Spot bitcoin ETF inflows net record $1 billion in a single day

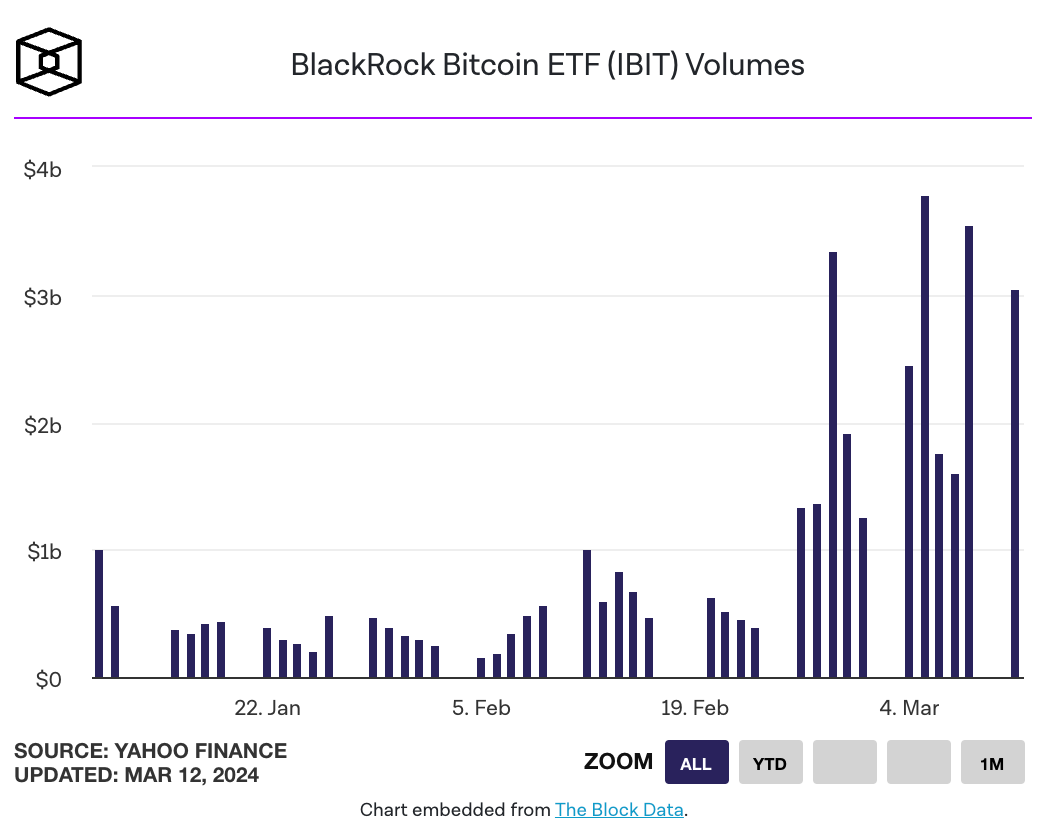

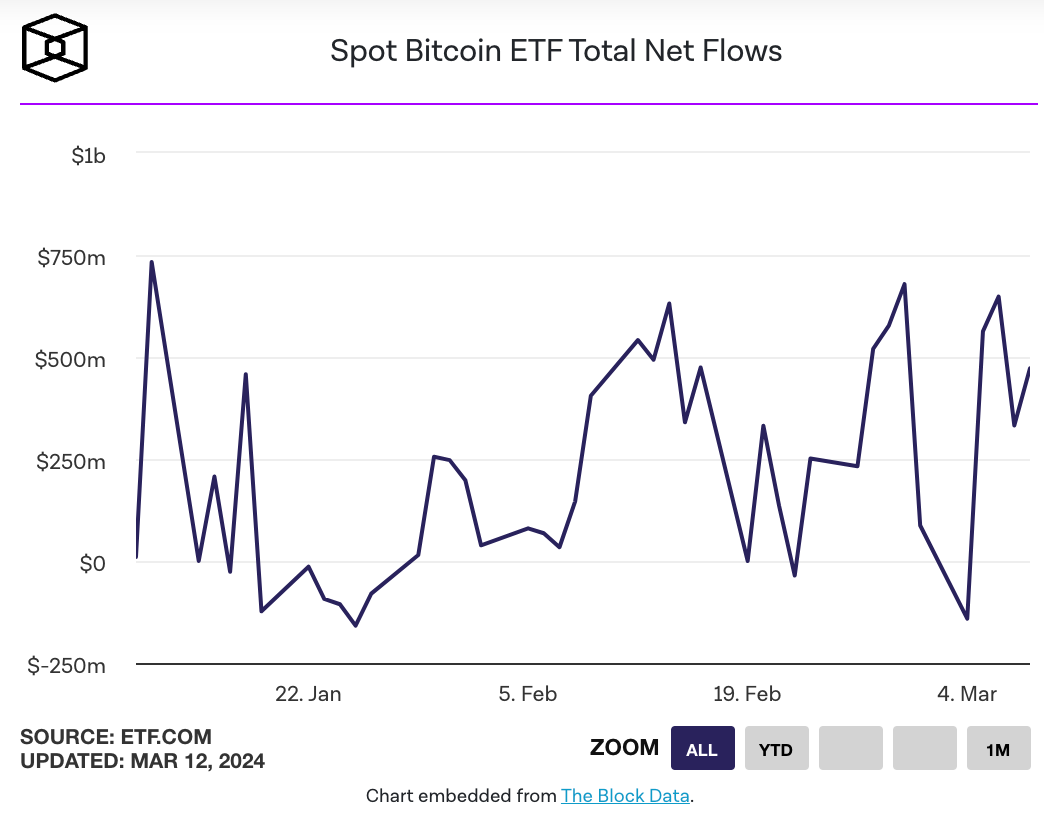

On March 12, net bitcoin ETF inflows hit over $1 billion.Blackrock’s IBIT product saw a record $849 million inflow.

On March 12, net bitcoin ETF inflows hit over $1 billion, according to data from BitMEX Research. At the same time, Blackrock's IBIT product saw a record $849 million inflow.

In bitcoin terms, it was a record 14,706 BTC +1.12% inflow.

Total net bitcoin ETF inflows since Jan. 11, 2024 reached $4.1 billion.

As of yesterday, spot bitcoin ETFs now hold upward of 90% of the daily trading volume market share for ETFs offering bitcoin exposure — an all-time high. Bitcoin futures ETFs, meanwhile, now claim just 10% of the market share.

“To see more than $1 billion of net inflows, a new record, more than a month since launch is nothing short of impressive for any ETF," noted The Block's VP of Research, George Calle.

“The U.S. spot Bitcoin ETFs have been widely successful well beyond even the most optimistic expectations,” GSR Research Analyst Brian Rudick told The Block yesterday. “Their $10 billion-plus of inflows in just two months is approaching what most thought they would do in the first year, and there are arguments for why inflows may increase from here, like greater issuer sales efforts, their addition to wealth manager product offerings, and normalizing GBTC outflows.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From yen rate hikes to mining farms shutting down, why is bitcoin still falling?

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The Economist: The Real Threat of Cryptocurrency to Traditional Banks

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

Grayscale's Top 10 Crypto Predictions: Key Trends for 2026 You Can't Miss

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.

From Yen Interest Rate Hike to Mining Farm Shutdown, Why Is Bitcoin Still Falling

The market is down again, but this may not be a good buying opportunity this time.