Greeks.live: $15 billion options about to expire, BTC call options still dominant

TechFlow News, Greek.live macro researcher Adam tweeted that tomorrow is the quarterly large delivery date, with $15 billion in options awaiting delivery. Market participants are intensifying their repositioning efforts, and BTC call options remain the absolute main force in repositioning.

In today's bulk transactions, a 6-8 basis point slippage is common, with slippages of over ten basis points not uncommon. It is a rare good time for participants who value precise pricing.

Due to the recent high volatility in the market, there has been no significant decrease in IV for major terms. This has led to a continuous increase in the cost-effectiveness of selling options currently available trading opportunities for selling options even in June and September.

Adam still believes that there will be a significant decrease in IV this weekend, allowing sellers to quickly realize profits.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

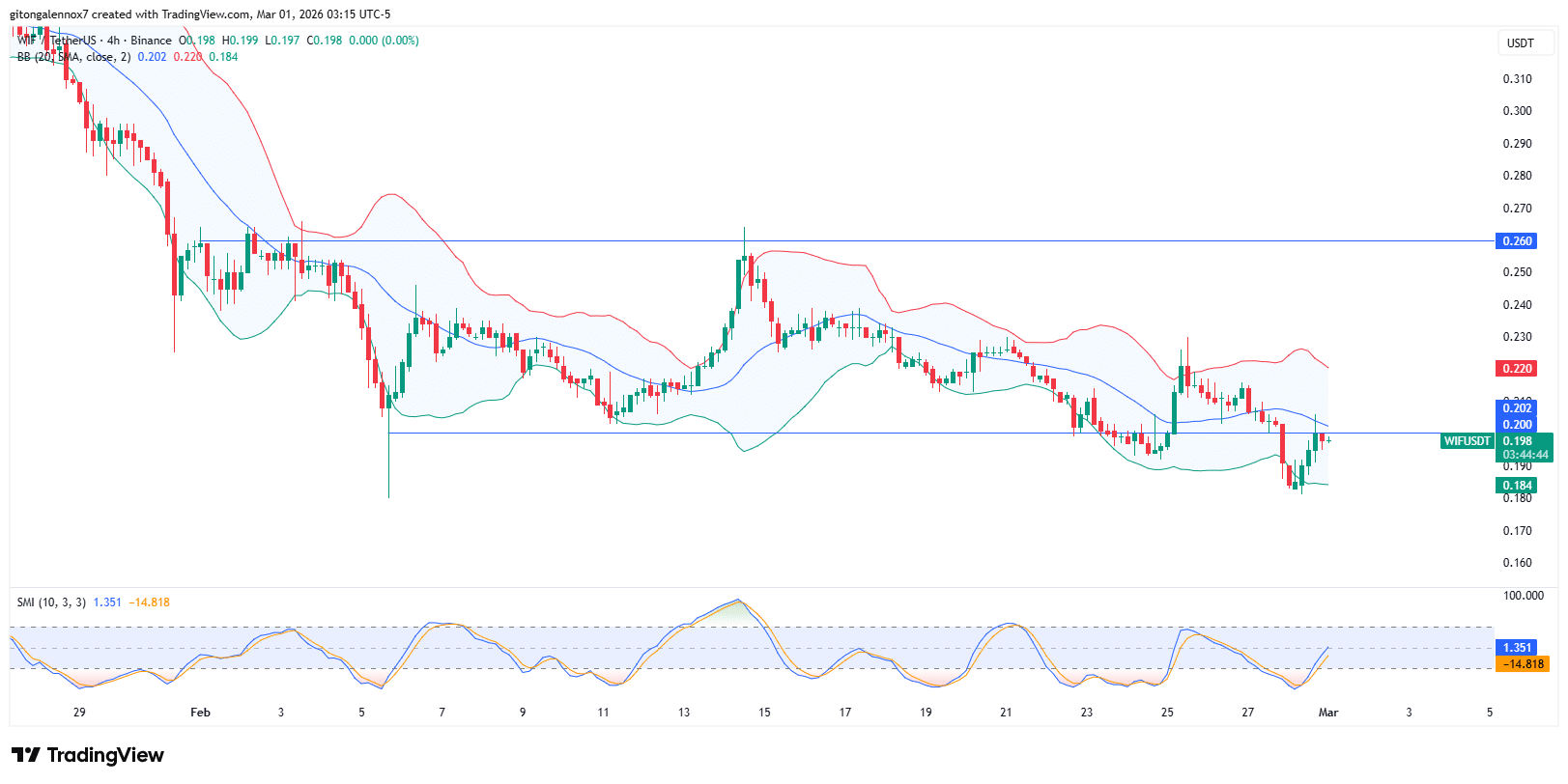

dogwifhat at $0.20: Reversal or further drop, what’s next for WIF?

"A sharp divide": Wall Street assesses the gains and losses as AI-fueled tech stocks tumble

How to Identify an Effective CEO: A Practical Guide

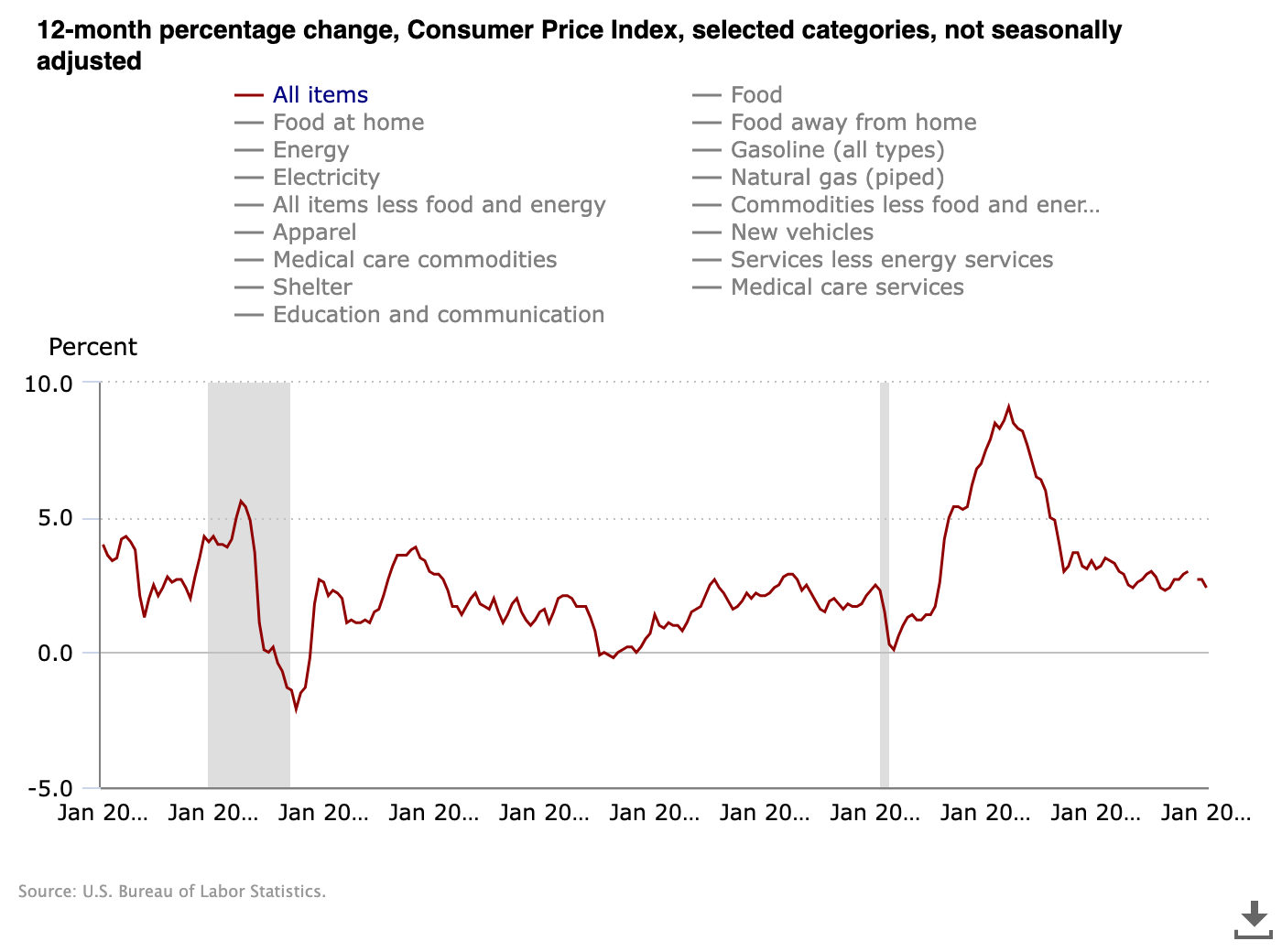

Bitcoin traders eye Iran reactions as oil sparks US 5% inflation forecast