Solana ETF on Nasdaq: Bitwise Solana ETP & Staking Rewards—2025 Investor’s Guide

Just last year, everyday investors witnessed a historic shift as the first spot Bitcoin and Ether ETFs launched on major US exchanges. These funds made it easier and safer for people to add top cryptocurrencies to their investment portfolios—no special wallets or technical know-how required. Shortly after, the Osprey Solana Staking ETF appeared, breaking new ground by letting investors earn rewards from Solana’s staking system right through a regular brokerage account.

Now, in October 2025, Solana is stepping further into the spotlight with the debut of the Bitwise Solana ETP on Nasdaq. This is more than just another crypto fund—it’s the first Solana ETF on a major exchange that combines price growth potential with built-in staking rewards. Whether you’re new to cryptocurrency or looking to diversify beyond Bitcoin and Ether, these new Solana ETFs make participating in the world of digital assets easier and more rewarding than ever before.

What is the Solana ETF and Why Is It a Big Deal?

Making Solana Accessible to All

A Solana ETF is a regulated exchange-traded fund that tracks the value and performance of Solana (SOL), letting investors buy and sell Solana exposure in their regular brokerage accounts, including Nasdaq accounts. No crypto wallets, no blockchain know-how—just direct Solana investment with traditional security and liquidity.

The Bitwise Solana ETP takes this further:

-

100% Direct Spot Exposure: The Bitwise Solana ETP physically holds SOL, offering true tracking rather than synthetics.

-

Built-in Staking: Bitwise stakes ALL of the fund’s SOL, distributing Solana staking rewards automatically to shareholders. No other US Solana ETF on Nasdaq or elsewhere offers this full integrated approach at scale.

-

Trading on Nasdaq: As one of the first altcoin spot ETFs available on Nasdaq, the Bitwise Solana ETP sets the bar for transparent, regulated SOL investing.

Solana Staking APY History: What Can Investors Expect Today?

How Has Solana Staking APY Changed Over Time?

The attractiveness of the Solana ETF is partly due to staking—the process of locking SOL to earn network rewards. Here’s a quick history:

-

2021: Solana staking APY was exceptionally high, often over 9%, as the network worked to attract validators and early adopters.

-

2022–2023: With more staking participation, APYs moderated, generally ranging from 6.5% to 7.5%.

-

2024: The APY stabilized between 6.8% and 7.3%, reflecting maturing tokenomics and ecosystem security.

-

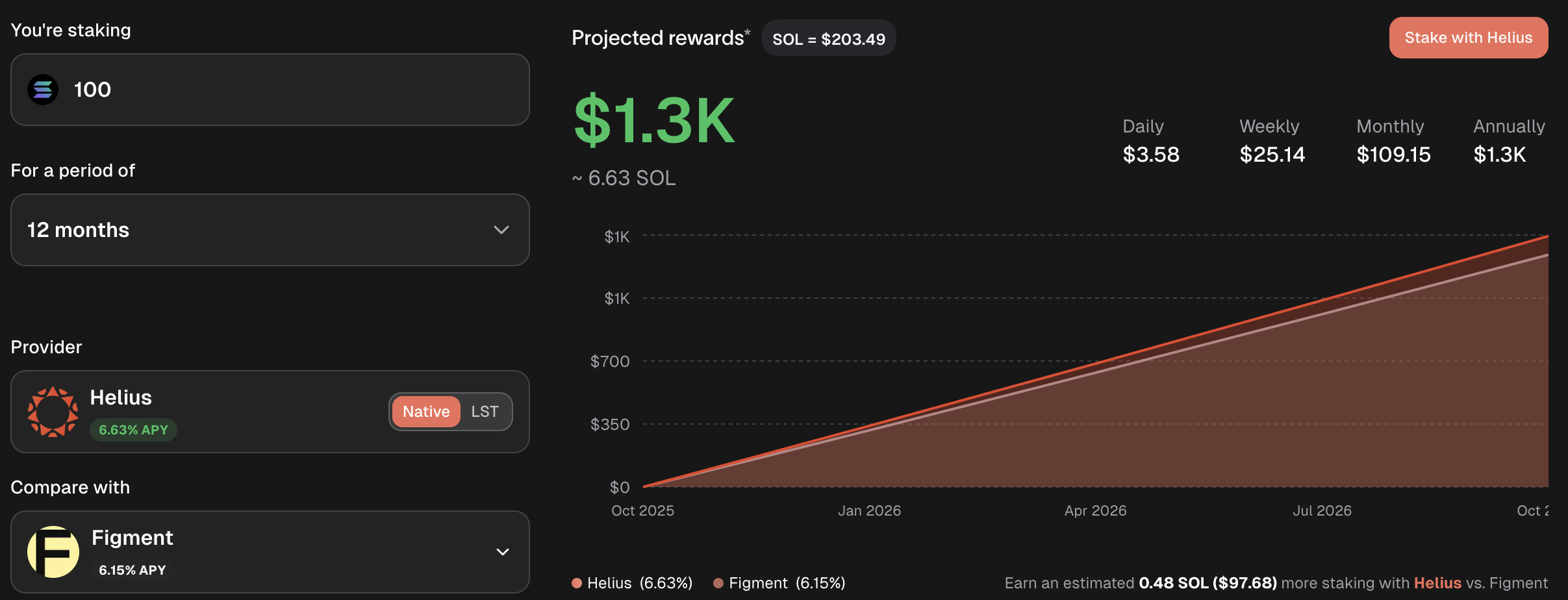

Now, October 2025: Solana staking APY averages 7.1% across major validators. This competitive yield is passed through to Bitwise Solana ETP holders automatically.

Source: Helium

Why Staking in an ETF Matters:

Most staking requires technical expertise or risky "yield-chasing" on DeFi. The Bitwise Solana ETP lets you capture this yield with Nasdaq-backed regulation, professional custody, and minimal fees.

Getting the Most from Your Investment: Bitwise Solana ETP on Nasdaq

Key Features Tailored for Investors

-

Ticker: BSOL

-

Exchange: Nasdaq (also available on select other US exchanges)

-

Management Fee: 0.20%, with 0% on the first $1B AUM for first three months

-

In-Kind Creation and Redemption: Keeps tracking tight to NAV

-

Backed by Helius: All staking beautifully managed under Bitwise Onchain Solutions via Helius technology

In short, the Bitwise Solana ETP on Nasdaq is an all-in-one Solana ETF solution designed for retail and institutional investors—providing instant SOL price exposure and seamless staking returns.

Solana Market Snapshot October 2025: Price, Cap & Technical Outlook

-

Current SOL Price: $203

-

Market Cap: Over $91 billion, solidifying Solana as the world’s sixth largest crypto asset

-

Recent Performance: SOL price surged 12% in the last week after $24M of fresh ETF inflows, driven by the success of the Bitwise Solana ETP on Nasdaq

-

Forecast: With both retail and institutional ETF demand accelerating, and technical resistance at $200 convincingly broken, analysts target $215 as the next key price ceiling—but volatility remains (as always in crypto).

Source: CoinMarketCap

JPMorgan estimates Solana ETFs (primarily the Bitwise Solana ETP) could attract up to $6 billion in AUM in 2025, far outpacing analyst expectations set only a year ago.

What Other Solana ETFs and Crypto ETPs Are Launching on Nasdaq and Beyond?

-

Grayscale Solana Trust (“GSOL”): Continues to grow, now supporting staking features and offered through major brokerages.

-

21Shares Solana ETF: Still awaiting regulatory greenlight as of October 2025, but expected to debut soon on Nasdaq.

-

REX/Osprey Solana Staking ETF: The first to offer direct staking exposure, but with lower AUM than Bitwise’s offering.

-

Canary Capital's Litecoin and Hedera ETPs: These and other altcoin ETFs/ETPs recently launched or announced for Nasdaq, signaling regulator confidence and deepening crypto-market integration.

Note: The SEC’s January 2024 greenlight for spot Bitcoin ETFs unleashed today’s flood of new Solana ETF, Bitwise Solana ETP, and other altcoin ETPs trading on Nasdaq.

Conclusion

October 2025 marks a tipping point: with the Bitwise Solana ETP live on Nasdaq, investing in SOL is now both easy and rewarding. By combining direct price exposure, institutional-grade custody, and built-in staking returns, the Solana ETF era is here for everyone, from first-timers to family offices. Watch nascent ETF volumes, Solana’s staking APY, and on-chain adoption metrics as this new wave of Nasdaq-listed products transforms both crypto and traditional finance.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.