News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Macro headwinds test Bitcoin price as $70K crumbles amid US market volatility2Trump filling Democratic seats at SEC, CFTC could advance crypto bill talks, TD Cowen says3Bitcoin price ignores $168M Strategy buy, and falls as Iran tensions escalate

Nvidia Has Divested From These Companies. Their Shares Are Falling.

101 finance·2026/02/18 19:33

Nestlé Considers Cutting Back Its Involvement in the Ice Cream Sector

101 finance·2026/02/18 19:30

The Graph Unveils Ambitious 2026 Technical Roadmap to Build Web3’s Data Backbone

BlockchainReporter·2026/02/18 19:21

Researcher: Expanded Cooperation Between Nvidia and Meta May Be Detrimental to Intel

新浪财经·2026/02/18 19:20

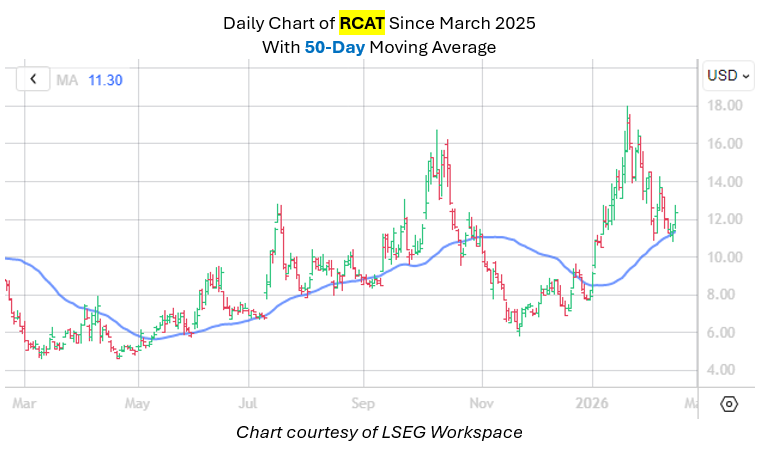

Bull Signal Flashing on Struggling Aerospace Stock

Finviz·2026/02/18 19:18

GEHC Expands BARDA Collaboration With $35M Boost for AI Ultrasound

Finviz·2026/02/18 19:12

Fed Maintains Rates as Meeting Minutes Reveal Uncertain Path Ahead

Cointurk·2026/02/18 19:12

Recursion Pharmaceuticals Stock Drops: What's Behind It?

Finviz·2026/02/18 19:09

Fed minutes: Many officials require further declines in inflation before backing rate reductions

101 finance·2026/02/18 19:06

Flash

19:21

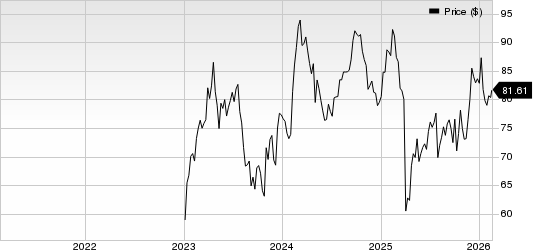

Activist investment firm Elliott Management Corp. is urging the London Stock Exchange Group (LSEG) to conduct a comprehensive review of its complex corporate structure.The current structure spans three core business segments: data services, exchange operations, and a 51% majority stake in the electronic trading platform Tradeweb Markets Inc. Elliott believes that the current structure may not fully unlock the overall value of the group. The complexity of its business portfolio—especially the synergy between data services and exchange operations, as well as the significant but non-wholly-owned asset of the Tradeweb stake—are key focuses of this review. Such moves are typically aimed at enhancing operational efficiency and shareholder returns by optimizing the company’s structure.

19:08

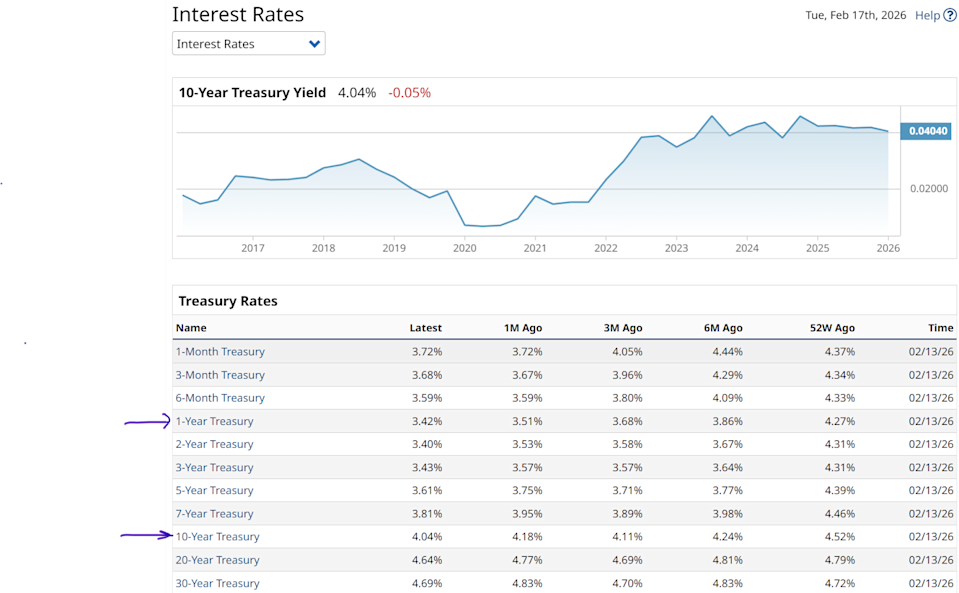

Federal Reserve meeting minutes adjust economic and inflation expectationsThe Federal Reserve meeting minutes show that Federal Reserve staff have a stronger outlook for economic activity compared to December last year. Inflation levels are expected to be slightly higher than previously anticipated, and the unemployment rate is projected to gradually decline starting from 2026.

19:06

The Federal Reserve meeting minutes mention a two-way statement on future interest rate decisions.The Federal Reserve meeting minutes show that several participants expressed support for adopting a two-way statement in future interest rate decisions, to reflect that raising rates may be an appropriate option if inflation remains persistently above target levels.

News