Good news for Ethereum - huge growth in staking on the network

The latest chain data shows a remarkable growth in Ethereum staking over the past month, which is good news for the network.

According to CryptoQuant data, 20 new participants have joined the Ethereum staking network since May 59,894. This jump coincided with the promotion of the chances of spot approval Ethereum ETF by Bloomberg analysts James Seyfarth and Eric Balchunas up to 75%.

Additionally, the influx of new stakers will likely reduce the circulating supply of Ethereum as these new validators must lock up a significant amount of ETH. Data from Dune Analytics shows that over 33 million ETH are currently staked, representing almost 28% of the total supply of cryptocurrency .

A decrease in Ethereum's circulating supply is a bullish signal, as it helps mitigate potential selling pressure on the token. This effect is amplified as the demand for Ethereum increases and the price of ETH reacts to the principles of supply and demand.

READ MORE:

The worst performing Ethereum investment products of all cryptocurrenciesThe distribution of ETH also supports the bullish outlook. Market data from IntoTheBlock shows that around 78% of the Ethereum supply, including staked ETH, is held by long-term holders – those who have held the token for more than a year.

This concentration of supply among long-term holders suggests that these individuals are unlikely to sell their holdings anytime soon. This is especially important in view of the expected increase in institutional demand for ETH once spot Ethereum ETFs start trading. These ETFs are expected to begin trading soon, potentially after July 8, as Balchunas suggested, although earlier estimates of a July 2 launch have been adjusted due to SEC delays.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is Marriott International Shares Beating the S&P 500 Index?

特朗普团队拟取消7500美元电动汽车税收抵免,电动汽车股大跌

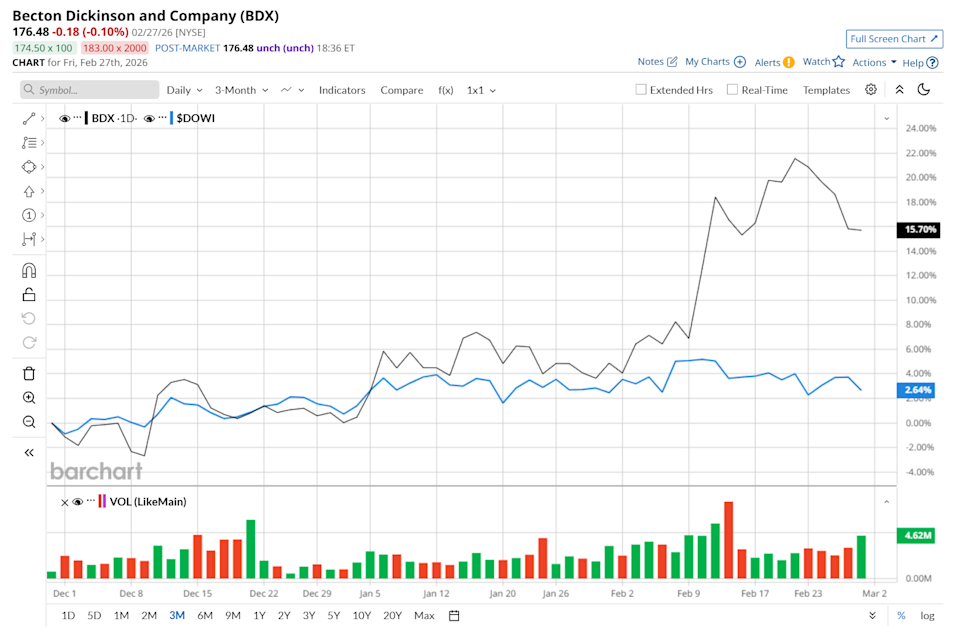

Is Becton, Dickinson and Company Shares Beating the Dow's Performance?

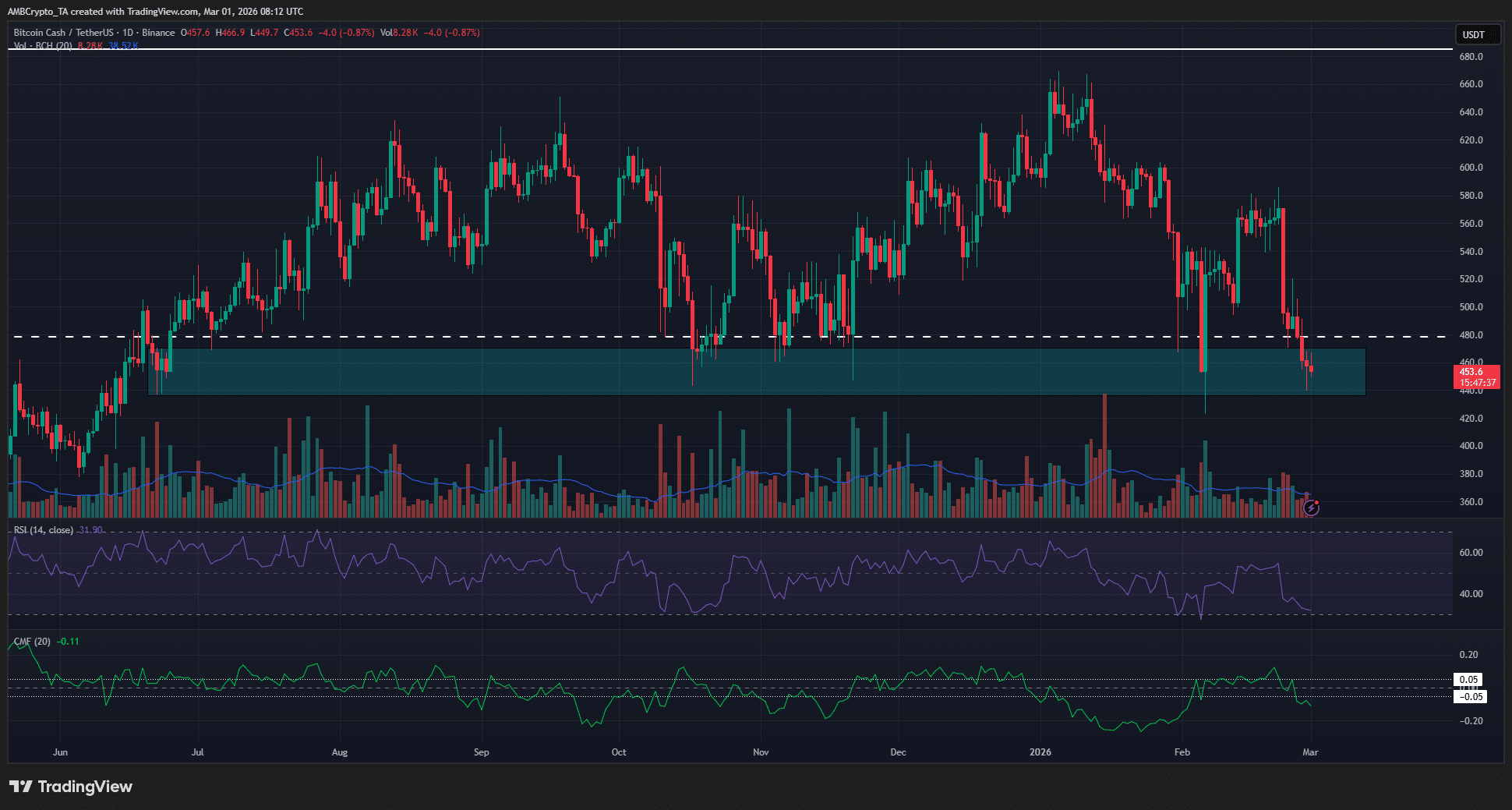

Crypto market’s weekly winners and losers – DOT, NEAR, BCH, PEPE