Nine Bitcoin spot ETFs in the United States reduced their holdings by 3,169 BTC today, worth about $208 million

According to Lookonchain monitoring, the holdings of 9 US Bitcoin spot ETFs decreased by 3,169 BTC, worth about $208 million. Among them, Fidelity reduced its holdings by 1,224 BTC, worth about $80.34 million, and currently holds 171,529 BTC, equivalent to about $11.25 billion. Grayscale reduced its holdings by 936 BTC, worth about $61.4 million, and currently holds 281,212 BTC, with a total value of about $18.45 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

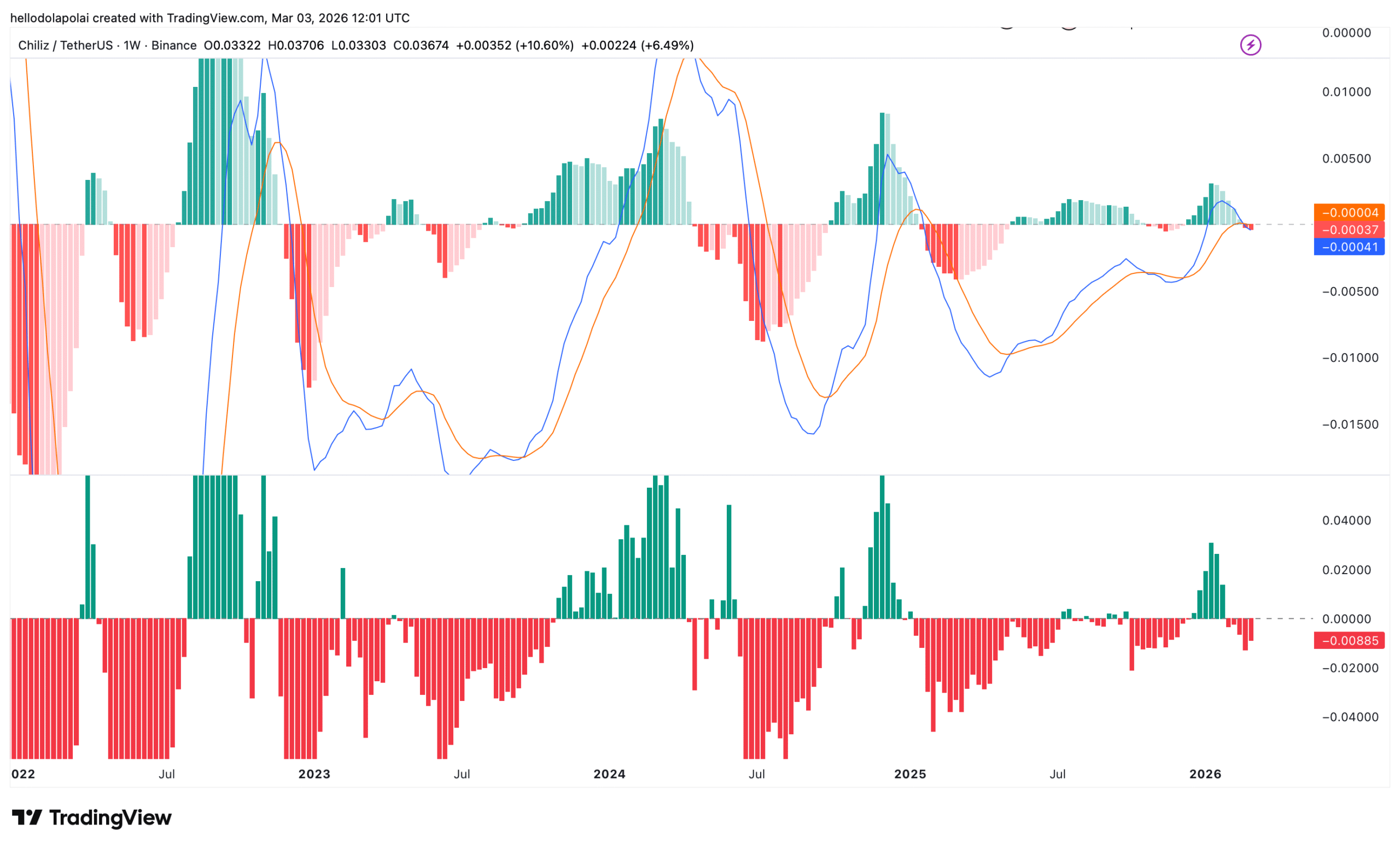

Chiliz nears key resistance: What’s behind CHZ’s fragile rally?

Marvell: Cramer's "Buy the Dip" Alpha vs. The "Lost Deal" Noise

Lumentum’s OFC Catalyst: A Strategic Move Riding the Wave of AI Infrastructure Growth

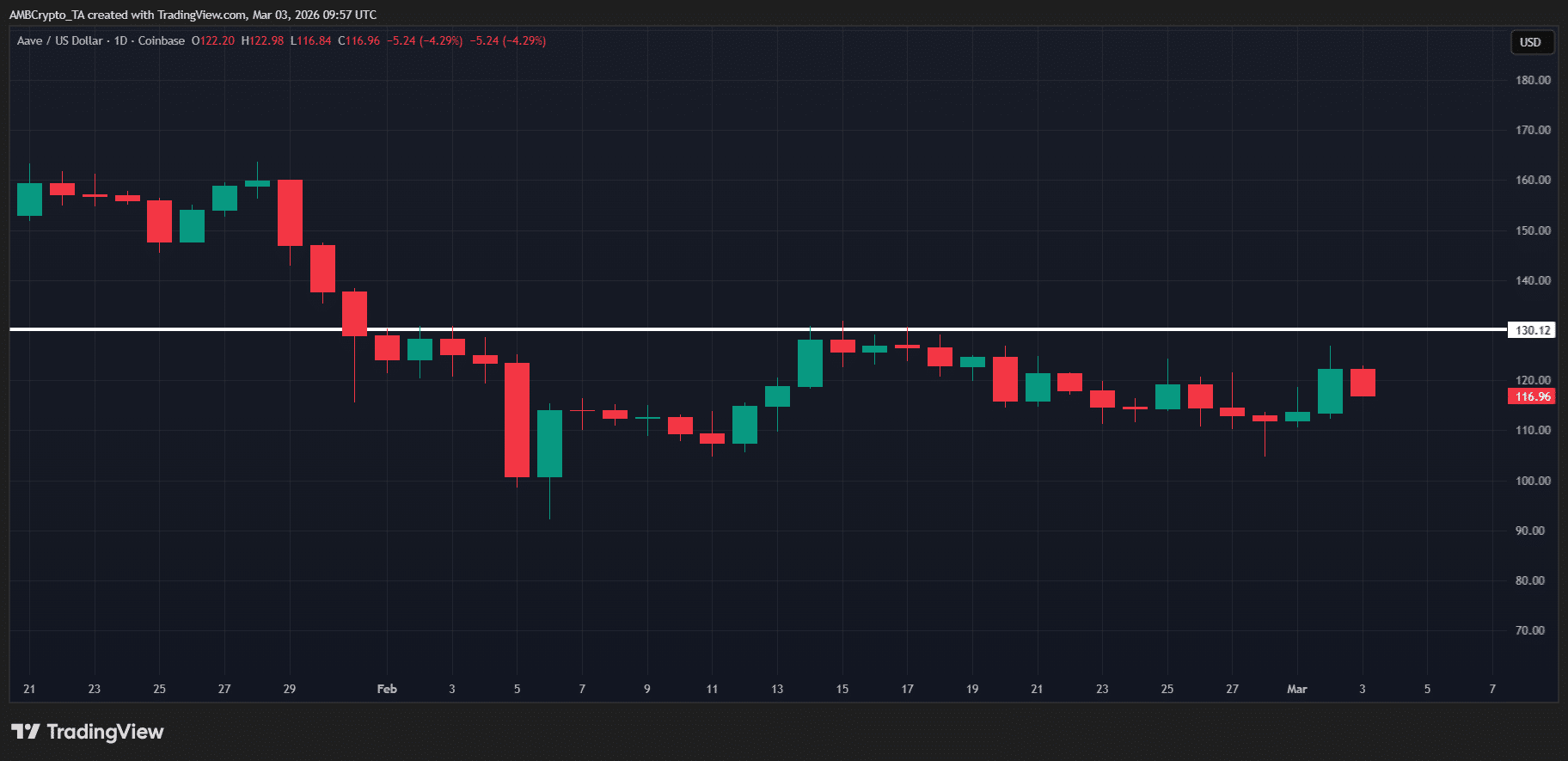

AAVE jumps 7% on $42.5 mln governance boost – Can it break $130?