Bitcoin Price Analysis: Is BTC on the Verge of Exploding to $75K?

Bitcoin’s price has recovered from its sudden drop from $75K and is currently targeting the same level again. Market participants are eagerly waiting for the market to make a new record high soon.

Technical Analysis

By TradingRage

The Daily Chart

On the daily chart, the price has rebounded from the $60K support zone and broken the $69K resistance level to the upside. BTC is currently climbing toward the $75K resistance once more.

The Relative Strength Index is also showing values above 50%, indicating that the momentum is in favor of a bullish continuation. It might be time before Bitcoin makes a new record high.

The 4-Hour Chart

Looking at the 4-hour timeframe, it is evident that the price has broken the large descending channel pattern to the upside.

It has also retested the $69K level after breaking above it and is on its way toward the $75K resistance zone once more. Judging by the price action and the fact that the RSI shows that the momentum is bullish, a new higher high seems imminent in the short term.

On-Chain Analysis

By TradingRage

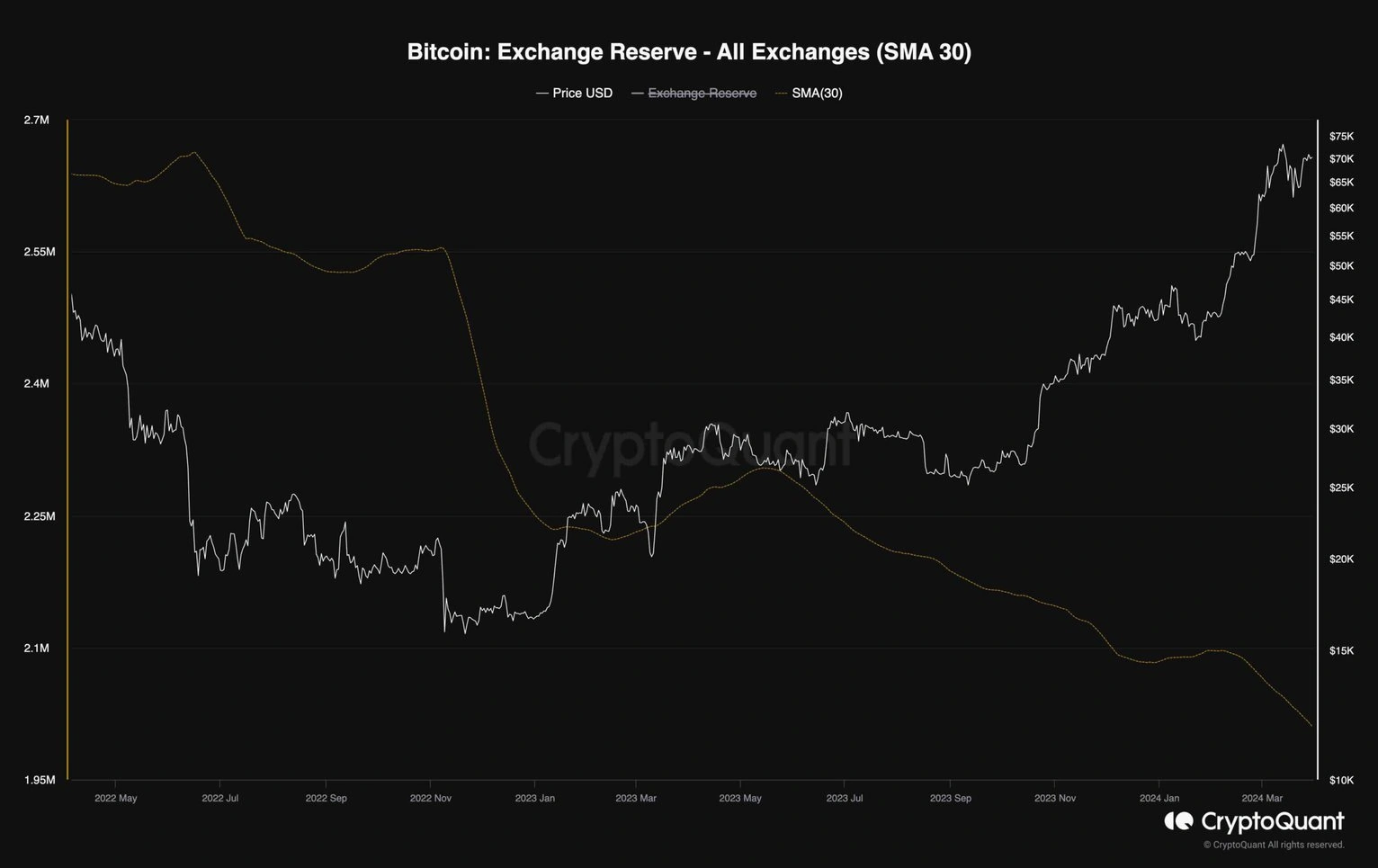

Bitcoin Exchange Reserve

The recent decline in Bitcoin exchange reserves, reaching new lows amidst rapid drops, suggests a tightening of available supply in the market. This diminishing reserve trend often correlates with increased demand for Bitcoin, potentially setting the stage for a surge in its price in the upcoming weeks.

As supply dwindles and demand remains steady or grows, basic economic principles suggest that the value of Bitcoin is poised to rise, reflecting a bullish sentiment among investors and traders.

Yet, it’s essential to note that while historical patterns may indicate a potential increase, the future performance of Bitcoin remains uncertain and subject to various factors, including market sentiment, regulatory developments, and macroeconomic trends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?

Crucial Alert: ZRO Leads This Week’s $100M+ Token Unlocks – What Investors Must Know