HBAR Skyrockets 60% Amid BlackRock Confusion, BTC Aims at $67K (Market Watch)

Numerous meme coins have also posted double-digit price increases in the past 24 hours.

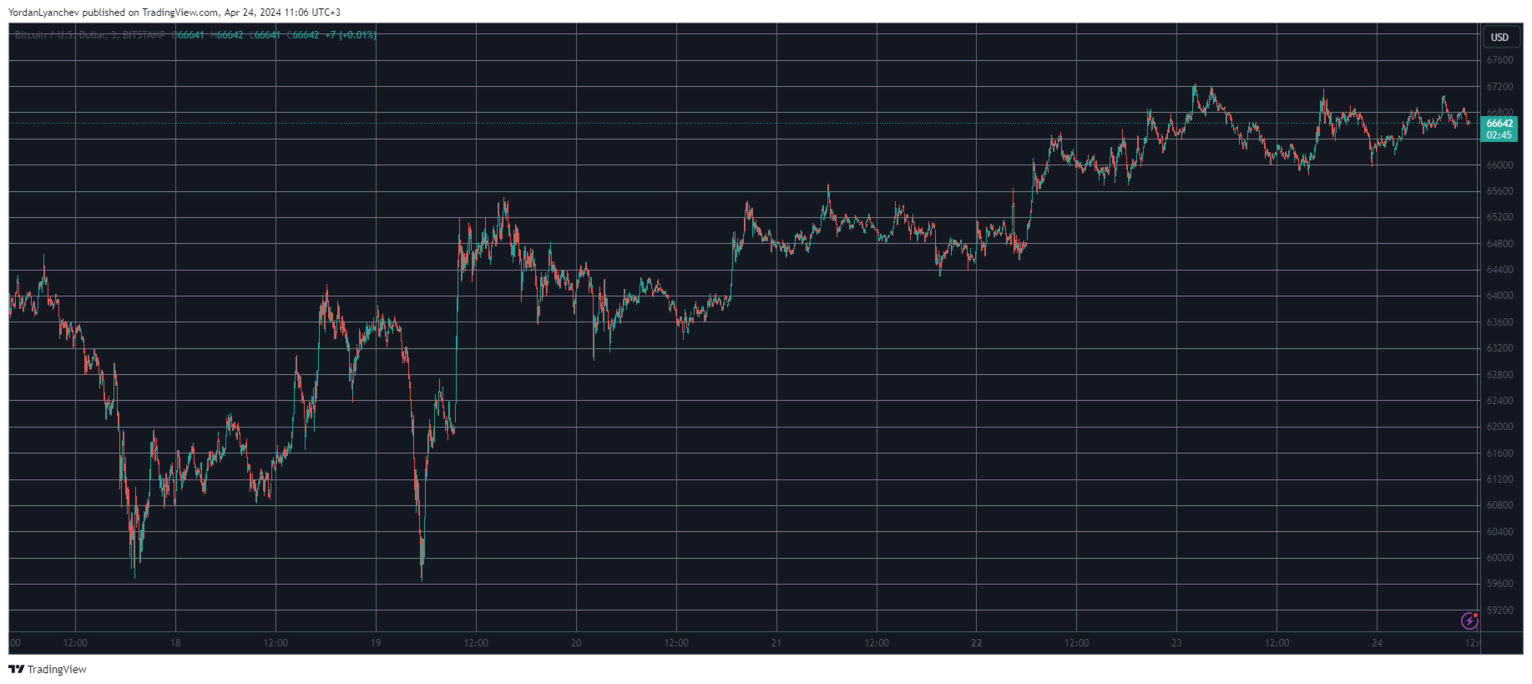

Bitcoin tried to take down the $67,000 level once more in the past day or so but failed to overcome it decisively and now sits inches below it.

The altcoins are well in the green, with ETH jumping to $3,250 and TON recovering some of the most recent losses. HBAR is today’s top performer after some interaction with BlackRock.

BTC Goes After $67K

Bitcoin’s price faced massive volatility last week, mostly driven by the escalating tension between Iran and Israel. The last such occasion was on Friday, hours before the fourth halving , when the latter launched an attack. In a matter of minutes, BTC slumped by several grand to under $60,000.

However, once Iran said there will be no retaliation soon, bitcoin went on the offensive and soared by more than $5,000. Another minor retracement followed to $63,000, but that was quickly overcome, and the cryptocurrency stood at around $65,000 once the halving was completed and the block rewards were slashed in half.

Since then, the price fluctuations have declined. Bitcoin has gradually increased in value and has challenged $67,000 a couple of times in the past day or so. So far, the asset has been unable to overcome that level and now trades a few hundred dollars below it.

Its market capitalization remains above $1.3 trillion, but the dominance over the alts has taken a hit and is down to 50.7% on CG.

HBAR Goes Up and Down

News came out yesterday that Hedera had partnered with Archax to tokenize BlackRock’s ICS US Treasury money market fund on its blockchain. The markets reacted immediately with a massive surge for HBAR, but then Archax’s CEO informed that it wasn’t BlackRock who picked Hedera, and it was the company he runs.

HBAR retraced from its peak, but it is still 60% up on the day, despite the criticism on X.

The other most impressive gainers from the top 100 altcoins are mostly reps from the meme coin industry, as reported earlier.

The rest of the larger-cap alts are also in the green, with ETH trading above $3,250, TON recovering to $5.9, and SOL and BNB with minor gains.

The total crypto market cap has neared $2.6 trillion on CoinGecko.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?

Crucial Alert: ZRO Leads This Week’s $100M+ Token Unlocks – What Investors Must Know