- Ethereum approaches a key resistance, which could spark gains if it breaks through.

- Market sentiment is mixed, with bullish signs but ongoing selling pressure affecting price.

- Technical indicators suggest potential upward momentum but warn of weakening bullish strength.

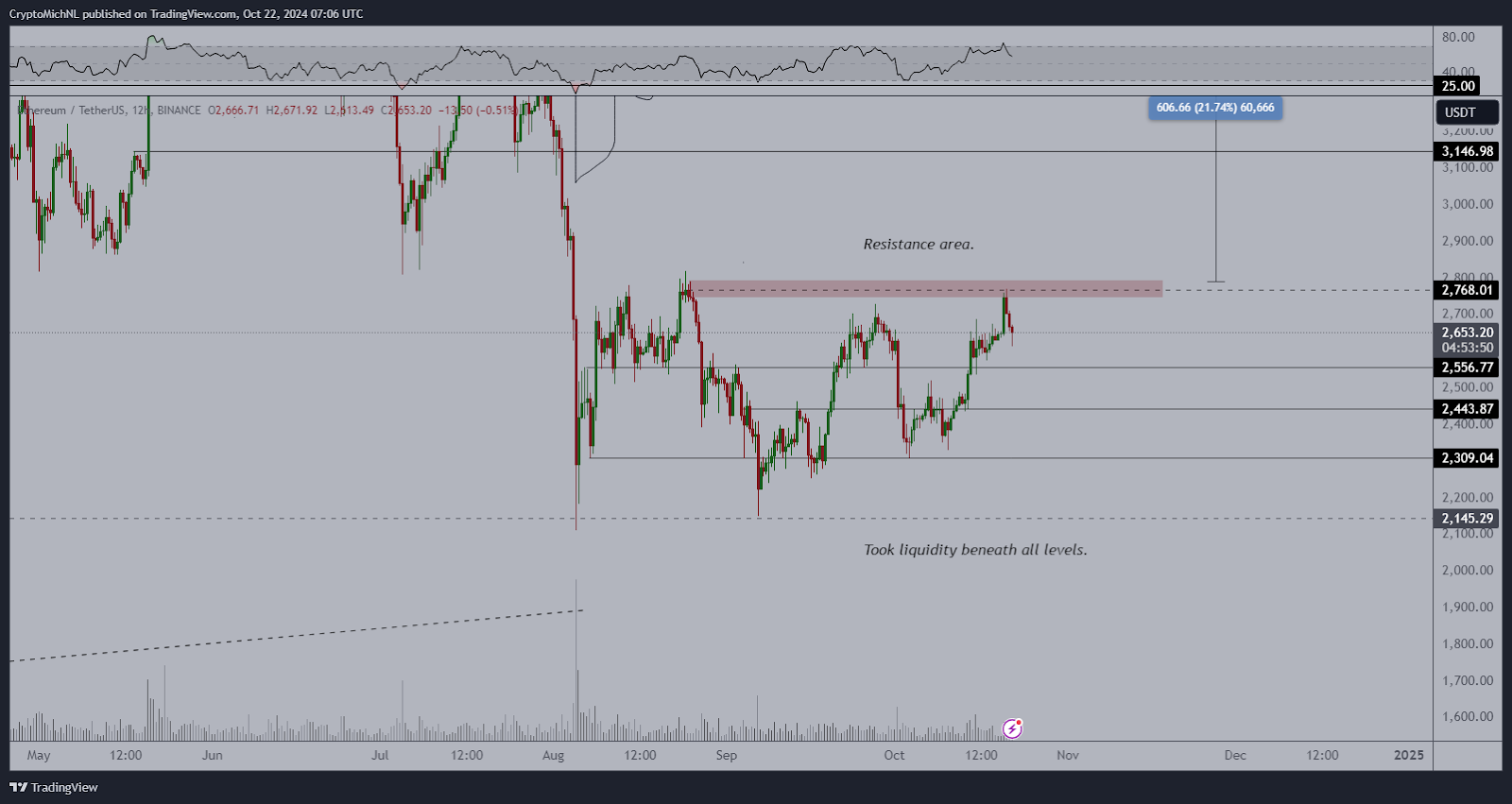

Ethereum (ETH) is at a critical juncture as it approaches the $2,700 resistance level. This level could determine whether the altcoin market will see gains. After recovering from a sharp dip, Ethereum is trying to break through this resistance, which could set the stage for a rally to the $3,000 to $3,200 range.

At its current price of $2,633.90, Ethereum remains in a trading range, with support zones at $2,556.77, $2,443.87, and $2,309.04. The resistance level is around $2,768, where it has historically encountered selling pressure.

Source: Michaël van de Poppe

Source: Michaël van de Poppe

Ethereum recently experienced a sharp sell-off, with its price falling to a low of $2,145.29 before recovering and retesting the resistance.

Michaël van de Poppe noted that this resistance test is typical market behavior. He added that the bullish momentum could continue even if Ethereum dips to the $2,500-$2,550 range.

According to van de Poppe, if Ethereum breaks above $2,700, it could reach the $3,000-$3,200 range, which would likely benefit the altcoin market.

Market Sentiment and Technical Indicators

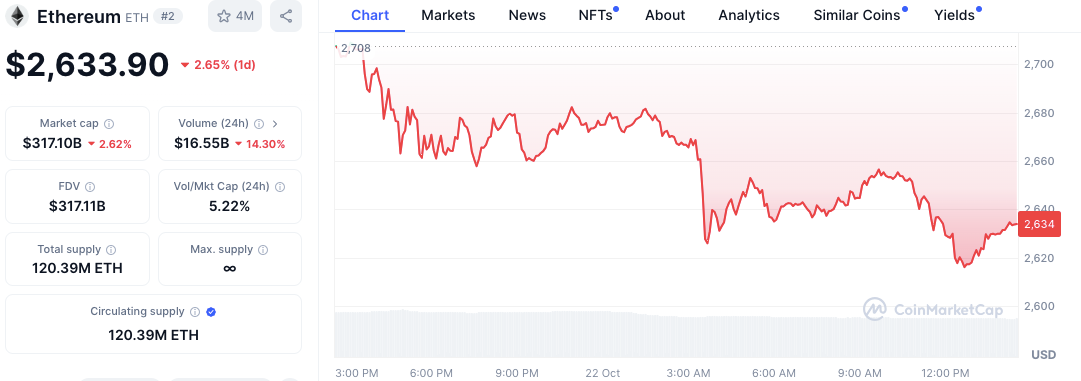

Ethereum fell 2.71% yesterday, with the price currently at $2,633.90. Its market cap has also decreased by 2.75% to $317.10 billion.

Read also: Vitalik Buterin Outlines Ethereum’s “Surge” Phase, ETH Price Jumps 10%

Source: CoinMarketCap

Source: CoinMarketCap

Short-term market sentiment appears bearish as selling pressure persists. Ethereum dropped to around $2,620 but has since begun to recover.

Technical indicators give mixed signals. The MACD is above the signal line, suggesting bullish crossover momentum. However, the MACD histogram shows declining bullish strength, raising concerns about a potential slowdown.

The RSI is at 56.49, just above the neutral 50 level, indicating that Ethereum is neither overbought nor oversold.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source:

Source: