Donald Trump Targets BRICS Over Plans to Bypass the US Dollar With Crypto

BRICS, which has recently expanded its membership, has been exploring de-dollarization strategies like using local currencies and digital alternatives to reduce reliance on the dollar.

President-elect Donald Trump has issued a stern warning to the BRICS bloc. He urged its members to abandon plans for creating an alternative currency to replace the US dollar in international trade.

Trump, known for his “America First” stance, reiterated that any such move would face severe consequences. This includes a 100% tariff on goods from BRICS nations and an inability to access the US market.

BRICS Faces Trump’s Pushback on De-dollarization Efforts

In a November 30 post on his Truth Social platform, Trump called for a firm commitment from BRICS countries not to develop or support a rival currency. He emphasized that the US would not tolerate efforts to undermine the dollar’s dominance.

“The idea that the BRICS Countries are trying to move away from the Dollar while we stand by and watch is OVER. We require a commitment from these Countries that they will neither create a new BRICS Currency, nor back any other Currency to replace the mighty U.S. Dollar or, they will face 100% Tariffs, and should expect to say goodbye to selling into the wonderful US Economy,” he stated.

This warning aligns with Trump’s campaign promise to safeguard the US dollar’s global reserve status. Reports suggest that his team is already exploring punitive measures for countries advancing de-dollarization strategies.

The BRICS bloc — comprising Brazil, Russia, India, China, and South Africa — has been at the forefront of discussions on de-dollarization since 2023. These talks gained momentum during a summit where member nations explored alternative settlement mechanisms, including using the Chinese yuan and blockchain-based stablecoins.

Market analysts pointed out that such digital currencies could bypass US sanctions and offer a new framework for international trade.

This year, BRICS expanded its membership for the first time in over a decade, adding Iran, Saudi Arabia, the UAE, Ethiopia, and Egypt. With 34 additional nations expressing interest in joining, the bloc aims to strengthen its influence in the global economy. By leveraging local currencies and alternative banking networks, member states hope to reduce reliance on the US dollar while evading Western sanctions.

Observers note that these initiatives could reshape international trade dynamics. However, Trump’s tough stance signals a potential escalation in economic tensions between the US and BRICS nations

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Duolingo prioritizes user growth over monetization, forecasts softer bookings

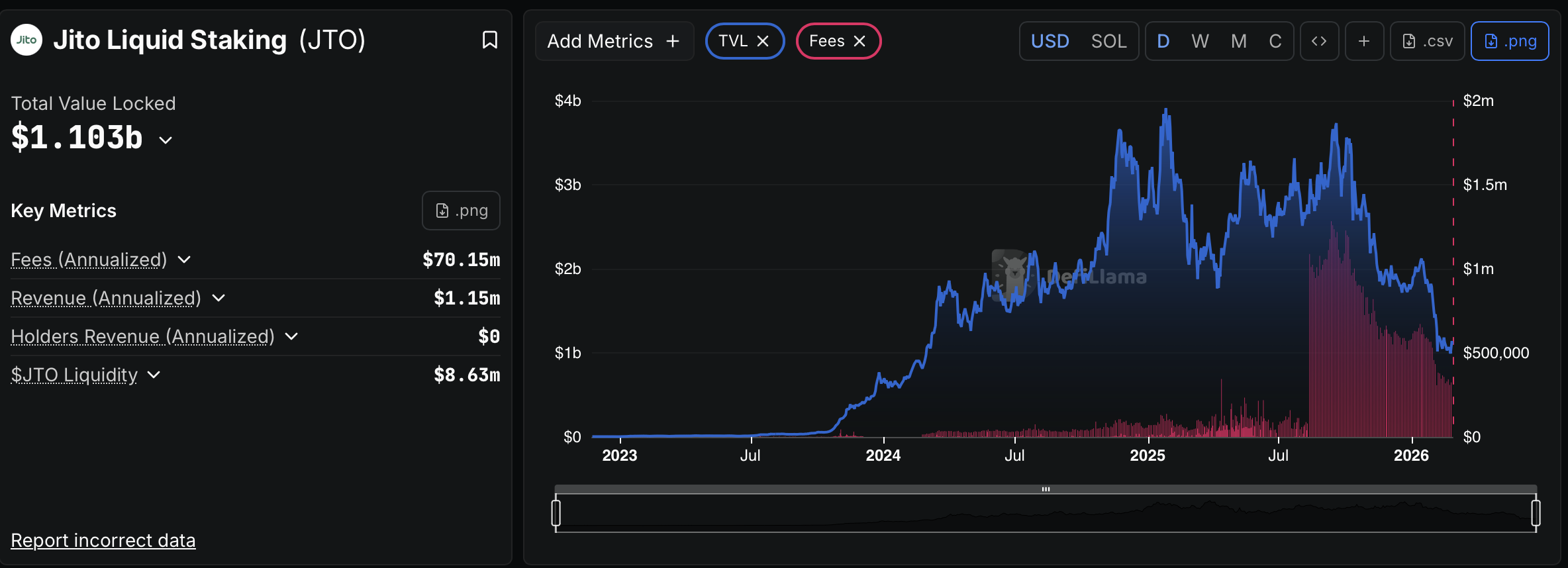

SEC approval sought for JitoSOL Solana-based liquid staking token ETF