The U.S. Bitcoin spot ETF had a net inflow of approximately US$124 million yesterday

PANews reported on April 11 that according to monitoring by HODL15Capital, the net inflow of the U.S. Bitcoin spot ETF on April 10 was approximately US$124 million. Among them, Grayscale GBTC had a net outflow of approximately US$18 million yesterday, BlackRock's IBIT had a net inflow of approximately US$34 million, Fidelity's FBTC had a net inflow of approximately US$76 million, ARK 21Shares' ARKB had a net inflow of approximately US$7 million, and Bitwise's BITB Net inflow was approximately US$24 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Exclusive-QIA, Visa and ADIA set to anchor SoftBank's PayPay IPO, sources say

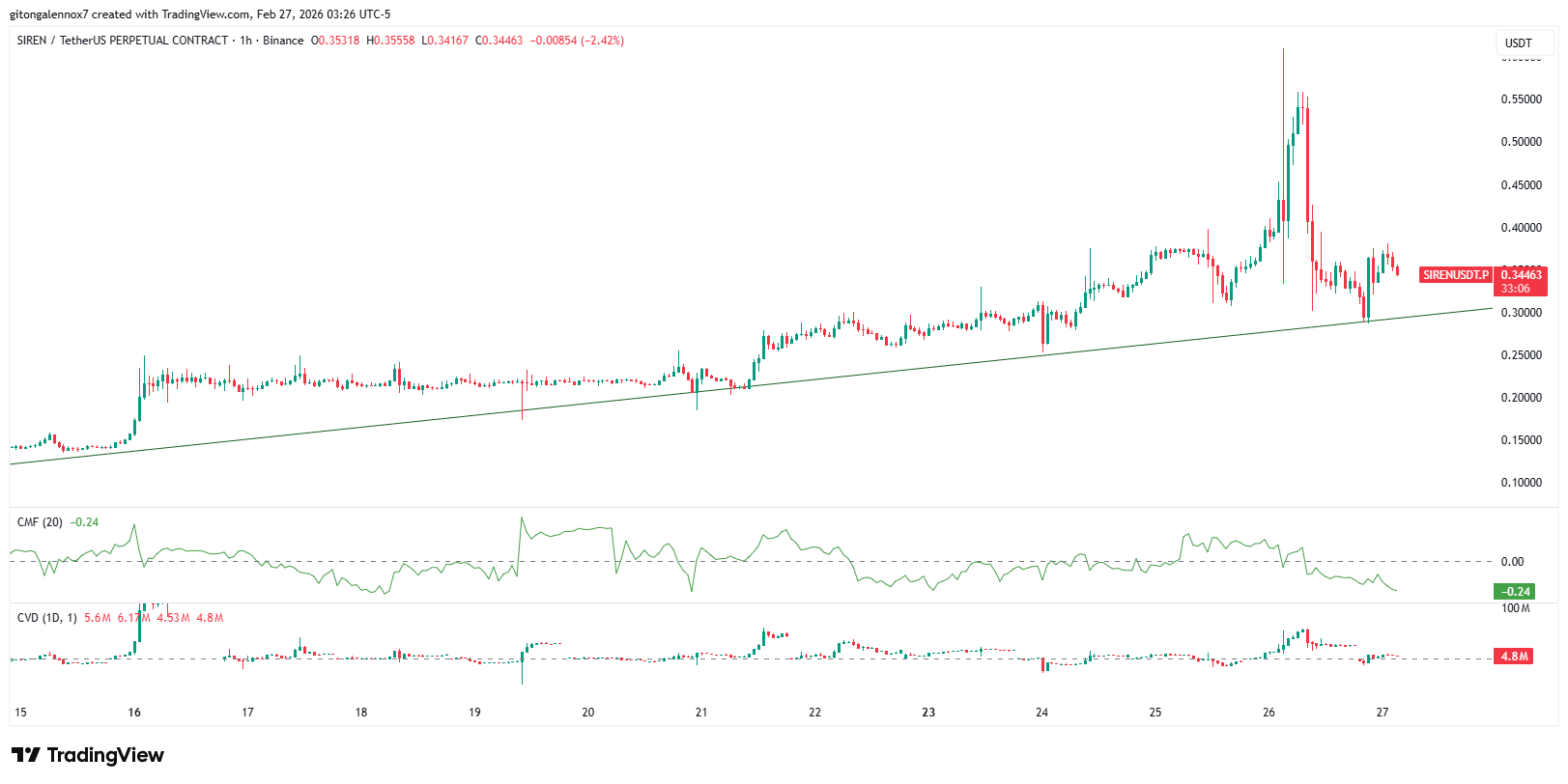

SIREN plunges after 1M token deposit: Will $0.30 support fall next?

Tricolor Noteholders File Lawsuit Against JPMorgan, Barclays, and Fifth Third

Celsius Q4 Beat: The Catalyst That Forced the Analyst Upgrade