Two Possible Reasons Why the Bitcoin Price Crashes Toward $40K

Bitcoin’s price is trending toward $40K and despite the recent attempts to recover, the bears seem to have the upper hand.

Bitcoin’s price is down 4.4% in the past seven days and about 16% from its January 11th highs at $48,500. The cryptocurrency is now getting dangerously close to the pivotal psychological level of $40K, triggering a discussion on whether or not the correction will continue.

That said, let’s have a look at a few of the potential reasons behind the recent decline, as well as a couple of possible catalysts for positive developments in the not-so-distant future.

Underwhelming Bitcoin ETF Launch

Following many years of rigorous attempts on behalf of multiple ETF providers, the spot Bitcoin exchange-traded fund is now a fact. The US Securities and Exchange Commission greenlighted the product earlier this month.

The launch wasn’t without hiccups. In fact, it was particularly underwhelming. Days before the expected confirmation date, the X account of the agency was compromised . The perpetrator tweeted falsely that the Bitcoin ETF was approved, triggering a bidirectional price spiral, which led to many millions of dollars worth of leveraged positions being liquidated.

Finally, when the date came, and the official announcement came, the SEC took the link containing the order down because they had published it during trading hours, as opposed to after that.

Nevertheless, Bitcoin’s price increased massively the day after, reaching its January peak at around $48,500.

And yet, it appears that the launch was indeed a “sell-the-news” event as the ETF inflows failed to compensate for the selling pressure, which continues to this date. as BTC trends toward $40K.

Overheated Crypto Markets

The cryptocurrency markets, in general, were trending upward without considerable corrections for a prolonged period of time before the current decline.

The main reason behind the increase was largely the anticipation of the approval of a spot BTC ETF.

As seen in the chart, the price went from around $26K in the middle of October to a high of $48,500 in January without almost any corrections. This represents an increase of about 86%.

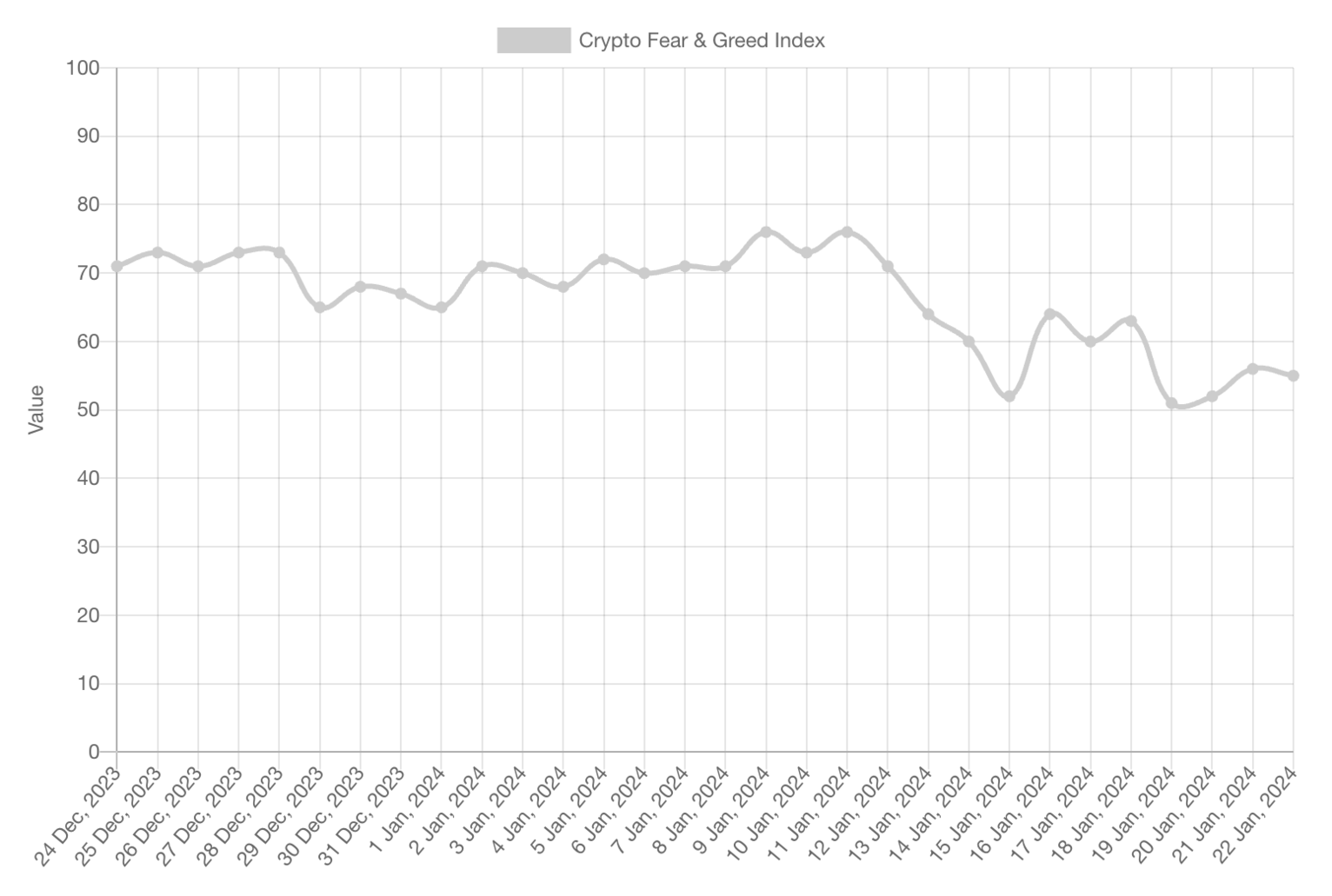

Additionally, the popular Crypto Fear Greed Index has been giving signs of an overheated market for quite a while. It’s been trending in the higher numbers for quite a while. As CryptoPotato recently reported , on January 15th, it dropped to Neutral for the first time in three months.

Prior to that, it was sitting mostly in Greed or Extreme Greed, indicating overly enthusiastic market participants based on multiple metrics.

When Will the Bulls Come Back?

At this rate, it’s clear that the sellers have had the upper hand for the past couple of weeks, and many are wondering if and when the bulls will come back.

While it’s hard to gauge potential developments in Bitcoin’s price, the fact of the matter is that the halving is right around the corner.

In April this year, the Bitcoin network will undergo this major shift, which will slash the block rewards in half, limiting the supply of freshly-minted BTC on the market while also halving its pre-programmed inflation.

The event has historically preceded major bull markets, and many analysts are of the opinion that this cycle will not be any different.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From yen rate hikes to mining farms shutting down, why is bitcoin still falling?

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The Economist: The Real Threat of Cryptocurrency to Traditional Banks

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

Grayscale's Top 10 Crypto Predictions: Key Trends for 2026 You Can't Miss

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.

From Yen Interest Rate Hike to Mining Farm Shutdown, Why Is Bitcoin Still Falling

The market is down again, but this may not be a good buying opportunity this time.