BlackRock Becomes Third-Largest Bitcoin Holder With Almost 350,000 BTC

BlackRock has rapidly expanded its Bitcoin holdings, now owning close to 350,000 BTC, making it the third-largest holder globally, behind only Satoshi Nakamoto and Binance, according to blockchain data.

This significant accumulation comes as BlackRock strengthens its foothold in the cryptocurrency market, driven by the success of its Bitcoin -focused ETFs and increased institutional interest. The firm’s change in approach is notable, especially given that BlackRock’s CEO, Larry Fink, once openly criticized Bitcoin as a speculative asset. Over the years, his views have shifted, and he now regards Bitcoin as an important international asset with transformative potential.

The iShares Bitcoin Trust (IBIT), launched by BlackRock earlier this year, has been a key factor in the firm’s growing Bitcoin reserves. Institutional investors have flocked to the fund, pushing BlackRock’s BTC holdings to nearly 350,000. For comparison, only Satoshi Nakamoto’s estimated 1.1 million BTC and Binance’s 550,000 BTC holdings surpass this figure.

Bloomberg’s ETF analyst, Eric Balchunas, pointed out that U.S. ETFs could soon surpass Satoshi’s holdings, with BlackRock on track to become the largest Bitcoin holder by next year.

This rise comes as Grayscale, once a leader in Bitcoin holdings, has faced challenges, including investor withdrawals due to its high fees. Meanwhile, BlackRock’s success has encouraged other traditional financial institutions like Goldman Sachs and Capula Management to explore similar investments.

However, the increasing presence of large financial players in the cryptocurrency space has sparked debate. Some within the crypto community argue that this trend runs counter to Bitcoin’s original goal of decentralization, raising concerns about institutional control over the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin: Why analysts warn BTC could drop to $38K in current cycle

The billion-dollar infrastructure deals powering the AI boom

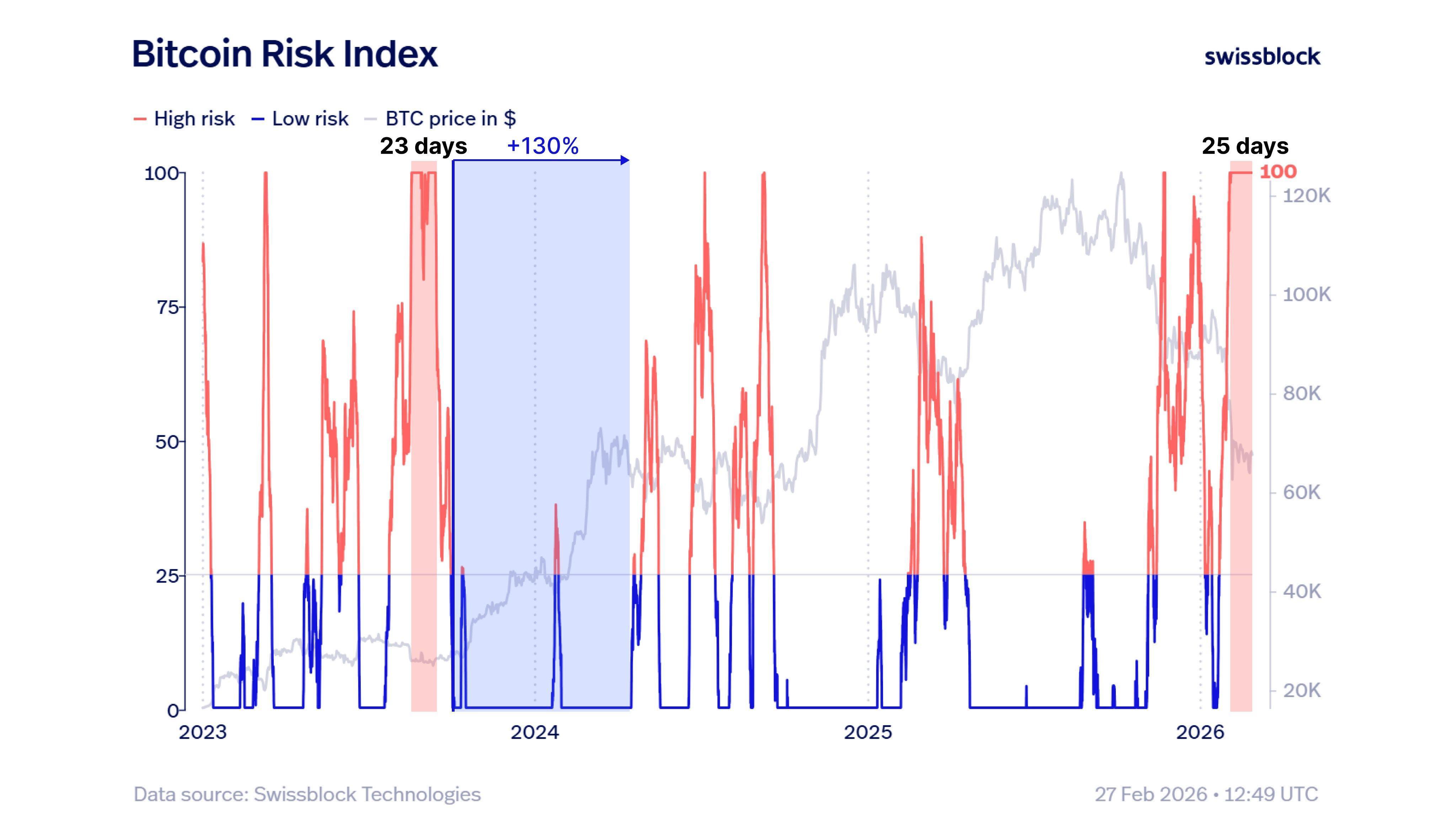

Bitcoin bottom fractal calls for 130% rally, but is the model valid in 2026?

Paylocity: Assessing the Moat and Intrinsic Value for a Long-Term Investor