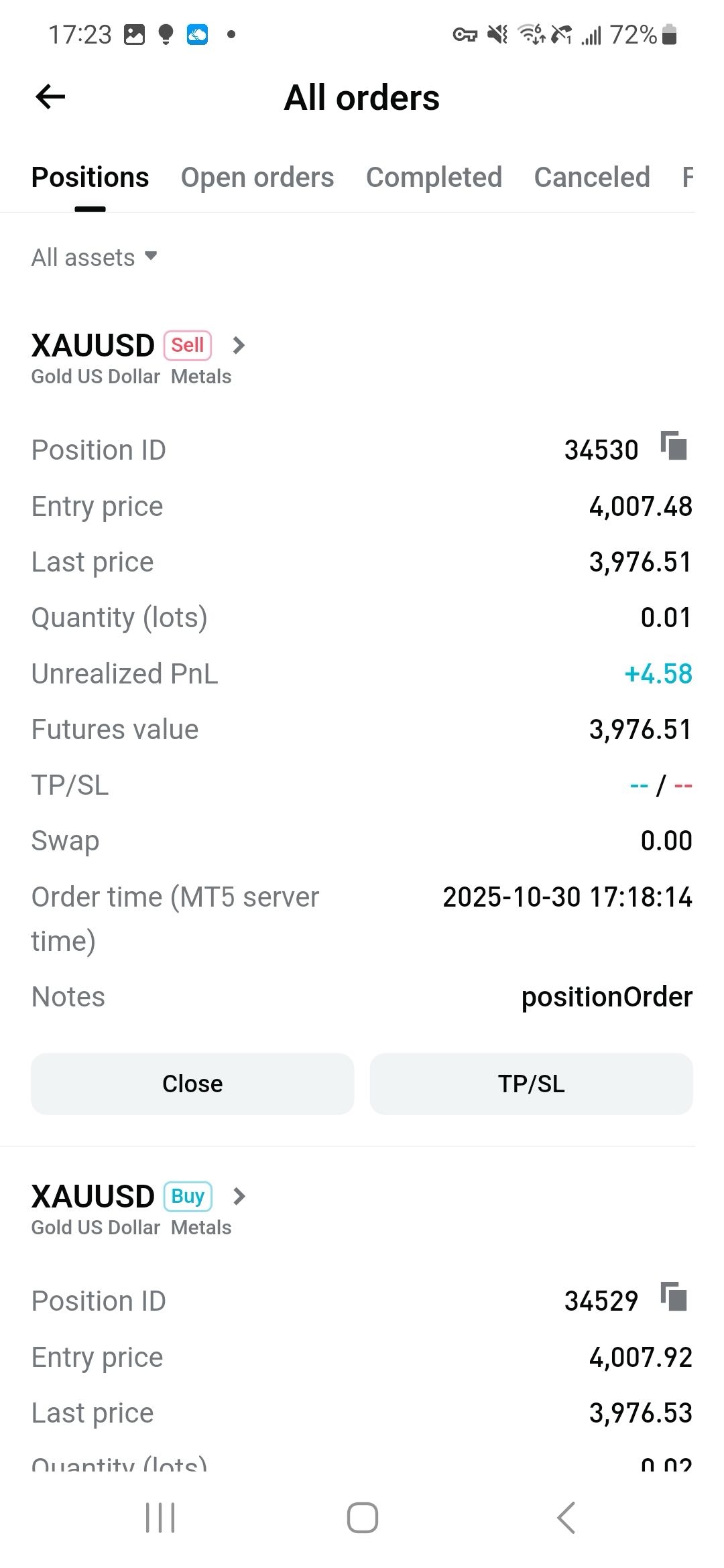

8. Can I trade in hedging mode?

Yes. Bitget TradFi allows trading in hedging mode. With this feature, you can open multiple independent positions on the same instrument, both long (buy) and short (sell). Each position is displayed as a separate line in the Positions tab, giving you flexibility to build more complex strategies. For example, you could open a long position to profit from rising prices while also holding a short position to hedge against potential downside risk.

9. Can I adjust the negative balance of my Bitget TradFi account?

No. Negative balances are automatically reset to zero. Users cannot make manual adjustments.

Get started with Bitget TradFi

Ready to trade forex, gold, and stock CFDs? Bitget TradFi brings traditional markets to your fingertips with seamless USDT trading—bridging crypto and TradFi in one powerful platform. Getting started is simple: create your Bitget account, complete identity verification, then activate your TradFi account, you're just minutes away from trading global markets!