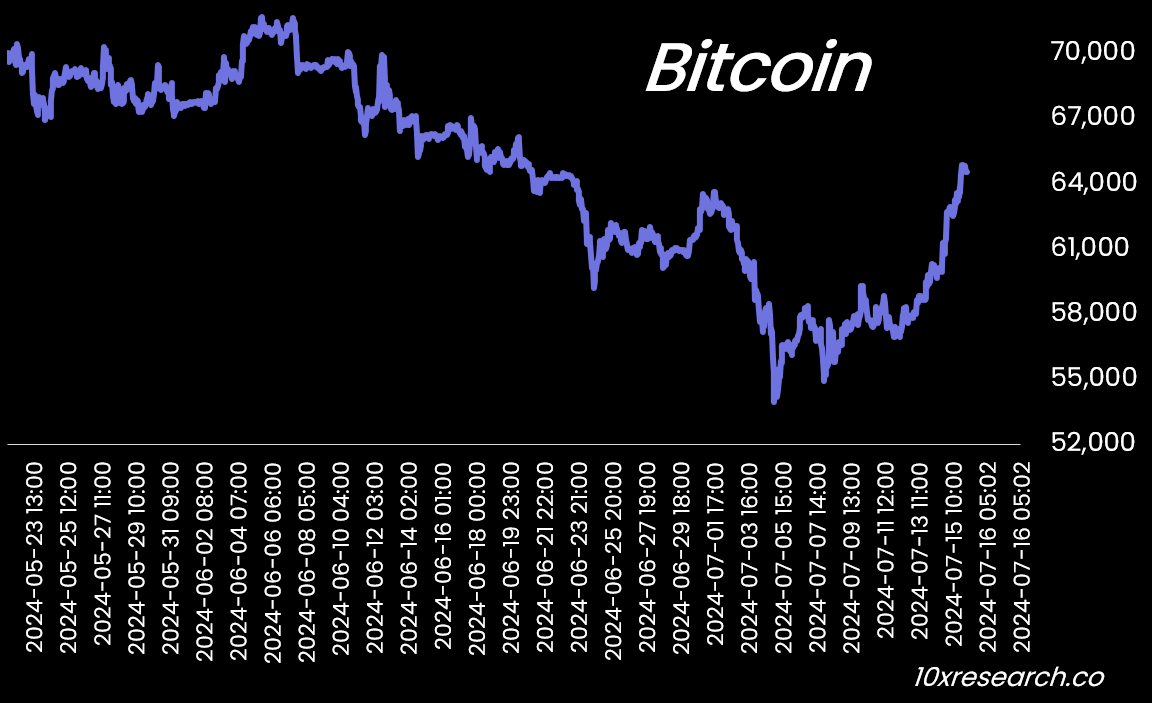

👇1-12) Often swayed by changing narratives, rumors, and speculation, Bitcoin can rapidly adjust its value based on new information. Since this past Friday, Bitcoin has surged by a significant 10%. What initially seemed like an oversold rally evolved into a breakout from a clearly defined downward trend. Our key level—bearish below 61,133 and bullish above—was surpassed, signaling a shift in market sentiment from bearish to bullish.

Here are the 10 key reasons behind this surge:

👇2-12)

Retail Trading and Weekend Rallies: Weekend rallies are often fueled by retail trading and hope. This past Monday, several positive factors sustained Bitcoin's momentum. Our trading signals alerted us to buy

MakerDAO (+14.2%), AAVE (+3.4%), and Polkadot over the weekend.

👇3-12)

Net Liquidity Inflows: After four weeks of net liquidity outflows totaling $8 billion, the crypto

markets saw $3.3 billion in inflows last week. This influx, primarily fro

m futures, stablecoins, and Bitcoin Spot ETFs, marked a positive trend change. Additionally,

Tether reported minting $1 billion in USDT.

👇4-12)

Bitcoin Spot ETFs: Bitcoin Spot ETFs received $0.5 billion in inflows over the last seven trading days, indicating strong retail interest. While institutional arbitrage players remained absent, the retail flow appeared more sustained.

👇5-12)

Larry Fink's Endorsement: Blackrock CEO Larry Fink gave a bullish interview on Bitcoin, expressing newfound optimism after studying its investment opportunities. This endorsement bolstered confidence in the market.

👇6-12)

Ethereum ETF Speculation: Rumors of an upcoming

Ethereum ETF, potentially starting trading on July 23, have created positive sentiment. The SEC's request for final S-1 applications by July 17 suggests that approval may come soon.

👇7-12)

Positive Historical Trends: Historically,

crypto markets rally ahead of major listings, such as the December 2017

Bitcoin futures listing, the April 2021 Coinbase listing, and the January 2024 Bitcoin Spot ETF listing.

👇8-12)

China's Potential Shift: Rumors suggest China might adopt a more favorable stance on crypto, with Hong Kong's crypto rules serving as a test. Some sources claim Chinese mainland investors may soon be able to buy Hong Kong-listed Bitcoin Spot ETFs. While these rumors are unsubstantiated, they have been frequently floated in the market.

👇9-12)

South Korea's Crypto Tax Delay: Due to deteriorating sentiment towards crypto assets, South Korea's ruling party has proposed delaying the crypto tax until 2028. Originally set for January 1, 2025, this delay has spurred speculative trading activity in the region.

👇10-12)

Dovish CPI Print: Last week's lower-than-expected CPI print set a floor for

Bitcoin prices following a 20% peak-to-trough decline. The end of significant sell flows from the German State of Saxony also removed a negative overhang.

👇11-12)

Political Developments: The attempted assassination of Trump has increased his chances of re-election, which some believe could positively impact crypto sentiment. Trump is scheduled to speak at a Bitcoin conference later this month, and his Vice Presidential candidate, JD Vance, is a known Bitcoin supporter.

👇12-12) These factors collectively contributed to Bitcoin's impressive 10% surge, reflecting a complex interplay of market dynamics, institutional actions, and geopolitical developments.