Nokia Stock Hits 10-Year High — Turns Out, AI Is the New Ringing Tone

A decade ago, Nokia was known for phones. Its ringtone was iconic, its hardware was everywhere, and for a while, it dominated the global mobile market. But after losing ground in the smartphone era and exiting the handset business, Nokia faded from the spotlight. Investors largely filed it under "legacy tech" — a steady but unexciting player in telecom equipment. That changed in October 2025.

Nokia’s stock has just surged to a 10-year high, jumping more than 20% in a single day after Nvidia announced a $1 billion investment for a 2.9% stake in the company. It wasn’t just a financial boost — it was a strategic signal. Nvidia’s backing has reframed how the market sees Nokia: no longer just a supplier of 5G base stations, but a potential enabler of the AI-driven networks and data centers of the future. As telecom, cloud, and AI infrastructure converge, Nokia seems to be in the right place — at the right time — with the right partner. In 2025, AI is the new ringing tone.

The Rise of Nokia: From Iconic Ringtones to AI Ambitions

Nokia’s reinvention didn’t happen overnight. After selling its handset business to Microsoft in 2014, the company turned its full attention to building telecommunications infrastructure — a sector far less glamorous, but essential. For most of the last decade, Nokia competed with the likes of Ericsson and Huawei, providing 4G and 5G networking gear to carriers around the world. It was a solid business, but not one that generated much buzz on Wall Street.

That started to change in recent years. Nokia began expanding its focus beyond traditional telecom customers, moving into high-performance optical networking, edge computing, and data center interconnects. These technologies are critical to the AI boom — powering the data flow behind machine learning workloads and generative AI applications. The company’s 2023–2025 strategic plan emphasized AI-ready infrastructure, and under CEO Pekka Lundmark, and more recently Justin Hotard, Nokia pushed deeper into the cloud and enterprise space. By the third quarter of 2025, revenue from hyperscale and AI customers had grown significantly — a clear signal that Nokia was becoming more than a telecom vendor. It was evolving into a full-stack enabler of AI-powered connectivity.

The Catalyst: Nvidia’s $1 Billion AI Endorsement

The market rarely shrugs when Nvidia makes a move — and its $1 billion investment in Nokia was no exception. On October 28, 2025, Nvidia announced it would acquire a 2.9% stake in Nokia by purchasing approximately 166 million newly issued shares at $6.01 each. This makes Nvidia one of Nokia’s largest shareholders and, more importantly, a strategic partner in co-developing AI-powered network infrastructure.

The investment isn’t just symbolic. Alongside the capital infusion, the two companies revealed plans to jointly build AI-native networking solutions, blending Nvidia’s GPU-driven computing platforms with Nokia’s expertise in cloud, fiber, and wireless infrastructure. The goal? To make global networks smarter, faster, and better optimized for the massive data demands of artificial intelligence. They also plan to work with T-Mobile US on developing and trialing next-generation 6G radio technologies starting as early as 2026.

For Nokia, this deal is more than a funding boost — it’s a strategic validation. Nvidia’s entry puts a spotlight on Nokia’s AI-readiness and fast-tracks its transition into a key player in the next wave of AI-enabled connectivity. And for investors, the Nvidia name alone was enough to reprice Nokia stock overnight — signaling a much broader transformation in progress.

How AI Became Central to Nokia’s Growth Model

Why is artificial intelligence such a big deal for Nokia’s business right now? Because the world’s explosive demand for AI computing power has created a surge in need for ultra-fast, scalable network infrastructure — exactly the kind of technology Nokia builds. As AI workloads grow more complex and widespread, telecom and cloud providers are rethinking how data moves across their systems. Nokia has positioned itself at the center of that transformation, evolving from a traditional telecom equipment supplier to an AI-era infrastructure partner. As one market analysis put it: “Nokia has been pivoting into AI data centers — and Nvidia evidently likes the strategic shift.”

That pivot is already showing up in Nokia’s numbers. In Q3 2025, the company posted an 11.6% year-over-year increase in revenue, driven largely by growing demand for AI-optimized networking products. Sales in its Optical Networks division — which provides fiber links crucial for AI data centers — rose 19%, while Cloud and Network Services grew 13%, reflecting increased investment from telecom operators upgrading to AI-capable core networks. These are strong growth signals for a company that, until recently, was seen as a slow-moving legacy player.

Guiding this transformation is CEO Justin Hotard, who stepped in with deep roots in data centers and AI from his tenure at Intel. Under his leadership, Nokia is integrating Nvidia’s AI software and hardware into its systems, pushing intelligence to the network edge — closer to where data is generated. This strategic shift isn’t just about efficiency; it’s about relevance. Nokia wants to be embedded in the next wave of global connectivity — where networks don’t just carry data, but analyze and act on it in real time. For Nokia, AI isn’t just an add-on. It’s the new engine powering the company’s future.

Market Rally and Investor Sentiment

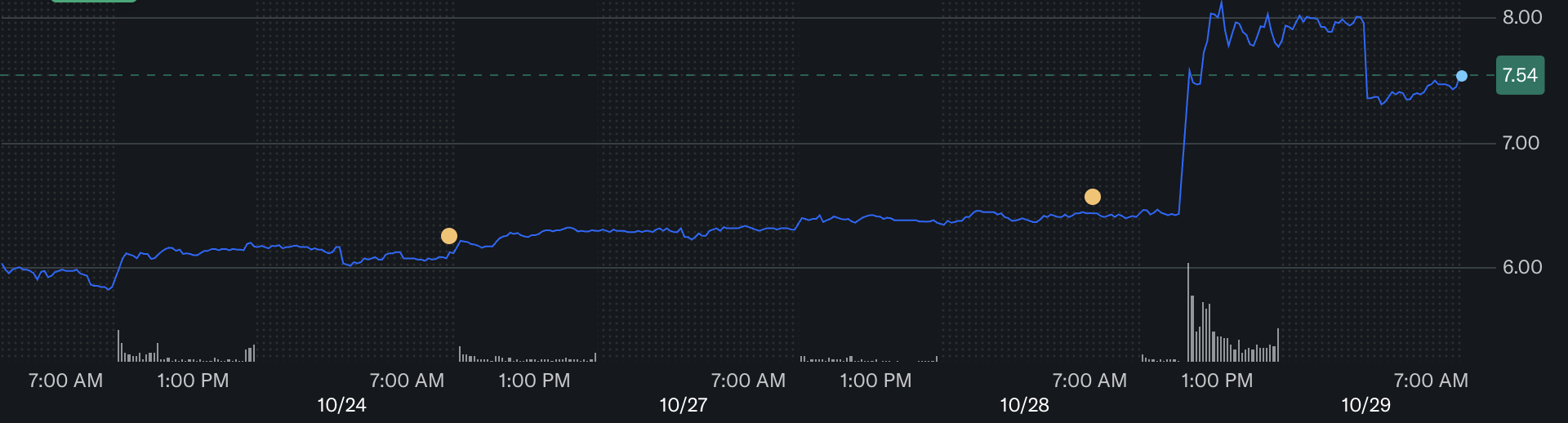

Nokia Oyj (NOK) Price

Source: Yahoo Finance

Nokia’s transformation hasn’t gone unnoticed by the markets. Even before the Nvidia deal, its stock had been gaining momentum throughout the second half of 2025 as investors warmed to its AI infrastructure strategy. But after the $1 billion announcement, momentum turned into a breakout. In just one day, Nokia’s U.S.-listed shares surged over 20%, pushing the stock to its highest price in a decade. By late October, the stock was up approximately 70% year-to-date, outperforming many large-cap tech peers and re-establishing Nokia as a company worth watching.

The rally has also changed how Nokia is valued. Traditionally seen as a conservative telecom hardware provider, Nokia traded at a discount to peers like Cisco and Ericsson. That’s shifting. After the Nvidia-driven spike, Nokia now trades at about 17× forward earnings — a multiple more typical of AI-adjacent or cloud-infrastructure stocks. In comparison, Ericsson trades around 13×, and Cisco, which also leans into AI infrastructure, sits closer to 17.5×. This re-rating shows that investors now see Nokia as a growth-oriented player, not just a stable legacy brand.

Importantly, analysts don’t believe the stock has overheated — at least not yet. Nokia’s market cap of $45 billion, strong net cash position (~€3 billion), and consistent profitability offer a solid foundation. The stock also carries a modest dividend yield of ~1.9%, and a price-to-book ratio of around 1.3, suggesting the rally is still grounded in fundamentals. That said, expectations are now higher. With the Nvidia vote of confidence and a major strategy shift in motion, investors are watching closely to see if Nokia can execute — and prove this new chapter has staying power.

Nokia Stock Price Prediction and Future Outlook

With its stock at a 10-year high and fresh momentum from Nvidia’s $1 billion endorsement, Nokia’s future is being re-evaluated by analysts — and the outlook is cautiously optimistic. Some forecasts suggest Nokia’s U.S.-listed shares (NYSE: NOK), which recently hit the $8 mark, could reach $10.20 to $10.50 within the next 12 months. That would represent roughly 27% upside from current levels. Analysts point to the company’s growing relevance in AI infrastructure, its healthy balance sheet, and its ability to monetize the Nvidia partnership over time as key drivers behind this bullish sentiment.

Much of that optimism hinges on execution. Nokia is still in transition, and its bold pivot toward AI and advanced networking will take time to fully deliver results. The company’s leadership expects new AI-centric product lines — including those co-developed with Nvidia — to begin generating significant revenue by 2027. If successful, these solutions could unlock long-term contracts with cloud providers, telecom operators, and even governments, tapping into what could be a multi-billion-dollar market for AI-native infrastructure.

That said, there are risks. Telecom operator spending remains under pressure globally, and 6G is still several years away from commercial rollout. If the AI infrastructure wave slows or competition from rivals like Ericsson or Huawei intensifies, Nokia’s growth could face headwinds. Still, most analysts agree that the company is better positioned than it has been in years. With strong cash reserves, rising investor confidence, and a clear strategic direction, Nokia has the potential not just to defend its recent gains — but to build on them.

Conclusion

Nokia’s climb to a 10-year stock high is more than a short-term rally — it marks a turning point in how the market sees the company. With a $1 billion vote of confidence from Nvidia and a growing presence in AI infrastructure, Nokia is no longer just a legacy telecom vendor. It’s repositioning itself at the intersection of cloud, connectivity, and artificial intelligence — and investors are responding to that shift. The strong performance in its optical and cloud segments, combined with a clear strategic vision, suggests this momentum isn’t just hype — it’s built on meaningful change.

That said, the road ahead will require execution. Nokia must turn partnerships into products, and strategy into sustained revenue. But for the first time in years, it has both the market’s attention and a credible path toward long-term growth. The familiar ringtone of its past may be gone — but the sound of servers, data, and AI processing just might be Nokia’s new rhythm. And if it stays in tune, this could be one of tech’s most unexpected second acts.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.