News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Ends Government Shutdown; Software Stocks Hit by AI Tools; Nvidia Plans Massive Investment in OpenAI (February 4, 2026)2BitMine adds 41,000 ETH to its balance sheet, while its unrealized losses amount to $6B3XRP price prediction: What the loss of the $1.77 swing low means for you

Jim Cramer Urges Saylor to Buy Bitcoin and Stop Price Drop

CoinEdition·2026/02/04 07:51

Wosh wants to reduce idle funds? First, overcome the interest rate hurdle

丹湖渔翁·2026/02/04 07:35

Glaxo: Fourth Quarter Earnings Overview

101 finance·2026/02/04 07:27

Samsung Electronics' Market Value Surpasses 1,000 Trillion KRW for the First Time

新浪财经·2026/02/04 06:56

TomTom sees lower to steady revenue in 2026, followed by growth in 2027

101 finance·2026/02/04 06:45

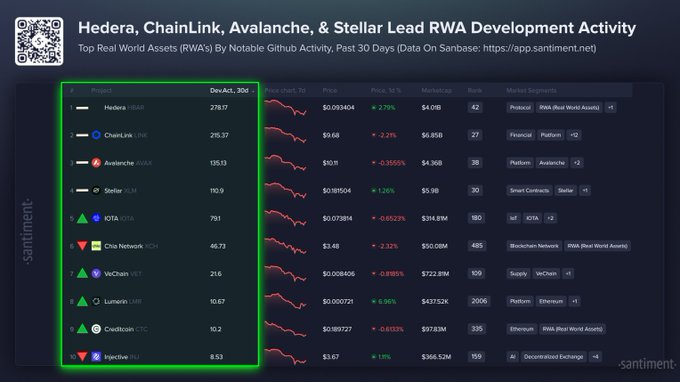

Avalanche adoption is exploding – but AVAX now faces its biggest test

AMBCrypto·2026/02/04 06:33

Anthropic's new AI tools deepen selloff in data analytics and software stocks, investors say

101 finance·2026/02/04 05:51

VeChain (VET) Price Prediction 2026, 2027 – 2030: Long-Term Forecast and Market Outlook

Coinpedia·2026/02/04 05:30

Trump administration intensifies actions to secure vital mineral resources from sources beyond China

101 finance·2026/02/04 05:12

Flash

07:50

Data shows that Bitcoin's realized profit/loss ratio has dropped to approximately 1.5; a drop below 1 could trigger a capitulation sell-off. according to glassnode, Bitcoin's realized profit and loss ratio (90-day simple moving average) has been continuously declining (currently about 1.5), gradually approaching 1, reflecting increasingly drying up market liquidity conditions.

From historical experience, if this indicator continues to fall below 1, it is usually accompanied by widespread capitulation selling — meaning the realized losses across the entire market will exceed profit-taking behavior.

07:46

A certain whale/institution bought the dip in the past few days, acquiring 83,392 ETH and 1,500 cbBTC.BlockBeats News, February 4th, according to on-chain data analyst Wu Jintao's monitoring, the whale/institution that has made $98.95 million in profits through scalping has once again bought 750 cbBTC (approximately $55.95 million) today. Over the past few days of sharp decline, he has bought the dip with a total value of $318 million in crypto assets, including:

· 83,392 ETH ($204 million) at an average price of $2,450· 1,500 cbBTC ($113 million) at an average price of $75,820

Now he holds a total of 173,000 ETH ($406 million) and 1,500 cbBTC ($113 million), with an unrealized loss of $65.43 million. The average cost of ETH is $2,667, and the average price of cbBTC is $75,820.

07:44

A whale/institution increased holdings by 750 cbBTC, accumulating purchases of $318 million worth of ETH and cbBTC after the sharp drop.According to ChainCatcher, on-chain analyst Yujin has monitored that the whale/institution, which previously made a profit of $98.95 million through swing trading, has bought another 750 cbBTC (worth $55.95 million). In the past few days following the sharp drop, this entity has purchased assets worth $318 million. Currently, this whale/institution holds 83,392 ETH (worth $204 million) at an average price of $2,450, as well as 1,500 cbBTC (worth $113 million) at an average price of $75,820. Now, in total, it holds 173,000 ETH (worth $406 million) and 1,500 cbBTC (worth $113 million), with an unrealized loss of $65.43 million. The average cost for ETH is $2,667, and for cbBTC is $75,820.

News