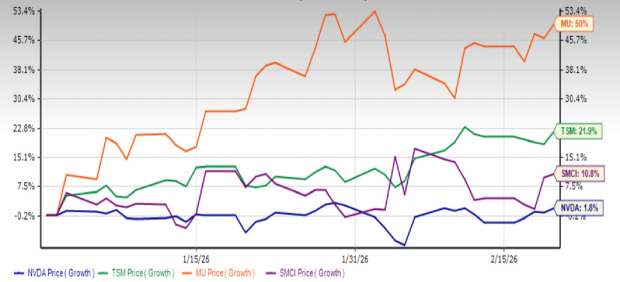

- ONDO trading volume surged over 300% in May, signaling high demand.

- ONDO led trading volume, surpassing other cryptocurrencies.

- Ondo Finance expands with USDY stablecoin integrating with Mantle.

ONDO’s trading volume surged by over 300% in May, signaling heightened on-chain activity and sustained market interest, according to data from IntoTheBlock .

ONDO’s transaction volume fluctuated with a generally upward trend, indicating a spike in trading volume and user engagement.

ONDO consistently maintained the highest transaction volume throughout the period, compared to cryptocurrencies like Maker, Pax Gold, Maple, and Goldfinch, which had significantly lower and more stable volumes.

Key observations include ONDO’s high volatility, with sudden spikes and drops suggesting periods of intense trading activity, likely driven by market events or news. For instance, ONDO surged nearly 20% following the approval of Ethereum spot ETFs, pushing it to an all-time high of $1.16. On May 9, the token increased from $0.7812 to $0.8092 after announcing a partnership with the decentralized infrastructure network, Zebec.

Despite this volatility, the relatively high transaction volume in May 2024 indicates sustained interest from traders and investors. Compared to the other listed cryptocurrencies, ONDO’s market dominance suggests it as a preferred trading asset.

Meanwhile, Ondo Finance, a yield coin solutions provider, is developing future financial offerings. The network’s native stablecoin, USDY, has integrated with Mantle to enhance capital mobility efficiency within the market. An initial supply exceeding $1 million USDY will support liquidity solutions.

However, USDY tokens are currently unavailable to U.S. investors due to ongoing registration under the U.S. Securities Act. As of press time, ONDO was trading at $1.31, reflecting a 4.03% intraday dip. Month-to-date, the token has had 16 green days, closing with green candlesticks.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.