Phantom wallet adds support for Base in multi-chain push

Quick Take Phantom’s support for Base is out of beta and available for all users. Base has a total value locked of nearly $3.4 billion as of Monday.

Phantom continues its multi-chain expansion by adding support for Base as the crypto wallet broadens its reach across blockchain networks.

In a post on X on Monday, Phantom noted that it rolled out support for Base, Coinbase's Ethereum-based Layer 2 blockchain. The integration is now out of beta and available for all users, allowing support for the Ethereum Layer 2 chain and token swaps from various chains to Base.

Phantom users can now buy ether and USDC on Base in the wallet and swap tokens between Base, Ethereum, Solana and Polygon.

"Our Base support makes it easy for you to use your Phantom wallet to interact with Base’s ecosystem, just as you already with Solana, Ethereum, Bitcoin, and Polygon," the wallet service provider said in an earlier post .

Phantom, initially a Solana wallet , transitioned to a multichain platform by supporting Ethereum and Polygon blockchains in May 2023. “We believe that the future of digital asset management lies in cross-chain interoperability, and we're committed to providing our users with the tools and resources they need to easily navigate and transact across various blockchain networks,” Brandon Millman, co-founder and CEO of Phantom, said at the time.

Base ranks sixth among blockchain networks in terms of total value locked (TVL), trailing Layer 1 chains Ethereum, Solana, Tron, BSC and Bitcoin. However, it remains the largest Layer 2 chain by TVL. Base has a TVL of nearly $3.4 billion, compared to Arbitrum’s TVL of $3 billion, according to data from DeFiLlama.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysis: Schroders' Acquisition Deal May Trigger Sale of Non-core Assets

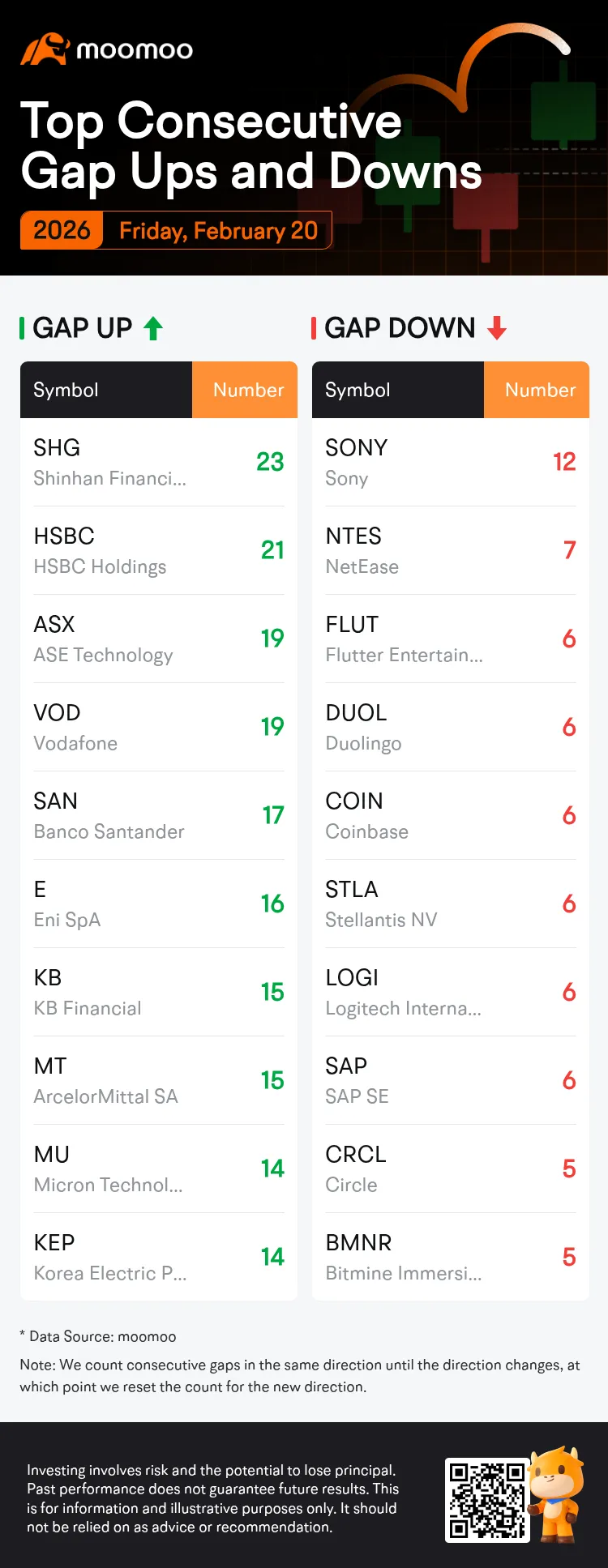

Top Gap Ups and Downs on Friday: WMT, ORCL, NVO and More

Unusual Options Activity: EQT, JPM and Others Attract Market Bets, EQT V/OI Ratio Reaches 787.7

Investors Are Selling Off Software Shares and Strong Earnings Won’t Change That