Is Bitcoin’s $95K Plunge a Signal for Altseason Ahead?

- Bitcoin’s (BTC) decline to below $95K ignites altseason speculation among crypto enthusiasts.

- Market pressure from ETFs and the Federal Reserve outlook adds to Bitcoin’s struggles.

- Analyst Crypto Rover predicts altcoins may surge by early 2025, following Bitcoin’s cycle.

The recent dip of Bitcoin to below $95,000 triggered discussions within the crypto community as to whether this may mark the start of the altseason. In a YouTube video on Friday, analyst Crypto Rover explained this movement by referring to the broader economic stress. He also highlighted the fluctuations in the stock market as contributing factors. Jerome Powell’s recent speech and the cautious projections of the US Federal Reserve have caused ripples across markets.

Bitcoin Breaches Support

The US stock market, which has depreciated by 4.5% from recent record highs, has contributed to the sliding Bitcoin trend. This negative pressure on conventional assets occurred at the same time as Bitcoin breached key support levels on the 4-hour chart. Rover noted that if Bitcoin did not reclaim $90,000 or $92,500, it could extend losses towards $88,000.

Source: Chart by

Crypto Rover

Source: Chart by

Crypto Rover

Withdrawals from spot Bitcoin ETFs have accelerated the recent decline in prices. A total of $671 million exited the market in these three months, with BlackRock not buying any Bitcoin within this period. According to Rover, such actions only strengthen the bearish trend. However, he also pointed out that the Pi Cycle Top Indicator, which has been accurate in predicting Bitcoin’s market top, is still flat implying that the bull cycle still has more latitude.

Altcoins Show Potential

However, Bitcoin’s market share has not yet fallen sharply, but experts predict that this may happen in the near future. According to Rover, the altcoins may have a good year in early 2025, following Bitcoin’s pattern.

Source: Chart by

Crypto Rover

Source: Chart by

Crypto Rover

Bitcoin’s price movements are mainly influenced by general market scenarios such as the stance of the Federal Reserve and global liquidity conditions. Seasonal trends, like a company may normally perform well during the Christmas period, will not necessarily be the same this year due to the economic environment. Analysts advised the investors to keep their eyes on the prize and not the small fluctuations in price, saying that one has to understand the market cycle.

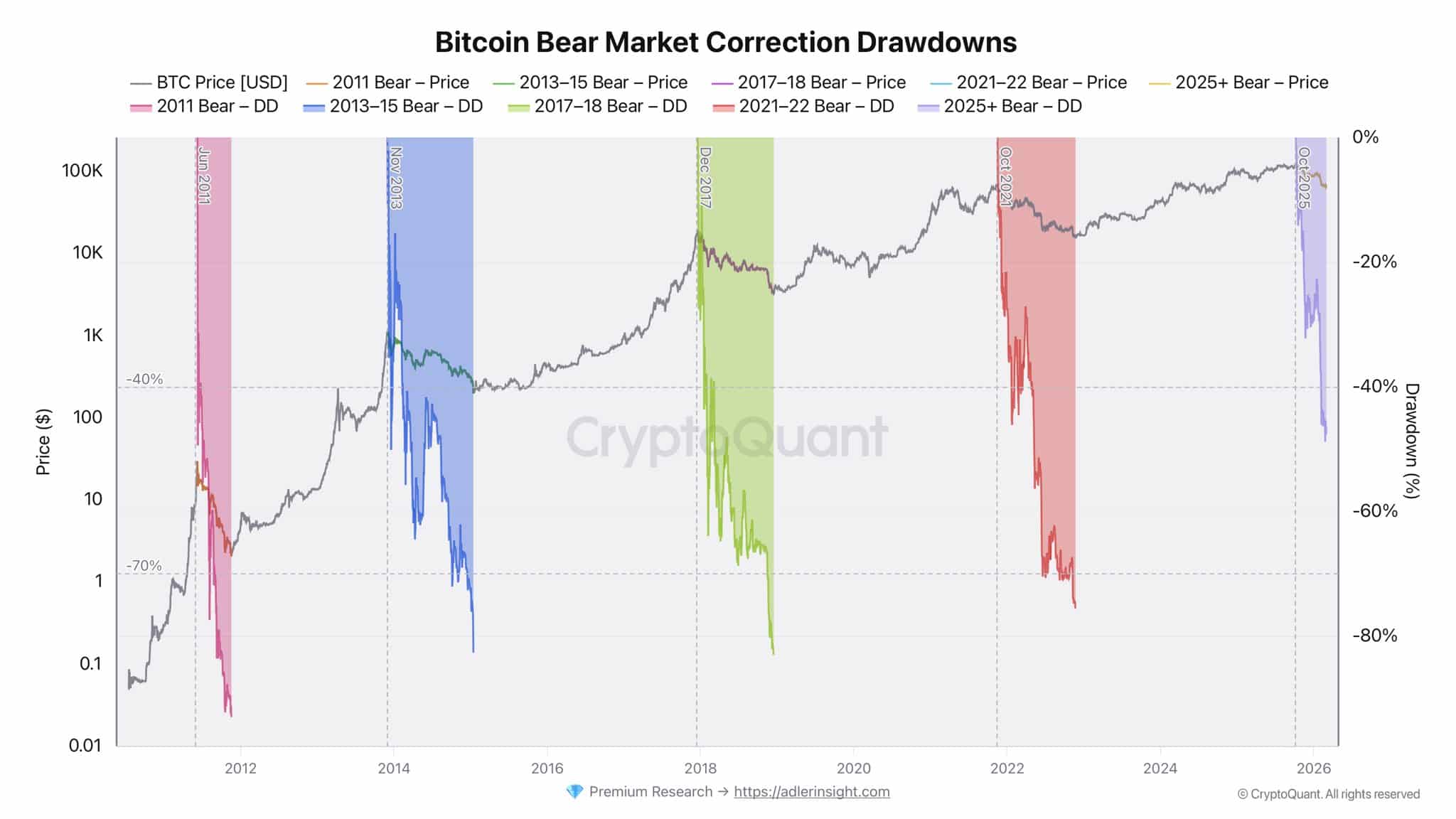

Market’s Sharp Reaction to Jerome Powell’s FOMC SpeechAs the current market situation still remains rather unpredictable, it is possible to observe that the current correction of Bitcoin is similar to previous ones. As always, traders and investors are also trying to find out whether this is just a short-term correction or a long-term trend.

The post Is Bitcoin’s $95K Plunge a Signal for Altseason Ahead? appeared first on CryptoTale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Decoding Bitcoin’s capital rotation – $5B retail exits as whales take control

FirstEnergy Secures $950M Transmission Project: A Strategic Move Toward Grid Upgrades

Apple unveils the more affordable iPhone 17e in an effort to increase iPhone sales

SPX Purchase by ITT: Strategic Expansion and Market Impact