News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Gold and Silver Rebound with Gold Back Above 5000; Nikkei 225 Hits New Historical High; US-India Reach Interim Trade Framework (February 9, 2026)2Why Alphabet's Free Cash Flow May Remain Resilient Even as the Market Worries - Strategies for Investing in GOOGL3Bitcoin Price Prediction 2026-2030: Unveiling the Critical Path for BTC’s Future Value

Euro rates might have to increase further in 2026 to boost demand

101 finance·2026/02/10 01:15

Is finance crypto’s first chapter or its final form? VCs weigh in…

AMBCrypto·2026/02/10 01:03

US Treasury Bonds: When the University of Tokyo Tightens Its US Treasury Exposure

BFC汇谈·2026/02/10 00:02

Chipotle's CEO aims to attract more diners earning above $100,000 — signaling that menu prices are set to rise

101 finance·2026/02/09 23:03

Alphabet's debt raise fuels forecasts for record year in corporate bond sales

101 finance·2026/02/09 22:09

Butterfield Bank (NYSE:NTB) Delivers Unexpected Q4 CY2025 Revenue Results

101 finance·2026/02/09 22:06

Arch Capital: Fourth Quarter Earnings Overview

101 finance·2026/02/09 22:06

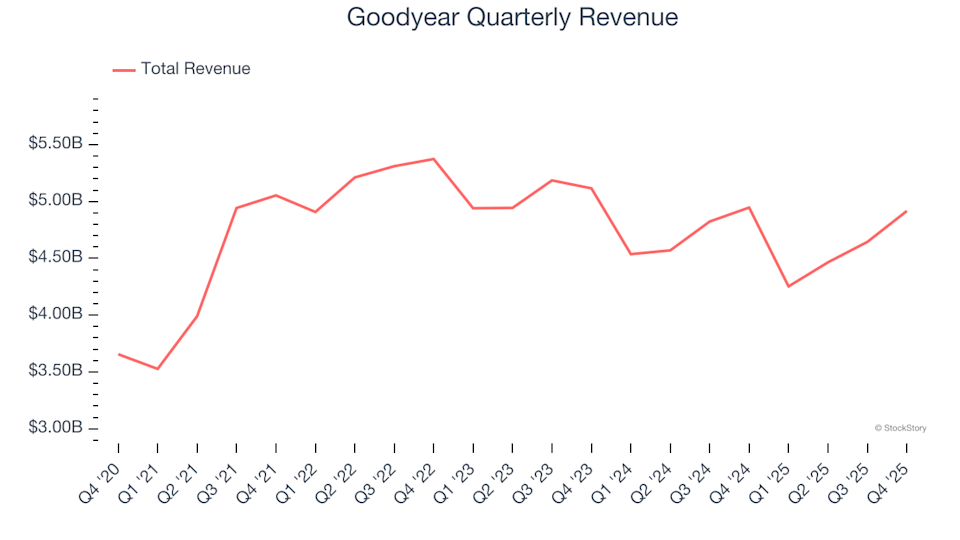

Goodyear (NASDAQ:GT) exceeded sales expectations in Q4 of fiscal year 2025

101 finance·2026/02/09 22:03

Flash

01:15

Eli Lilly to acquire Orna for $2.4 billion to strengthen its presence in the autoimmune fieldGelonghui, February 10th | Eli Lilly announced that it will acquire biotechnology company Orna Therapeutics for up to $2.4 billion in cash. Orna Therapeutics' main candidate drug, ORN-252, is intended to treat B cell-driven autoimmune diseases and is currently in the early stages of development.

01:15

Google "Asks for Another 100 Years"! The Global Tech Industry Will Welcome the First "Century Bond" of the CenturyGlonghui, February 10th|As part of a massive debt issuance plan, Google’s parent company Alphabet has planned to issue an extremely rare century bond, marking the first time since the late 1990s that a global technology company has auctioned such ultra-long-term debt. According to media reports citing informed sources, this 100-year bond will be denominated in British pounds, and there will be four other bonds with different maturities also denominated in this currency. The source added that this is Alphabet’s first issuance of pound-denominated bonds, which could be priced as early as Tuesday. KBRA European macro strategist Kerr stated: “They (Google) want to tap every potential investor, from structured finance investors to ultra-long-term investors.” He pointed out that the main buyers of century bonds will be insurance companies and pension funds, and “the people underwriting this deal may no longer be around when the debt is repaid.”

01:06

SEC Commissioner Uyeda: Tokenization of Securities Markets Requires Technologically Neutral RegulationMark T. Uyeda, a commissioner of the U.S. Securities and Exchange Commission (SEC), stated at the 2026 Asset Management Derivatives Forum that the SEC has approved the registration of two new clearing agencies, CME Securities Clearing and ICE Clear Credit, providing market participants with more clearing options. According to data from the Office of Financial Research, if the Treasury clearing rules are implemented in the first eight months of 2025, U.S. global systemically important banks could free up an average of $34.5 billions in balance sheet space. Regarding the tokenization of securities markets, Uyeda emphasized that the SEC has shifted from an enforcement-led approach to promoting limited-scope pilots through regulatory guidance and exemption orders, and pointed out that SEC rules should remain technologically neutral, focusing on outcomes rather than processes, while ensuring investor protection measures.

News