Bitcoin realised profit drops 76% as sell pressure eases

Bitcoin’s (CRYPTO:BTC) realised profit has decreased by 76% following the initial excitement surrounding its $100,000 price surge, according to crypto analysts.

This drop signals a shift in market dynamics, with analysts predicting that future price declines may be less abrupt than the recent 10% dip.

On December 6, Bitcoin experienced a nearly 10% drop from $103,493 to under $93,000, just a day after surpassing the $100,000 mark.

This sudden price fall triggered significant liquidations, amounting to over $404 million, with $303.5 million in long positions liquidated in just one hour.

However, Bitfinex analysts believe that market conditions are stabilising.

According to their report, Bitcoin’s realised profit, which tracks the gains from moved coins, peaked at $10.5 billion during the surge towards $100,000 but has since fallen to around $2.5 billion daily, signaling a sharp 76% drop.

This suggests that profit-taking has slowed down, and future sell-offs may be less severe.

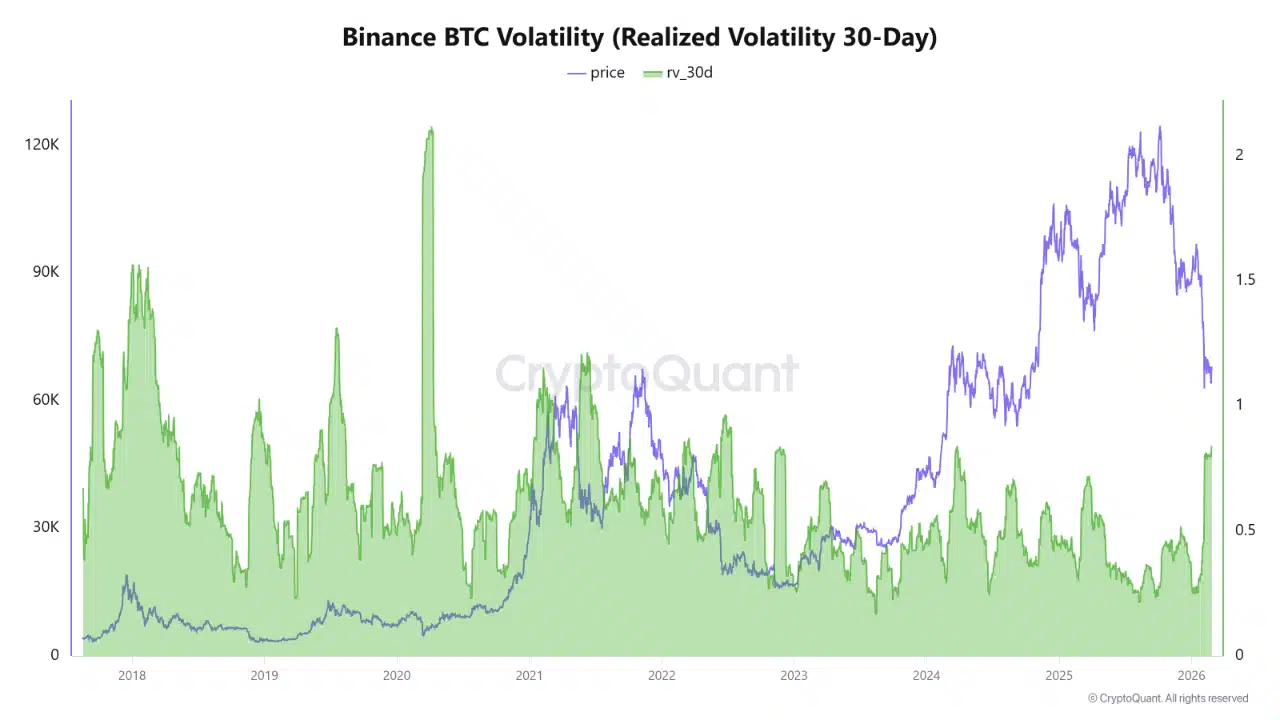

The funding rates for Bitcoin on major exchanges like Binance have also been stabilising, reflecting a more balanced phase in the market.

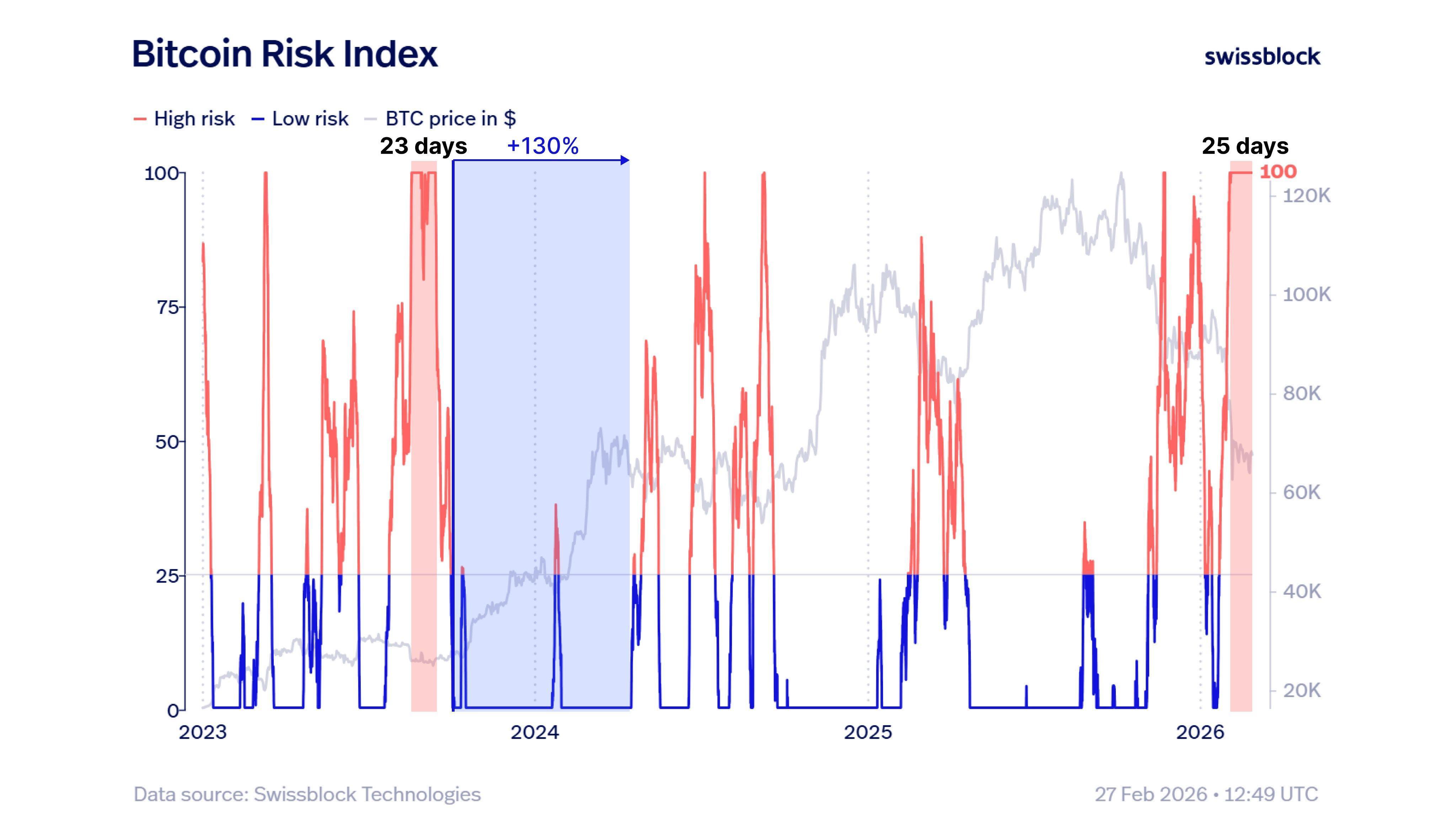

Bitfinex analysts believe that price movements may become less erratic in the medium term.

Despite these signals, Glassnode’s James Check remains cautious about the market's stability.

He noted that sell-side pressure from existing Bitcoin holders is overwhelming the demand from institutional buyers like ETFs and MicroStrategy (MSTR).

Furthermore, long-term Bitcoin holders are seeing significant profits, with the average realised price for long-term holders around $24,481, marking a 400% gain.

At the time of reporting, the Bitcoin price was $97,097.22.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin: Why analysts warn BTC could drop to $38K in current cycle

The billion-dollar infrastructure deals powering the AI boom

Bitcoin bottom fractal calls for 130% rally, but is the model valid in 2026?

Paylocity: Assessing the Moat and Intrinsic Value for a Long-Term Investor