Ethereum-Related Altcoins on the Rise as ETH Climbs to 21-Month Peak Above $2.9K (Market Watch)

MATIC and OP are among the top performers from the larger-cap alts.

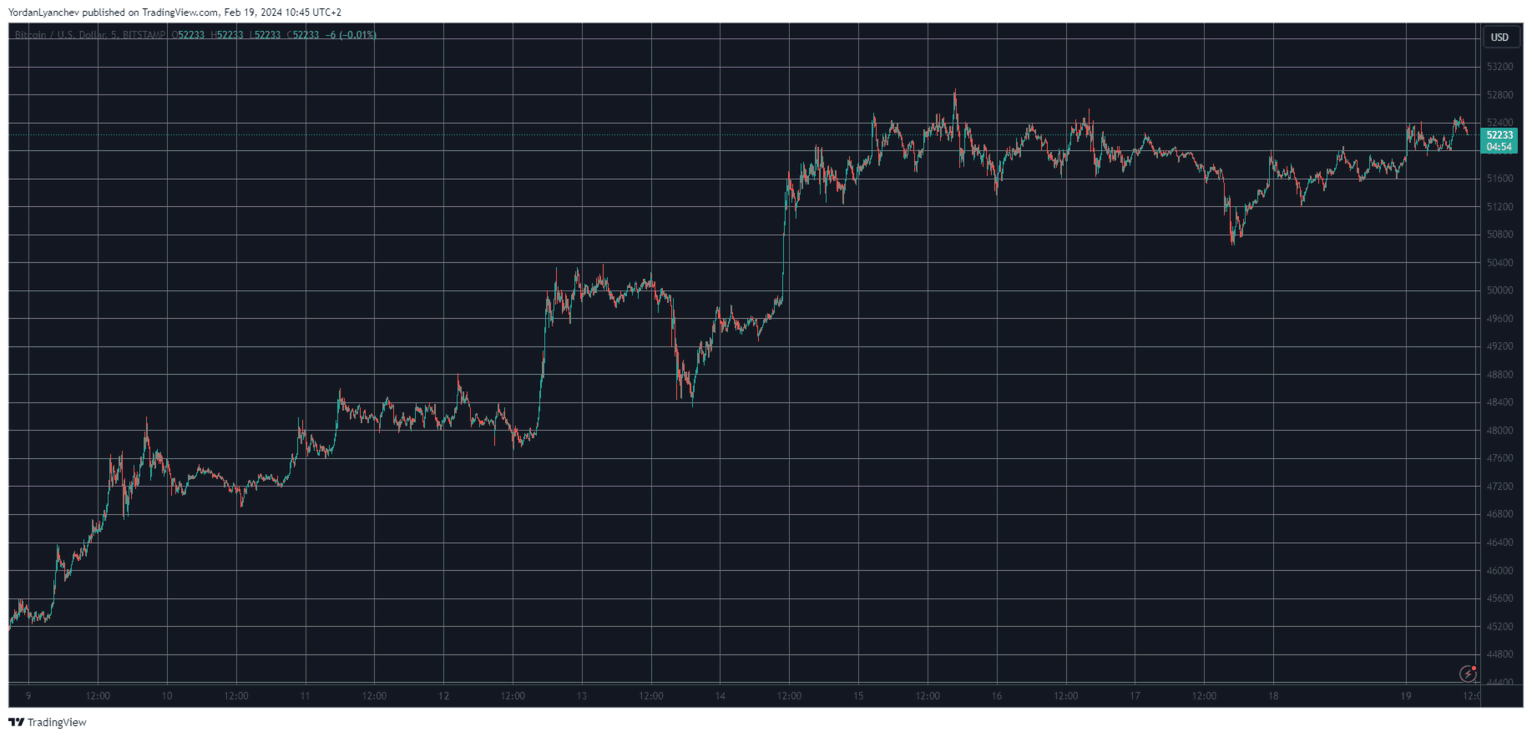

After the relatively quiet weekend in which BTC dipped slightly to under $51,000, the asset has erased most losses and currently sits above $52,000 once again.

Ethereum is among the most notable performers in the past 24 hours, as it has jumped to its highest price tag in nearly two years of over $2,900.

BTC Back Above $52K

The trading week that closed on February 11 turned out to be BTC’s biggest since October, with a surge of 13%. The past seven days were quite impressive for the primary cryptocurrency as well.

It all started with a large uptick on Monday that pushed Bitcoin beyond $50,000. A painful but brief retracement followed on Tuesday when the US announced the latest CPI numbers.

BTC’s offensive returned later that week, and the asset found itself surging to $52,900 by Thursday for the first time since late 2021. However, it failed to overcome that level and was pushed down to $50,500 on Saturday.

The past 36 hours or so have been quite calm, but BTC has gradually increased to just over $52,000 as of now. Thus, it has ended another week with a notable rise of over three grand.

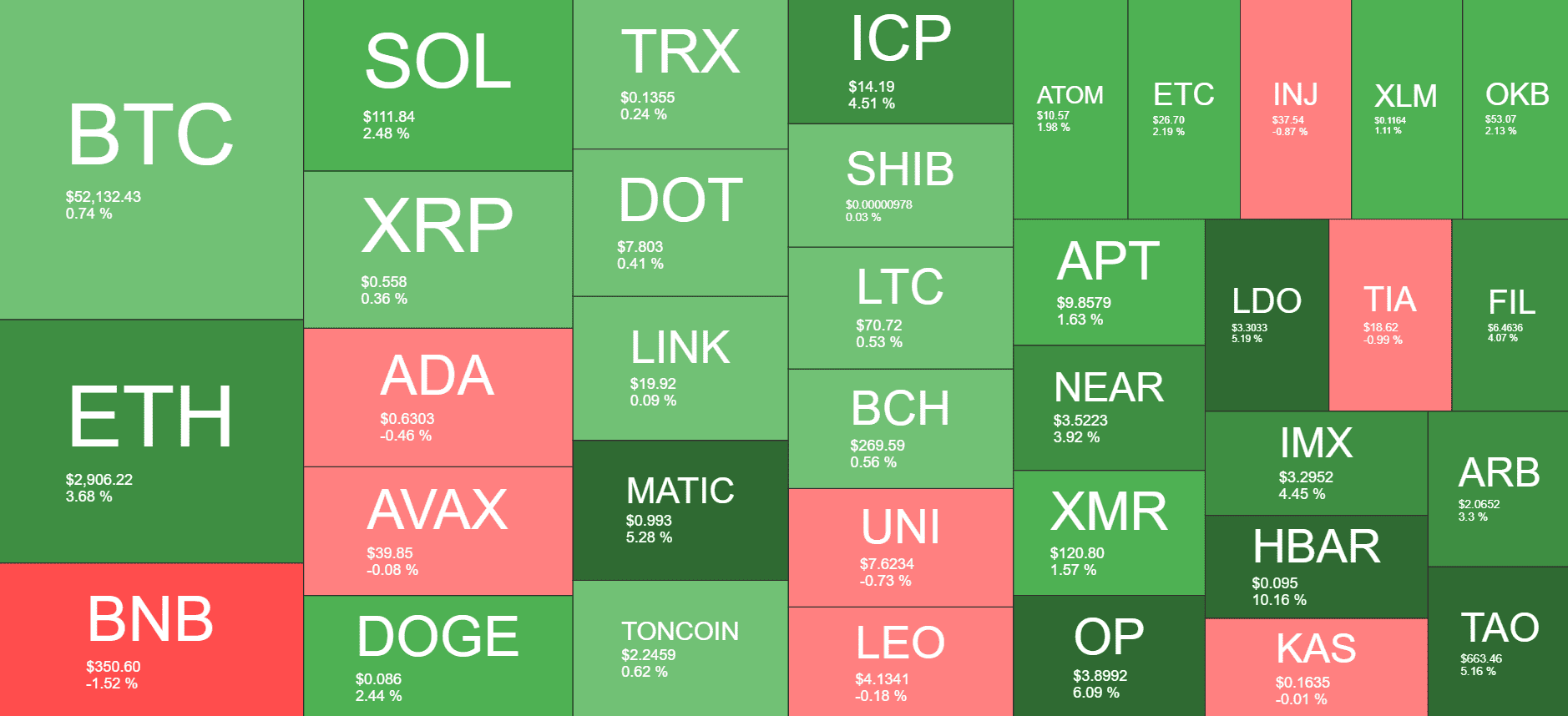

Its market capitalization remains above $1.020 trillion , while its dominance over the altcoins has taken a hit and is down to 49.2% on CG.

ETH Goes Higher

Ethereum has been slowly but surely surging in value in recent weeks, perhaps mimicking the BTC increase when the hype about the potential approval of spot Bitcoin ETFs was on the rise. ETH is up by another 4% in the past 24 hours alone and now sits at a 21-month peak of over $2,900 as the community anticipates that the SEC will greenlight spot Ethereum ETFs.

Other tokens related to the Ethereum landscape have also surged in the past 24 hours. MATIC is up by 5% and sits close to $1, while OP has soared by 6% and trades at $3.9.

Solana has reclaimed the $110 level after a 2.5% increase, mimicked by DOGE, which has risen above $0.086. In contrast, BNB has retraced by over 1% and sits at $350.

The total crypto market cap, though, has added over $40 billion overnight and stands above $2.080 trillion on CG.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Iran's Missile Retaliation: A Tactical Catalyst for Volatility

Analyst Spots XRP Cup and Handle Formation, Sets Price Target

Will the Resumption of War in Iran Push Brent Crude Oil Past $80 Again?

Crypto : Ransomware attacks jump 50% in 2025, but ransoms decline