Ethereum ETF Launch Triggers Price Drop but Sets Stage for Possible Rally

The launch of Ethereum's (ETH) ETF has led to new selling pressure on the cryptocurrency, potentially linked to Grayscale’s substantial ETH holdings, which were acquired at lower prices.

Following the ETF’s introduction, ETH prices fell to around $3,100, with the ETF initially seeing limited inflows and ultimately experiencing outflows.

Grayscale, which controls a significant portion of ETH, may be contributing to this pressure, though analysts suggest this trend might persist for a couple of months before ETH rebounds. Despite this, Grayscale’s recent transactions have bolstered its ETH reserves to $9.17 billion, aiding ETH’s recovery above $3,200.

The Grayscale Ethereum Trust (ETHE) is trading around $2,600 per ETH, reflecting the market’s mixed sentiment towards such products. Grayscale holds a commanding 95% of the ETH available for ETFs, whereas competitors like BlackRock have a much smaller share.

The current market dynamics resemble early Bitcoin ETF trends, with initial outflows potentially setting the stage for a larger ETH rally in the future. Analysts forecast a price range of $6,000 to $10,000 for ETH, despite recent price corrections. Additionally, a major new long position on Huobi and increased Ethereum user activity suggest a potentially volatile yet optimistic outlook for the cryptocurrency.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cryptocurrency Market Faces New Liquidity Risks as Buyers Reemerge

Why Isn’t Cardano (ADA) Price Going Up? One Analyst Claims to Have Found the Reason

USD/MXN Update: The Mexican peso keeps recovering and is nearing the 17 pesos per dollar mark

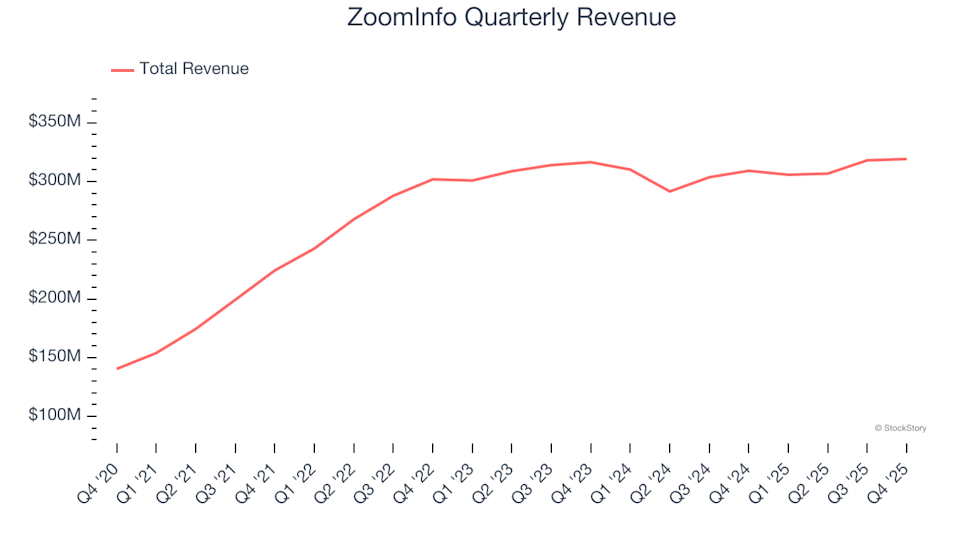

ZoomInfo (NASDAQ:GTM) Exceeds Sales Expectations in Q4 CY2025