Bitcoin ETF battle heats up as BlackRock closes in on Grayscale

BlackRock’s spot bitcoin ETF appears on pace to overtake Grayscale as biggest of the crypto-based investment vehicles.Grayscale’s fund, which has higher fees than many competitors, has shed billions of dollars in AUM since trading started in January.

It has been three months since spot bitcoin ETFs began trading and BlackRock's fund appears to be on pace to usurp Grayscale's as the biggest of the crypto-based investment vehicles on offer.

According to Trackinsight data compiled by The Block Data Dashboard , as of Tuesday, BlackRock's IBIT fund had $18.2 billion in assets under management compared to Grayscale's $23.2 billion.

As Grayscale's GBTC fund, which charges a higher fee than BlackRock's, has consistently shed capital since it began trading, BlackRock's ETF has been slowly narrowing the gap in terms of assets under management, or AUM. Grayscale's fund had about $23.4 billion in AUM two months ago compared to BlackRock's $4.4 billion, according to The Block Data Dashboard .

Grayscale's ETF started with nearly $30 billion in AUM as the firm's exchange-traded fund is a conversion of its flagship fund. The fund's declining AUM is likely due, in part, to Genesis selling GBTC shares , said Eric Balchunas, senior ETF analyst at Bloomberg.

RELATED INDICES

In terms of trading volume, Grayscale’s fund has also been gradually losing market share, down from about 50% when the spot bitcoin ETFs launched on Jan. 11 to 23.5% as of Tuesday.

Grayscale’s fund shed $154.9 million in outflows on Tuesday, while BlackRock’s took in $128.7 million in inflows.

Fidelity's spot bitcoin ETF is third in trading volume market share and AUM.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

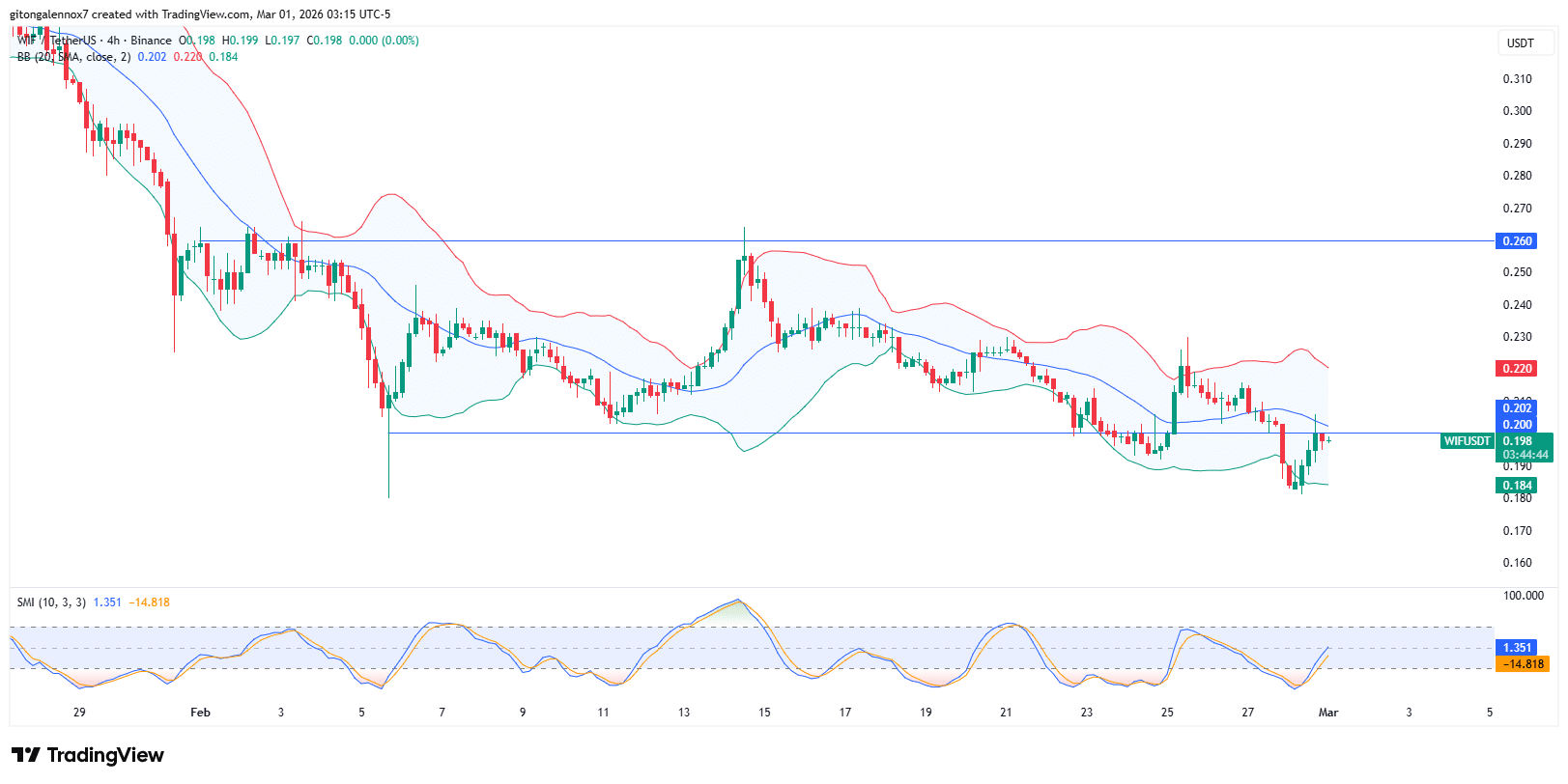

dogwifhat at $0.20: Reversal or further drop, what’s next for WIF?

"A sharp divide": Wall Street assesses the gains and losses as AI-fueled tech stocks tumble

How to Identify an Effective CEO: A Practical Guide

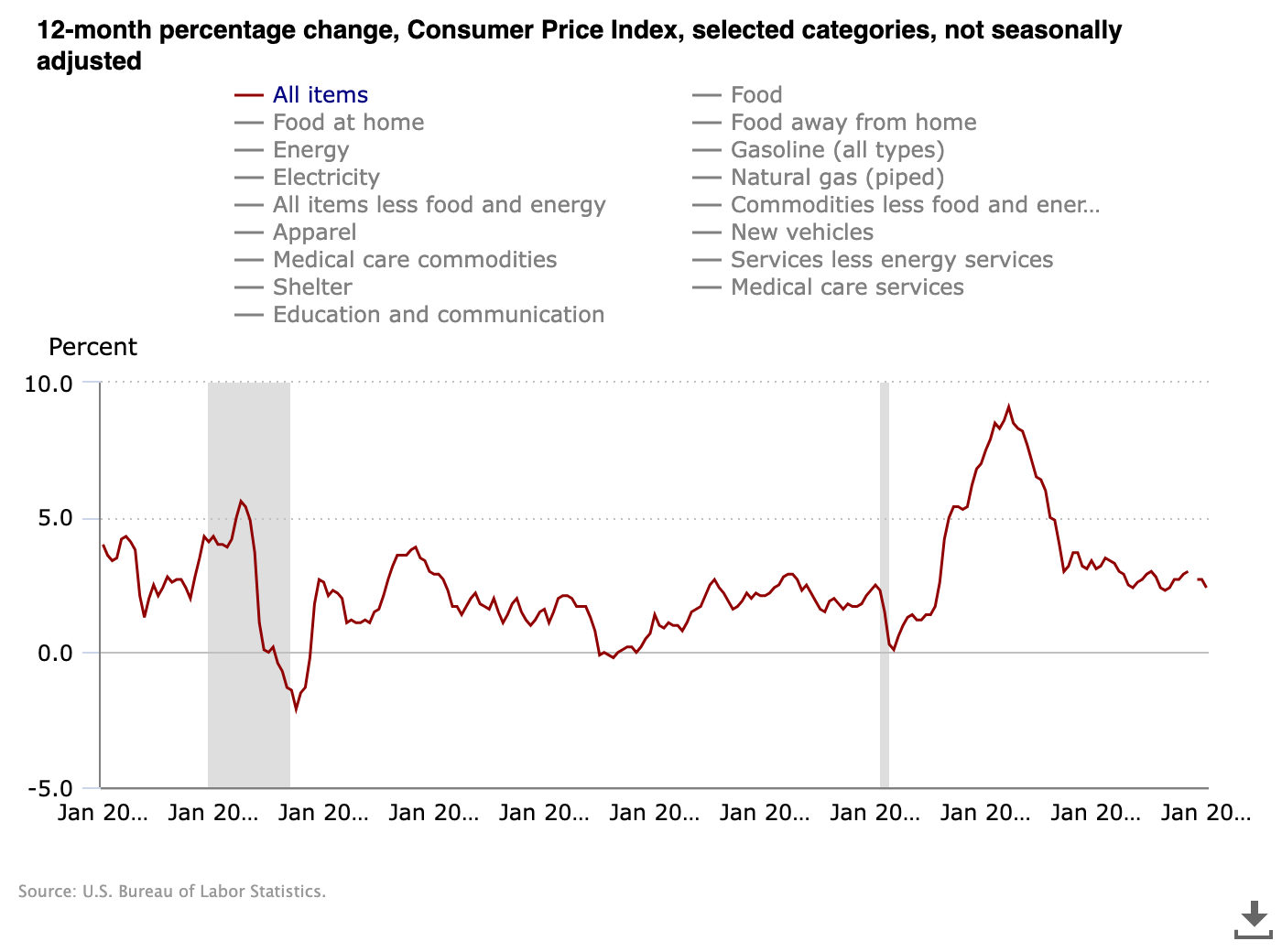

Bitcoin traders eye Iran reactions as oil sparks US 5% inflation forecast