Bitget Daily Futures Market Update

Bitget2024/07/08 07:04

By:Bitget

Bitcoin ETFs score highest net inflows in 30 days amid volatility from Mt. Gox unlocks

Despite the price of bitcoin falling as low as $54,000 in recent days, down about 25% from its peak above $73,000 in March, spot bitcoin ETFs had their strongest day of inflows for a month on July 5, gaining $143 million in total.

Four out of the 11 top spot bitcoin ETFs saw inflows which added up to over 3,000 BTC, worth about $172 million at current prices, with about 80% of that sum going to Fidelity's FBTC fund. The ETF offerings from Bitwise (BITB), Ark 21Shares (ARKB), and VanEck (HODL) drew the remainder of the inflows, while Grayscale's GBTC saw 500 BTC of outflow, worth about $29 million, according to Coinglass data. The remaining ETFs saw no significant change.

The net inflow value is the highest single-day sum since June 6; however, early June saw significant inflows to the ETFs, with $1.7 billion in inflows over just four days, June 4 to June 7. June 7 marked a record-breaking 18-day streak of net inflows though June 10, the next trading day, saw $65 million in outflows from the funds. BlackRock's iShares Bitcoin Trust (IBIT) remains the top ETF with over $17 billion AUM, according to The Block's Data Dashboard, despite the fund seeing no major inflows or outflows on July 5. The ETF inflows may reflect some consumer optimism over the price of bitcoin, despite the Mt Gox sell-off.

Source: The Block

Futures market Updates

Although BTC has reclaimed the $55K mark, the corresponding

funding rates at -0.0005% and Long/Short ratio still show bearish sentiment.

Bitcoin Futures Updates

Total BTC Open Interest: $27.39B (-4.04%)

BTC Volume (24H): $55.81B (+42.74%)

BTC Liquidations (24H): $51.80M (Long)/$31.07M (Short)

Long/Short Ratio: 48.33%/51.67%

Funding Rate: -0.0005%

Ether Futures Updates

Total ETH Open Interest: $11.77B (-5.98%)

ETH Volume (24H): $23.56B (+56.66%)

ETH Liquidations (24H): $35.09M (Long)/$12.87M (Short)

Long/Short Ratio: 47.07%/52.93%

Funding Rate: 0.0014%

Top 3 OI Surges

GLM: $22.53M (+323.17%)

COS: $614.95K (+202.76%)

SAGA: $24.02M (+80.34%)

1

1

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

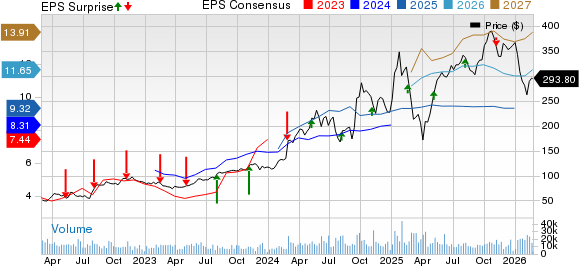

Constellation Energy Q4 Earnings Surpass Estimates, Revenues Rise Y/Y

Finviz•2026/02/24 16:42

Student loan turmoil impacts real estate as major housing provider affected

101 finance•2026/02/24 16:39

Google enters into agreements with AES and Xcel to secure energy supplies for its data centers

101 finance•2026/02/24 16:39

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$63,977.29

-2.53%

Ethereum

ETH

$1,849.95

-2.48%

Tether USDt

USDT

$1

+0.05%

XRP

XRP

$1.35

-1.56%

BNB

BNB

$586.54

-3.16%

USDC

USDC

$1.0000

-0.01%

Solana

SOL

$77.83

-2.27%

TRON

TRX

$0.2821

-0.45%

Dogecoin

DOGE

$0.09207

-3.45%

Bitcoin Cash

BCH

$476.98

-10.44%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now