News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Ends Government Shutdown; Software Stocks Hit by AI Tools; Nvidia Plans Massive Investment in OpenAI (February 4, 2026)2BitMine adds 41,000 ETH to its balance sheet, while its unrealized losses amount to $6B3XRP price prediction: What the loss of the $1.77 swing low means for you

5 Best Crypto Presales for Degens: High-Risk, High-Reward Moonshot List (2026)

BlockchainReporter·2026/02/04 12:51

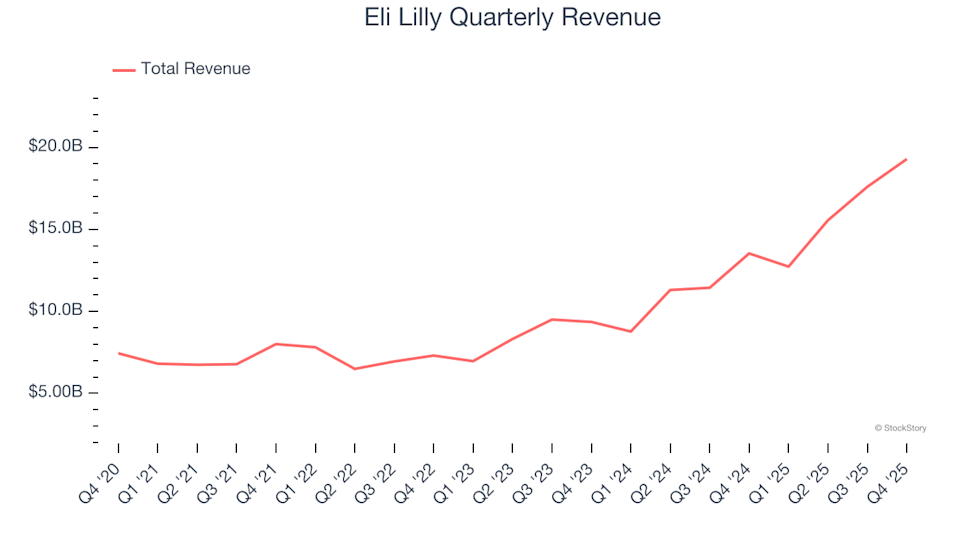

Eli Lilly (NYSE:LLY) Delivers Robust Q4 Results for CY2025, Shares Surge

101 finance·2026/02/04 12:51

Global Software Stocks Drop Amid Anthropic AI Disruption Warning

新浪财经·2026/02/04 12:43

GE HealthCare forecasts 2026 profit above estimates on strong demand for medical devices

101 finance·2026/02/04 12:27

Flex: Fiscal Third Quarter Earnings Overview

101 finance·2026/02/04 12:27

Vitalik Signals New Path as Ethereum Layer One Expands Fast

Cryptotale·2026/02/04 12:21

Idex: Overview of Fourth Quarter Financial Results

101 finance·2026/02/04 12:15

Uber forecasts profit below estimates as cheaper rides boost trips but hurt margins

101 finance·2026/02/04 12:09

Flash

12:57

On-Chain Recurrence of the "Bottom Signal"? Bitcoin Stock-to-Flow Convergence Aiming Toward $60,000BlockBeats News, February 4th, according to Coindesk's report, an on-chain metric that has been through multiple validation cycles has once again attracted market attention. The data shows that when the supply in a profitable state and the supply in a loss state of Bitcoin converge significantly, it often corresponds to a market bottom in a bear market phase.

According to Glassnode data, there are currently about 11.1 million BTC in a profitable state, with another 8.9 million BTC in a state of unrealized losses. Historically, when these two metrics are close to equilibrium, Bitcoin has repeatedly completed its cyclical bottom.

If calculated based on the current cost basis, further convergence of the profitable and loss supply could mean that the spot price of Bitcoin is close to the $60,000 range. This signal has appeared in 2015, 2019, 2020, and 2022, highly coinciding with significant market lows.

Analysis points out that as the price fluctuates around the overall market cost line, Bitcoin migrates between "profitable supply" and "loss supply," reflecting the overall investor pressure and sentiment cleansing. If history repeats itself, this metric may provide a key reference for judging whether this bear market cycle is nearing its end.

12:56

Evercore Q4 results exceed expectations, with strong performance across multiple business areas last yearEvercore, an investment banking advisory firm, announced its fourth quarter results for last year. Revenue increased by 32% year-on-year to $1.28 billion, surpassing analysts' expectations of $1.12 billion. Adjusted earnings per share were $5.13, also exceeding the expected $4.05. In 2025, the company demonstrated strong performance across multiple business areas, with North America advisory, EMEA advisory, private capital advisory, and the private funds group all achieving record annual revenues. In addition, the company announced a quarterly dividend of $0.84 per share.

12:56

Survey: Geopolitical Risk and Central Bank Buying Support Gold Price to Hit New High in 2026BlockBeats News, February 4th, a Reuters survey shows that gold is expected to hit a new high in 2026, with geopolitical uncertainty and strong central bank buying still the main driving factors. A survey of 30 analysts and traders over the past three weeks showed a 2026 gold price median expectation of $4746.50 per ounce, setting a new high in Reuters' annual forecast since the survey began in 2012, a significant increase from the $4275 estimated in October last year.

A year ago, a similar survey had an average price expectation for 2026 of only $2700. Analysts believe that factors driving the rise in gold prices—including geopolitical risks, ongoing central bank gold purchases, concerns about the Fed's independence, rising U.S. debt, trade uncertainty, and the "de-dollarization" trend—will continue to support gold in 2026.

Silver price expectations have also been raised, with the current expected average price for silver in 2026 at $79.50 per ounce, compared to just $50 in the October survey last year. (Jinse Finance)

News