Venture Capital Firm a16z Unloads $7M of MKR Tokens as Price Soars

Lending platform Maker’s governance tokens soared to near one-year high prices last week prior to the sales.

Venture capital heavyweight (a16z) is selling a part of its investment in crypto lender MakerDAO's governance tokens as the price of coins soared to a near one-year high, blockchain data shows.

Some $7 million of MKR were transferred from a16z’s crypto wallet to a freshly created address late Thursday, according to Ethereum blockchain monitoring website . The new wallet on Saturday then began depositing batches of 1,380 tokens – worth roughly $1.5 million – per day to crypto exchange Coinbase.

Sending tokens to an exchange usually signals intention to sell. Up through Tuesday, deposits from that wallet to Coinbase totaled $6.1 million, with the latest transaction occurring at Tuesday 14:18 UTC.

A representative of a16z did not immediately return a request for comment.

The transactions happened as MKR Friday to a near-one year high above $1,200 following the activation of a new token buyback scheme that is removing coins from the market, reducing their supply. The token pared some of its gains, sinking to as low as $1,040 on Monday, and has risen 10% since to its current $1,140.

MakerDAO is one of the largest decentralized finance () lending platforms and the issuer of the $4.6 billion stablecoin . The platform is managed by a decentralized autonomous organization (), where MKR token holders – including a16z – can vote on governance proposals.

The venture capital firm was one of the largest investors in MakerDAO, 6% of MKR’s supply for $15 million in September 2018.

The protocol is currently undergoing a major overhaul spearheaded by founder Rune Christensen. The so-called includes breaking up the protocol’s units into smaller, autonomous entities (SubDAOs) that could issue their own tokens.

In October, a16z the plan to create new units arguing that the structure at the time was sufficiently decentralized. However, community members favored the changes in a governance vote.

After the transactions, a16z’s crypto wallets still hold 12,395 MKR – 1.3% of its circulating supply – worth $14 million, per blockchain forensics platform Arkham Intelligence’s .

Edited by Stephen Alpher.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Brink's: Fourth Quarter Financial Overview

Strategic Education: Fourth Quarter Financial Overview

Puma Biotech: Fourth Quarter Earnings Overview

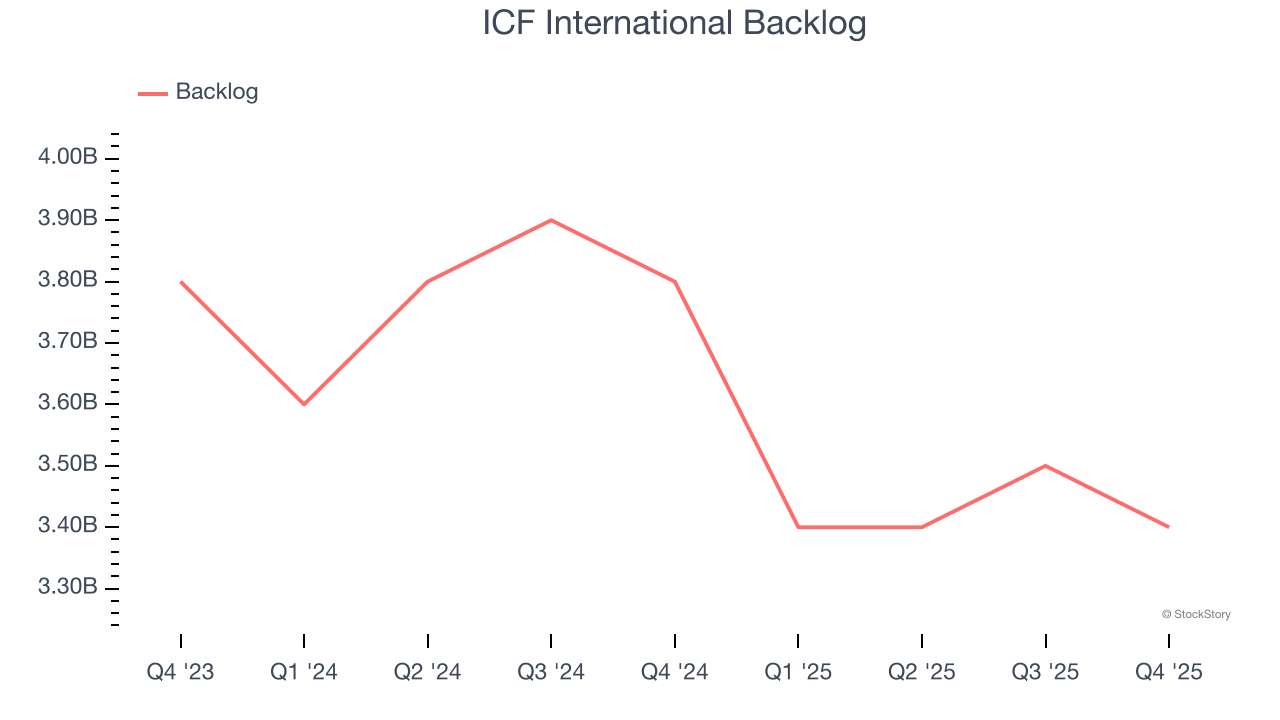

ICF International's (NASDAQ:ICFI) Q4 CY2025: Beats On Revenue