$537 million Binance deposits tied to BTC price drop suggest whales selling: LookOnChain

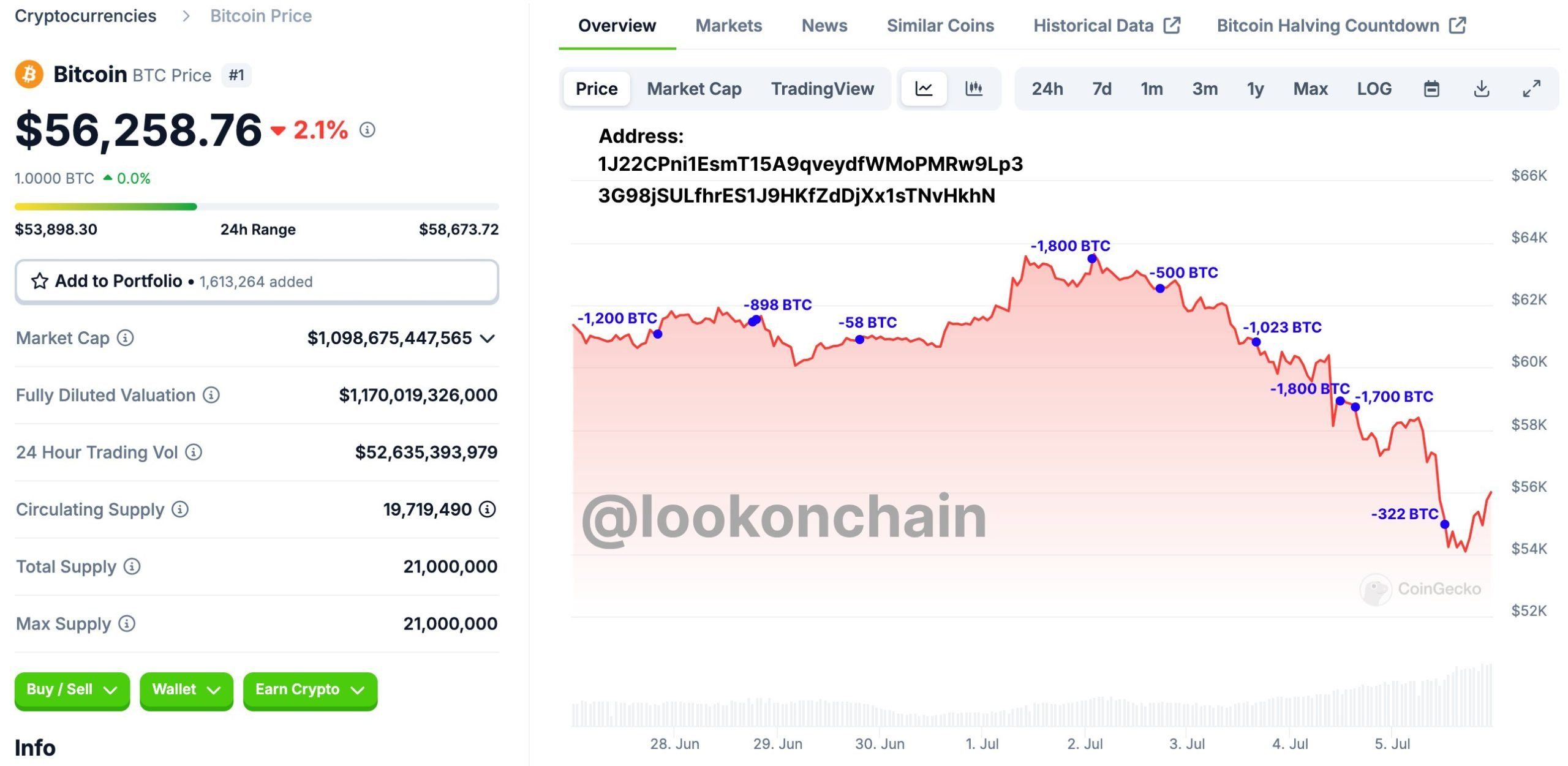

Two wallets identified by LookOnChain have transferred 9,500 BTC worth about $537 million, at current prices, to Binance within the past week.The transfers were associated with subsequent drops in the price of bitcoin, which may indicate the whales selling.

Two wallets have deposited 9,500 BTC -2.88% to Binance since June 27, potentially indicating whales liquidating nearly $550 million in cryptocurrency.

The wallets, first spotted by blockchain analytics firm Lookonchain, could represent whales cashing in on their bitcoin holdings, which are currently valued at $537 million. When the transfers began last week, the stash was worth closer to $575 million.

Lookonchain also analyzed the timing of transfers from each of the two wallets and found a correlation between the transfers to addresses tagged as Binance deposit wallets by Arkham Intelligence and subsequent declines in the price of bitcoin that were likely sparked by the large sales.

One wallet still holds over 4,300 bitcoin worth nearly $250 million at current prices. Its most recent deposit to a Binance address occurred two days ago.

The crypto industry has been roiled in recent days by the movement of bitcoin associated with hacked exchange Mt. Gox's repayment of creditors in bitcoin and bitcoin cash. The news has already caused hundreds of millions of dollars of liquidations across the crypto market, though the timeline for repayments varies per custodian, and some creditors may have to wait up to three months to receive their coins.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Michael Saylor hints at next Bitcoin buy as BTC falls below $88K

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?