Bitcoin Markets Brace for US Election Volatility: Bitfinex Report

Bitcoin volatility is low as the U.S. presidential election approaches, with Bitfinex anticipating increased market activity after the results are announced.

According to the latest weekly report by Bitfinex, while Bitcoin’s implied volatility is currently muted, the research expected a potential spike in activity following election day with a potential Republican victory favorable for Bitcoin.

“Calm Before the Storm”

Under current market conditions, Bitfinex Alpha observed that while Bitcoin’s price has seen a spike followed by fluctuations, its implied volatility continues to be restrained.

Based on the report, the subdued volatility, especially in the options markets, suggests investors are cautious ahead of the U.S. presidential election.

The analysis noted that recent “Trump Trade” speculation, spurred by fluctuating odds in favor of a Republican victory, had briefly driven Bitcoin’s price upward. However, the ongoing election uncertainty has tempered that movement.

Bitcoin dominance has reached over 60% in the altcoin sector, signaling a cycle high. According to Bitfinex, this dominance has led to altcoins experiencing greater sensitivity to Bitcoin’s price movements, with notable pullbacks seen in Ethereum and Solana.

Bitfinex also highlighted the broader U.S. economic backdrop as a factor potentially impacting market sentiment. Despite economic disruptions from natural disasters and strikes, consumer spending, wage growth, and employment indicators have shown resilience.

The report pointed to a complex mix of political and economic factors at play, with the potential for increased volatility in the days following the election as investors react to the results and any subsequent regulatory developments.

US Presidential Election Poll Ends on Nov 5

The final national polls indicate that Donald Trump and Kamala Harris are in a tight race for the 2024 U.S. presidential election.

Trump and Harris are locked in a close race as election day approaches, with a November 3 New York Times and Siena College poll showing Trump leading in the key swing state of Arizona and narrowing Harris’ advantage in Pennsylvania, while Harris holds leads in other battleground states like Nevada, North Carolina, Wisconsin, and Georgia.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump Media could spin out Truth Social amid crypto push

How China’s restriction on rare earths led to a technological breakthrough in the United States

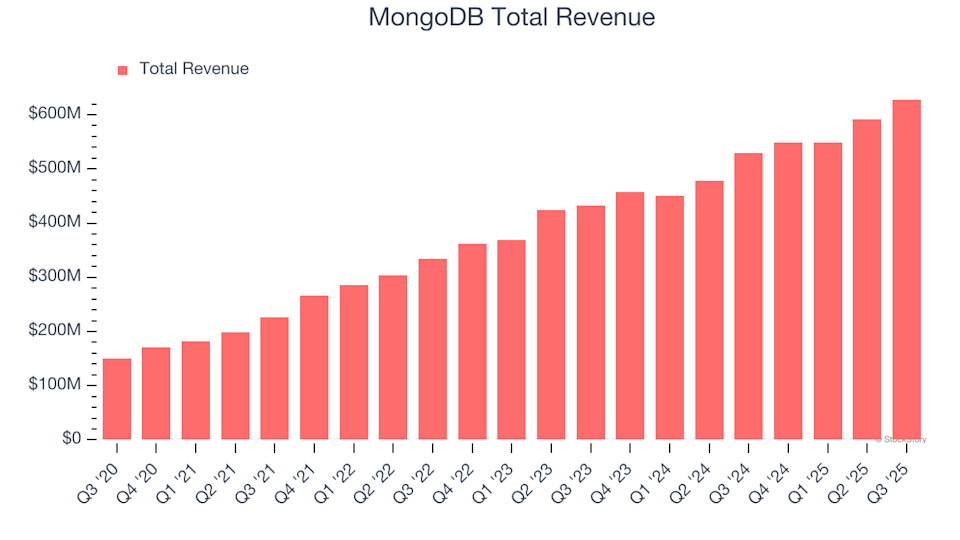

What Should You Anticipate From MongoDB’s (MDB) Fourth Quarter Results