News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin’s post-quantum plan BIP-360 gains traction, but will it reverse market sell-off?2Bitcoin holders are being tested as inflation fades: Pompliano3 Bitcoin Price Bottom Not In Yet? Data Signals More Pain Ahead

RBA: Record of the Reserve Bank Board’s Monetary Policy Discussion

101 finance·2026/02/17 00:33

Buterin attacks corporate neutrality culture

Grafa·2026/02/17 00:15

AEHR's +25% Spike: Latest AI Hyperscaler Order Improves Outlook

Finviz·2026/02/16 23:45

McGlone Raises Possibility Of 10000 Dollar Bitcoin

Cointribune·2026/02/16 23:21

Ethereum Price Prediction: Bullish $2,500 Rally Looms as Whales Execute Massive Accumulation Strategy

Bitcoinworld·2026/02/16 23:06

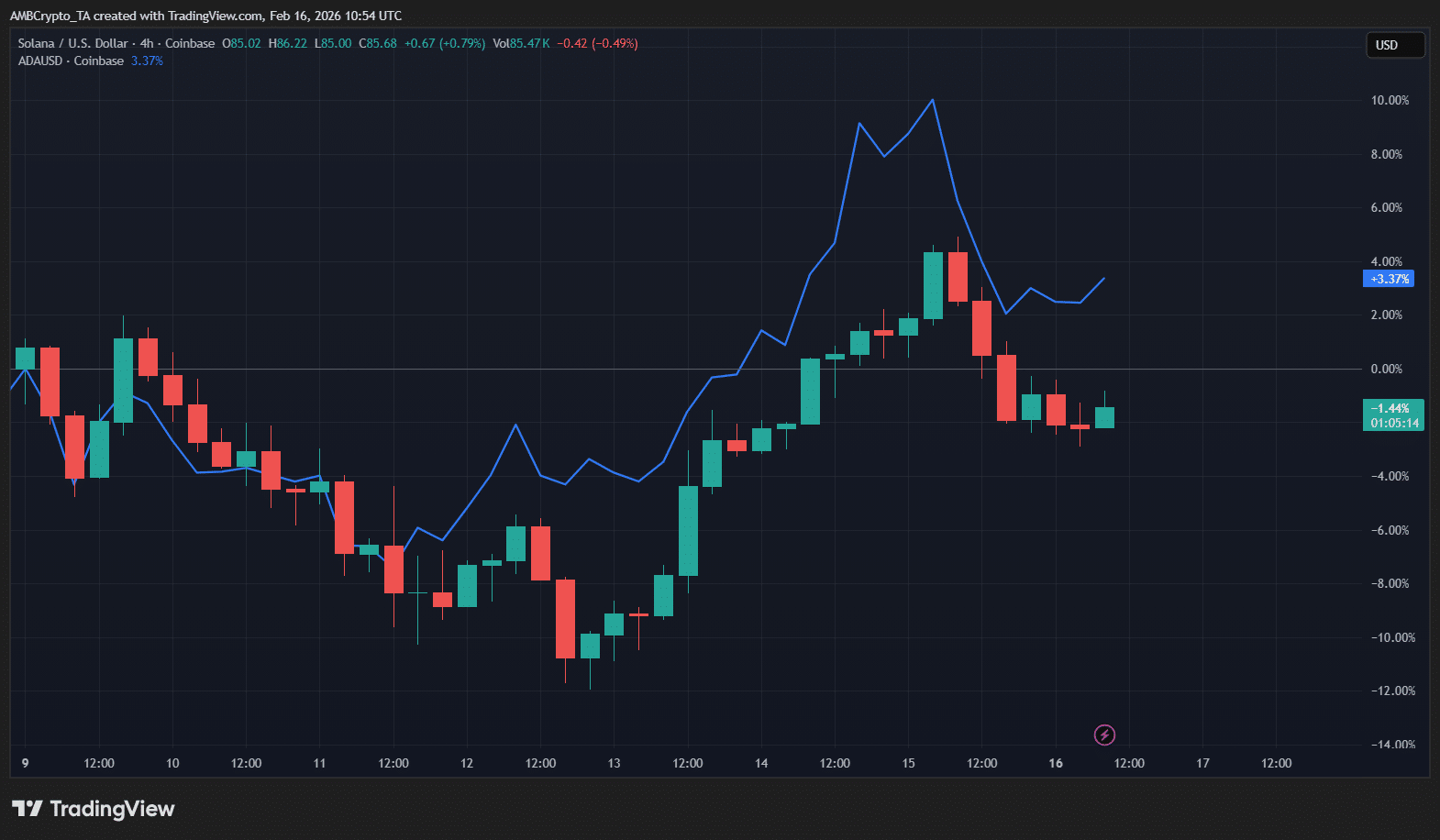

Solana lands PayPal, Cardano gets USDCx – But why are SOL and ADA flat?

AMBCrypto·2026/02/16 23:03

Chairman of Hyatt Hotels resigns from board due to ties with Epstein

新浪财经·2026/02/16 22:59

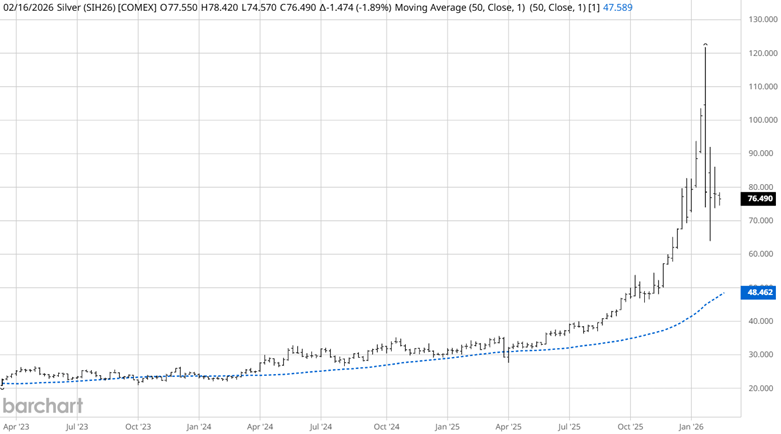

Speculators Became Enthusiastic—But the Market Remained Unmoved: Silver’s Performance Post-Valentine’s Day

101 finance·2026/02/16 22:42

Hyatt executive chairman resigns amid connections to Epstein

101 finance·2026/02/16 22:24

Flash

00:31

Vitalik Buterin: No need for shared values, anyone is free to use EthereumPANews reported on February 17 that Ethereum co-founder Vitalik Buterin stated on the X platform that users do not need to agree with his views on application forms, DeFi, privacy payments, AI, etc., to freely use Ethereum. As a decentralized protocol, Ethereum should maintain its permissionless and censorship-resistant properties. However, this does not mean that individuals cannot make value judgments or publicly criticize applications. Neutrality should belong to the protocol layer, while individuals and communities need to clearly express their own principles and build an ecosystem consistent with their values on this basis, while also accepting that Ethereum will be used in different ways by people with different philosophies.

00:23

The Bank of Japan may raise interest rates in AprilPANews, February 17—According to Golden Ten Data, former Bank of Japan Policy Board member Seiji Adachi stated that the Bank of Japan is likely to use the large amount of new data available in April as an opportunity to raise interest rates, disregarding market speculation about a possible rate hike in March. In an interview on Monday, Seiji Adachi said: "A rate hike in March would be risky because it would be based on expectations rather than confirmed signals. In April, a large amount of data will be available to confirm improvements in underlying inflation." Seiji Adachi's view is in line with growing market expectations that the committee led by Governor Kazuo Ueda may take action in the spring—earlier than most economists predicted after the last rate hike in December.

2026/02/16 23:59

US stock index futures remain flat as investors digest the ongoing tech sell-off during the holiday weekendGlonghui, February 17th|After another brutal week for tech stocks, U.S. stock index futures were mostly flat during early Asian trading on Tuesday morning. Dow Jones futures recently rose by about 80 points, an increase of 0.2%. S&P 500 futures rose 0.1%, while Nasdaq 100 futures fell 0.2%. Gold and silver futures fell on Monday, while bitcoin remained below the $70,000 level. Crude oil futures rose by more than 1% as investors remained anxious about the possibility of U.S. military action against Iran. Most markets closed higher last Friday, but concerns over the potential disruptive impact of AI continued to weigh heavily on tech stocks, causing all three major U.S. indexes to end the week lower. The Dow Jones fell 1.2%, marking its worst weekly performance since November last year, while the S&P 500 dropped 1.4%, and the Nasdaq Composite plunged 2.1%, falling for a fifth consecutive week—the longest losing streak since 2002. U.S. markets were closed on Monday for Presidents' Day. In the coming week, the Federal Reserve will release the minutes of its last meeting on Wednesday, and another key inflation indicator—the core Personal Consumption Expenditures Index—will be released on Friday.

News