Inflows to US Bitcoin ETFs Decline

After the U.S.-based spot Bitcoin ETFs recorded two trading days with a higher net income of $200 million this week, they continued the positive streak on July 11, but more modestly.

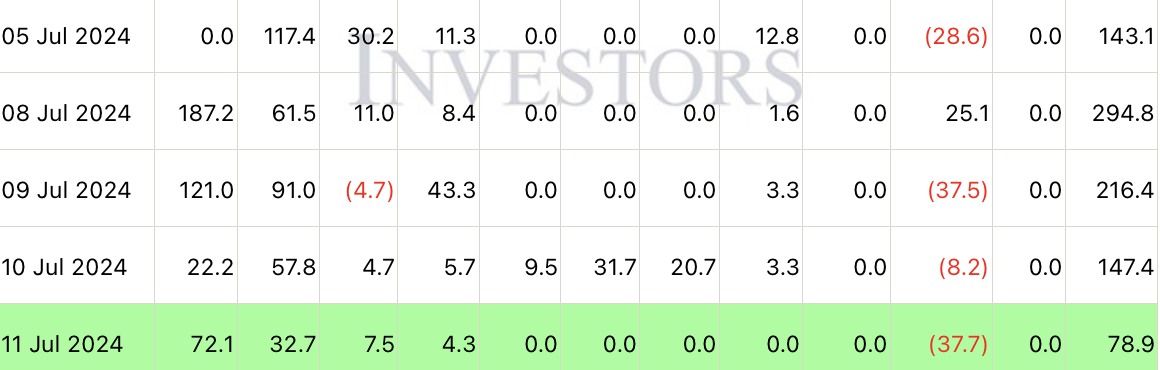

Registering $295 million on July 8, $216 million the day after and $147 million on July 10 , yesterday all-U.S. ETFs attracted just $78.9 million.

On July 11, BlackRock’s ETF, the iShares Bitcoin Trust, attracted $72.1 million, and Fidelity’s Wise Origin Bitcoin Fund followed with $32.7 million.

Bitwise’s BITB ranked third with inflows of just $7.5 million. In total, all U.S. spot Bitcoin exchange-traded funds attracted $78.9 million on the day.

READ MORE:

Crypto market Faces Uncertainty Amid Rate Cut Speculation and Upcoming PayoutsAlthough the last four trading days saw positive overall results – Grayscale Bitcoin Trust (GBTC) again registered outflows of $37.7 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

OPNUSDT now launched for pre-market futures trading

Join the BGB holders group—unlock Spring Festival Mystery Boxes to win up to 8888 USDT and merch from Morph

Trading Club Championship (Margin)—Trade to share 58,000 USDT, with up to 3000 USDT per user!

CandyBomb x XAUT: Trade futures to share 5 XAUT!