Crypto Analyst Predicts Extended Bull Run, Bitcoin and Ethereum Eye Record Highs

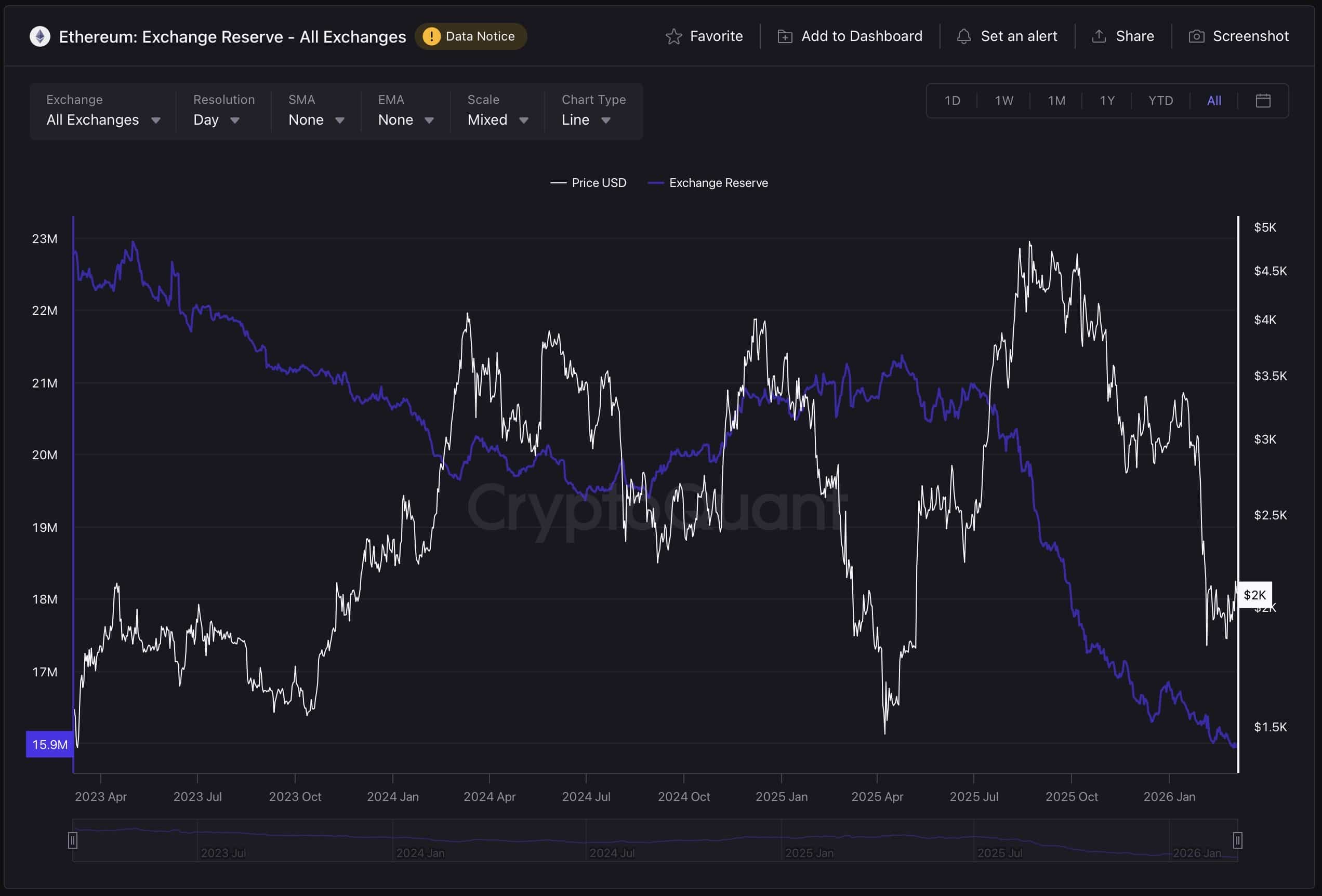

A prolonged crypto bull market could be unfolding, with Bitcoin and Ethereum potentially reaching unprecedented highs, according to analyst Michaël van de Poppe.

He suggests that after an extended altcoin downturn, a longer-than-expected rally might take shape, with Bitcoin eyeing $500,000 and Ethereum targeting $20,000.

Rather than sharp corrections, Bitcoin could see steadier growth, driven by rising liquidity and market expansion. Van de Poppe believes the peak could arrive between late 2025 and early 2027, with fewer extreme price swings.

At present, Bitcoin trades around $104,600 with minimal movement, while Ethereum has climbed 4.1% in the past day to $3,268. Meanwhile, altcoins could be primed for major moves, with tokens like Optimism (OP), Wormhole (W), and Omni Network ( OMNI ) showing signs of strength.

Van de Poppe points to Sui’s ( SUI ) recent breakout as an example—its bullish divergence preceded massive gains against Bitcoin. He notes similar setups in other utility-focused altcoins, suggesting that projects tied to Ethereum’s ecosystem could be next in line for explosive growth.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

GLP-1s: The $200 Billion Surge and the Addiction Treatment Revenue Driver

**Ruger’s Move into Accessories: Profitable Strategy or Threat to Brand Identity?**

Nikkei 225 Faces Stagflation Shock—Yield Curve Steepening Could Signal Fragile Recovery Window

Ethereum Price Brutal Bull Trap? Or Last Cheap Buying Opportunity?