Trump wants bitcoin to hit $150,000 during his presidency: report

Quick Take Donald Trump, set to return to the White House in January, “would love” for bitcoin to reach $150,000, according to a report from Axios, which cited an anonymous “transition” source.

Bitcoin eclipsed $100,000 in the wake of Donald Trump winning the election to become the next president of the United States.

Now, Trump apparently "would love" for bitcoin to keep rising and eventually pass $150,000, according to a report from Axios on Tuesday, which cited an anonymous "transition" source. Both bitcoin and the broader cryptocurrency market have been on the upswing since Trump defeated Vice President Kamala Harris.

Axios reported that Trump "is going to be very focused on the price of bitcoin, " adding that the media outlet's source said the cryptocurrency is "another stock market" for the politician.

During his previous term as president, Trump frequently pointed to the performance of the U.S. stock market as a measure of how well his administration had been managing the nation's economy.

Since being elected in November, the price of bitcoin has risen from about $68,000 to as much as $103,000. Less than a week ago, Trump congratulated bitcoiners on the largest cryptocurrency by market cap surpassing the $100,000 mark in a post on Truth Social. In the post, he appeared to take some of the credit for the price increase.

Bitcoin was trading at $95,205.73 as of 12:19 p.m. ET on Tuesday, according to The Block Price Page .

Axios also reported that Trump plans to "promote crypto-friendly regulations," including nominating Paul Atkins to run the U.S. Securities and Exchange Commission. According to the firm's website, Atkins founded the consulting firm Patomak Global Partners, which has serviced crypto exchanges and DeFi platforms.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

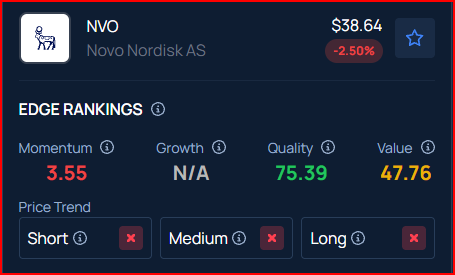

Novo Nordisk To Slash GLP-1 Drug Prices By Up To 50% In US Starting 2027

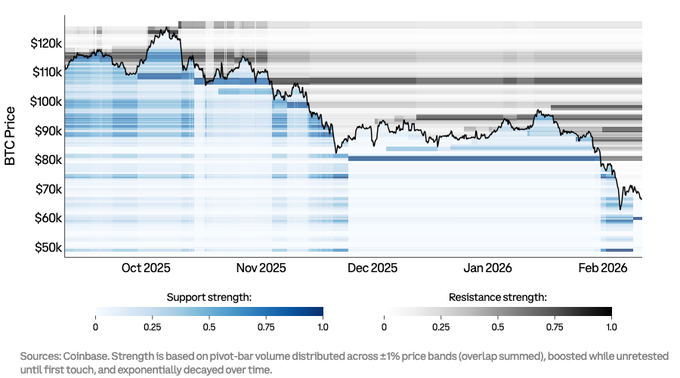

Bitcoin’s Next Big Move? Gamma Data Highlights $60K Risk, $90K Resistance

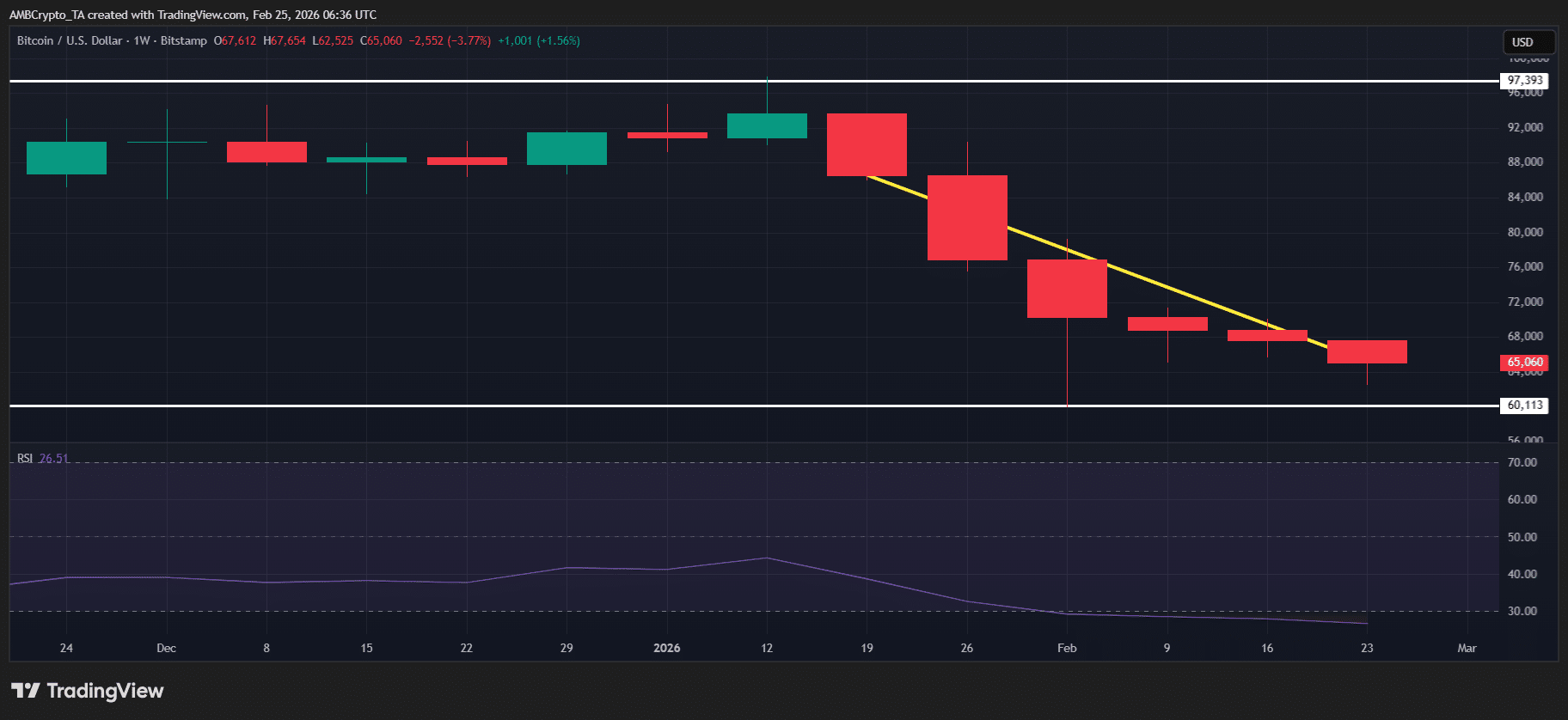

Bitcoin’s weekly RSI hits an all-time low – Is a bear trap brewing?