News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin whales participate in V-shaped accumulation, offsetting 230K BTC sell-off2Ethereum: Why Fundstrat sees $1.7K as a possible ETH bottom3ProShares' stablecoin-ready ETF generates record $17 billion in day-one trading volume

United Airlines intensifies the competition over credit card benefits

101 finance·2026/02/21 11:03

Polygon holds KEY support after 100M POL burn: What’s next?

AMBCrypto·2026/02/21 11:03

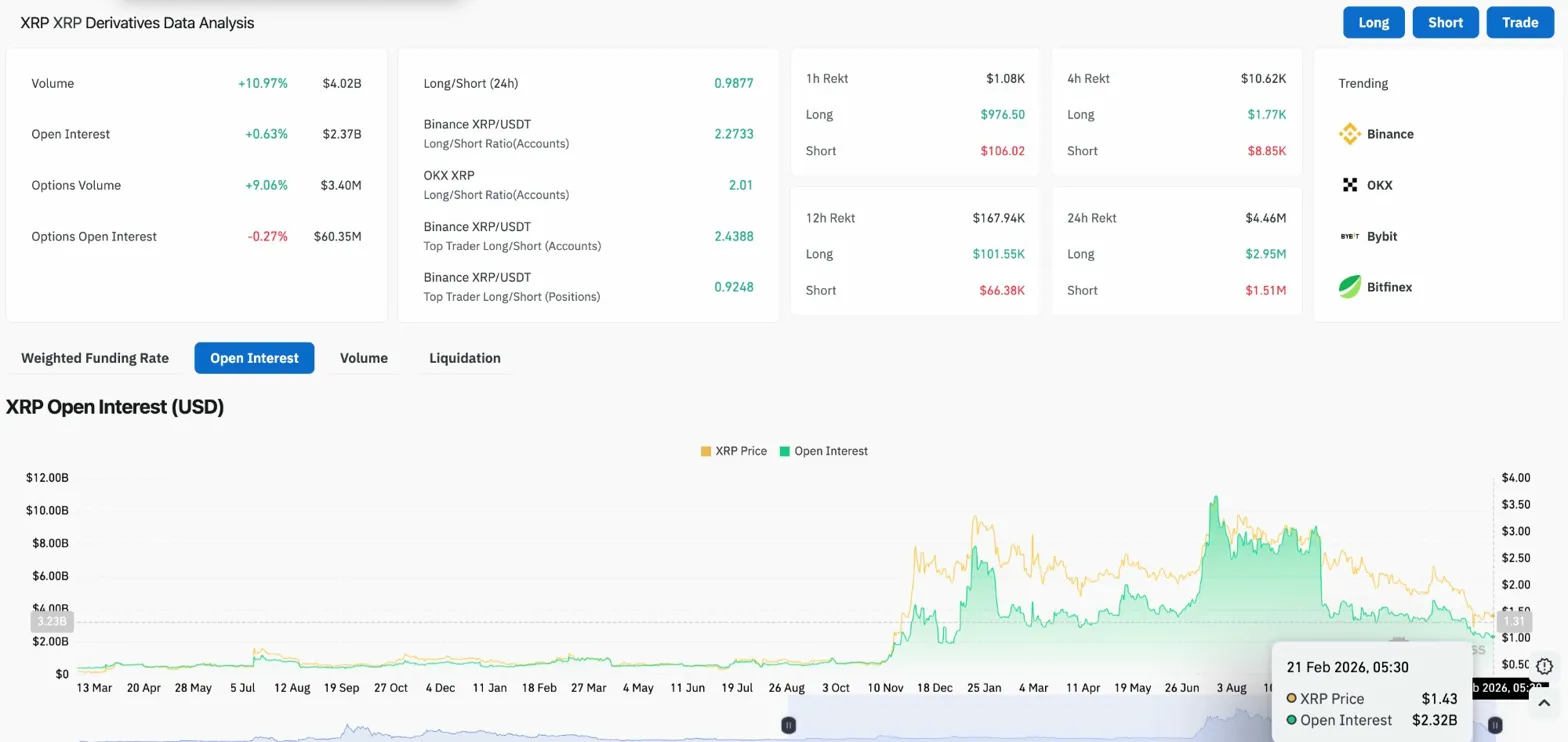

XRP Price Prediction: What Will Be the XRP Price at the End of February?

CoinEdition·2026/02/21 10:45

Large Bitcoin Holders Rebuild Reserves After Heavy Selling

Cointribune·2026/02/21 10:18

If OpenAI is valued at $830 billion, how much should Google be worth?

华尔街见闻·2026/02/21 09:59

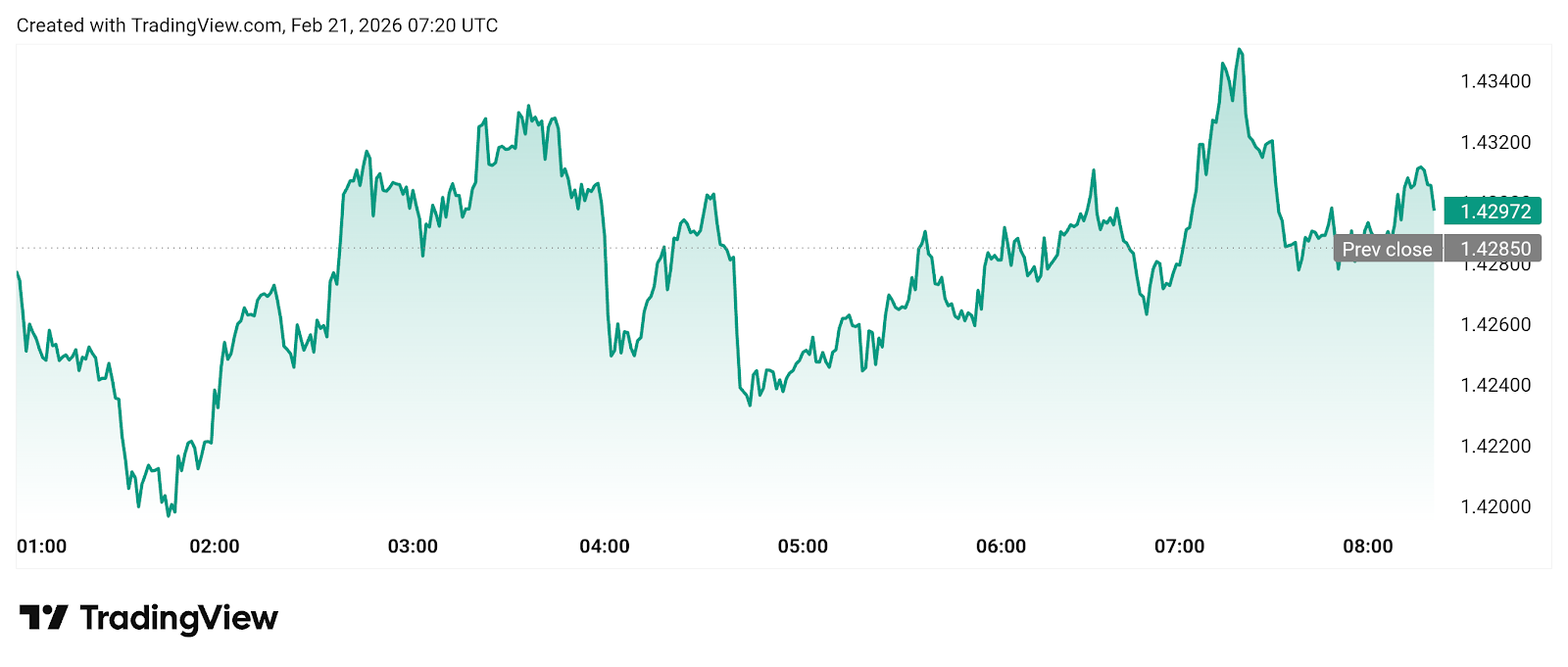

XRP Price Prediction: XRP Holds $1.4306 As Deutsche Bank Expands Ripple Tech

CoinEdition·2026/02/21 09:51

Crypto News Today: How Bitcoin, Ethereum and XRP Are Positioned Into the Weekend

Coinpedia·2026/02/21 09:30

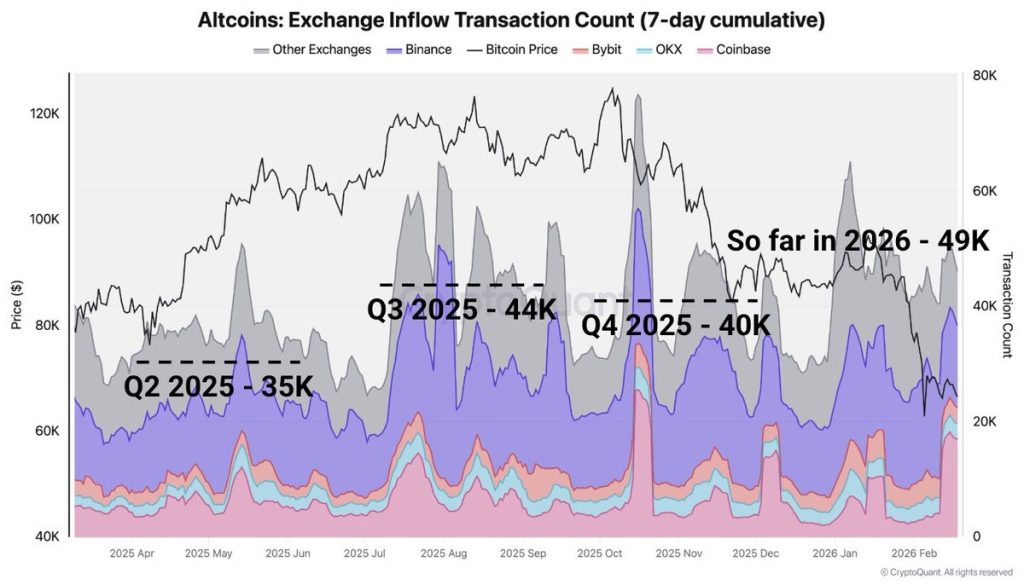

Major Altcoin Dump Ahead? Charts Hint at Broader Crypto Sell-Off Risk; What’s Next?

Coinpedia·2026/02/21 09:30

Robert Kiyosaki Buys Bitcoin at $67,000, While Whale Dumped

Coinpedia·2026/02/21 09:30

Is the Options Market Predicting a Spike in IBM Stock?

Finviz·2026/02/21 09:12

Flash

11:06

Analyst: Realized losses from the recent bitcoin pullback have reached a record high, possibly signaling a near-term bottomBlockBeats News, on February 21, crypto analyst Michaël van de Poppe posted that, "The recent correction in bitcoin has led to a significant surge in realized losses, reaching an all-time high. This is one of the largest realized loss events in bitcoin's history, comparable to the bear market crash in 2018, the March 2020 COVID-19 plunge, and the peak losses during the 2022 Luna/FTX collapse." A large number of holders are capitulating, either selling at a loss or transferring their BTC while in a loss position. Such extreme realization of losses typically indicates panic selling and forced liquidations in the market. Historically, similar surges in large-scale realized losses often occur at or near cyclical bottoms, as this represents the complete washout of "weak hands" and high-leverage positions. It is worth noting that the Sharpe Ratio has dropped to its lowest level since the last cycle bottom; the market is experiencing a massive capitulation event with extremely high realized losses; and market sentiment is almost at rock bottom. The only difference is that in this cycle, bitcoin has only fallen about 50% from its historical high, rather than 80%. The bottom is near."

10:59

Japan's SBI Holdings has issued 10 billion yen in on-chain bonds, with returns to be paid to investors via XRPJinse Finance reported that Japan's SBI Holdings has issued on-chain bonds with a scale of 10 billion yen (64.5 million USD), and the bond yields will be paid to investors in XRP.

10:52

IoTeX Confirms Asset Theft, But Actual Loss Much Lower Than Market RumorsBlockBeats News, February 21st, IoTeX announced that, regarding the asset theft incident, the team has been evaluating and actively controlling the situation, with the initial estimated loss being much lower than the rumored amount. IoTeX has stated that it has been coordinating with major exchanges and security partners to actively trace and freeze the hacker's assets, and the current situation is under control. Continuous monitoring will be in place, with timely updates to the community on the latest developments.

News