News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Nominates Warsh and Sets 15% Growth Target; Alphabet Issues $20 Billion Bonds; US Tech Stocks Rebound (February 10, 2026)2Bitmine buys $84 million in ETH as Tom Lee calls market pullback 'attractive' entry point: onchain data3As Palantir Projects a 61% Increase in Revenue for 2026, Is Now the Time to Invest in Palantir Shares?

Kenya's Safaricom starts offering stock trading on its M-Pesa platform

101 finance·2026/02/10 17:03

With Solana Falling Below $130 and TAO Showing Relative Strength, Attention Turns to BlockDAG’s Private Sale

Crypto Ninjas·2026/02/10 17:03

Excitement Peaks as BlockDAG Mainnet Goes Live Today! Pepe Coin Price Turns Bearish & Avalanche Drops to $9

BlockchainReporter·2026/02/10 17:00

What Is the Cockroach Theory in Finance, and Why It Matters for AI and Crypto

CoinEdition·2026/02/10 16:51

RWAs Are Defining the Next Phase of Crypto Adoption—Chainlink Co-founder

CoinEdition·2026/02/10 16:51

Spotify Has Announced Record-Breaking User Growth This Quarter. Shares Are Soaring

101 finance·2026/02/10 16:48

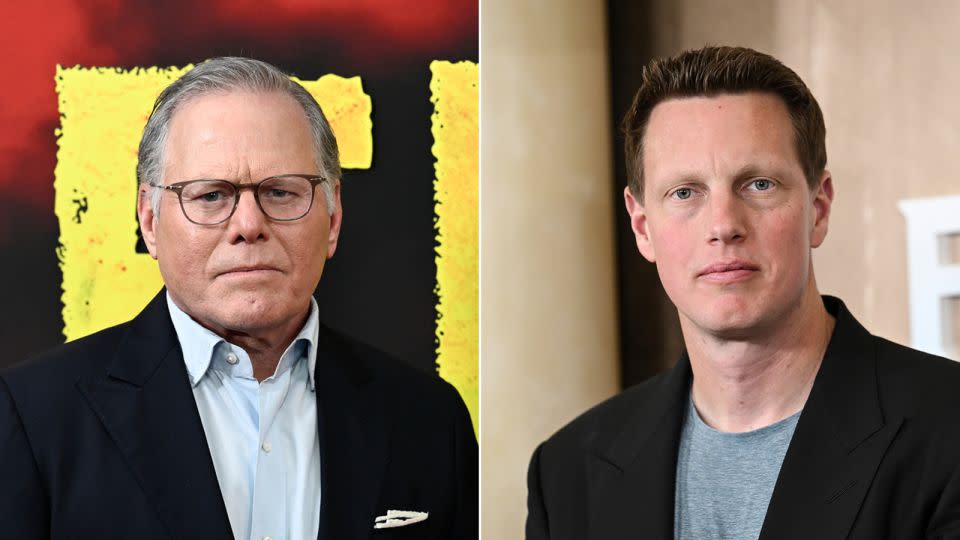

Paramount sweetens offer for Warner Bros. shareholders in hostile takeover fight

101 finance·2026/02/10 16:39

Paramount enhances its unsolicited offer in an effort to block the Netflix-Warner Bros. agreement

101 finance·2026/02/10 16:36

Backpack Unveils Innovative Tokenomics Model Tied to U.S. IPO Plans

Cointurk·2026/02/10 16:30

Flash

17:05

Hammack: There is a risk that inflation will remain at 3%ChainCatcher news, according to Golden Ten Data, Federal Reserve official Harker stated that there is a risk of inflation remaining at 3% this year, while emphasizing that inflation needs to decline further.

16:59

Current mainstream CEX, DEX funding rate display shows the market still maintains an overall bearish viewBlockBeats News, February 11th, according to Coinglass data, Bitcoin's downturn has stabilized, reclaiming $69,000. Current mainstream CEX and DEX funding rates indicate the market remains predominantly bearish, as shown in the attached image.

BlockBeats Note: Funding Rate is a fee set by cryptocurrency exchanges to maintain the balance between the contract price and the underlying asset price, usually applied to perpetual contracts. It is a funding exchange mechanism between long and short traders, and the exchange does not charge this fee. It is used to adjust the cost or profit for traders holding contracts to keep the contract price close to the underlying asset price.

When the Funding Rate is 0.01%, it represents the baseline rate. When the Funding Rate is above 0.01%, it indicates a generally bullish market sentiment. When the Funding Rate is below 0.005%, it indicates a generally bearish market sentiment.

16:55

The average daily trading volume of U.S. stocks in January exceeded $1 trillion, setting a record for capital flows.ChainCatcher News, according to Golden Ten Data, the scale of capital flows in the US stock market has reached a new high. In January, the average daily stock trading volume exceeded 1 trillion US dollars, reaching a record 1.03 trillion US dollars, an increase of about 50% compared to the same period in 2025. The daily number of shares traded was about 19 billion, the second highest in history. Trading activity from both retail investors and institutional funds has risen simultaneously, but amid concerns about high valuations, the continuous inflow of funds also exposes participants to higher risks.

News