Bitcoin Price Prediction amid a Bitcoin Reserve Announcement by David Sacks

The United States is intensifying its focus on cryptocurrency regulation and adoption , with several high-profile initiatives emerging. President Trump's Crypto Czar David Sacks is assessing the feasibility of a Bitcoin Reserve, while lawmakers push for stablecoin regulation to maintain US dollar dominance. Meanwhile, the SEC has launched a Crypto Task Force website, aiming to provide greater regulatory clarity. These moves highlight a growing institutional interest in crypto as a financial pillar for the future.

David Sacks: Stablecoins and Bitcoin Reserve Under Evaluation

David Sacks, President Trump's appointed Crypto Czar, has made bold statements regarding stablecoins and Bitcoin. He believes stablecoins could ensure US dollar dominance internationally, reinforcing the role of digital assets in global finance. In addition, his recent revelation that the administration is evaluating a Bitcoin Reserve indicates a potential shift toward integrating Bitcoin into US financial strategy.

Senator Bill Hagerty’s Push for Stablecoin Regulation

In a significant move toward regulatory clarity, Senator Bill Hagerty has introduced legislation aimed at establishing a clear regulatory framework for crypto stablecoins. With stablecoins playing a critical role in crypto liquidity and cross-border transactions, this initiative could provide much-needed guidelines for their issuance and operation in the US market.

SEC’s Crypto Task Force Website: A Step Toward Clarity?

The US Securities and Exchange Commission (SEC) has launched a dedicated Crypto Task Force website to "provide clarity" on crypto laws and regulations. This initiative follows years of uncertainty and enforcement actions in the sector. While some see this as a positive step toward regulatory transparency, others remain skeptical about whether it will lead to fairer policies or stricter enforcement.

New SEC Task Force Website

New SEC Task Force Website

Michael Saylor and the Ongoing Bitcoin Strategy

Prominent Bitcoin advocate Michael Saylor recently hinted at major developments with his post, "₿ig Strategy Day." As a key proponent of institutional Bitcoin adoption, Saylor's strategies often influence market sentiment, raising speculation about new corporate Bitcoin investments or policy shifts.

Bitcoin Price Prediction: What to Expect for the BTC Price Next?

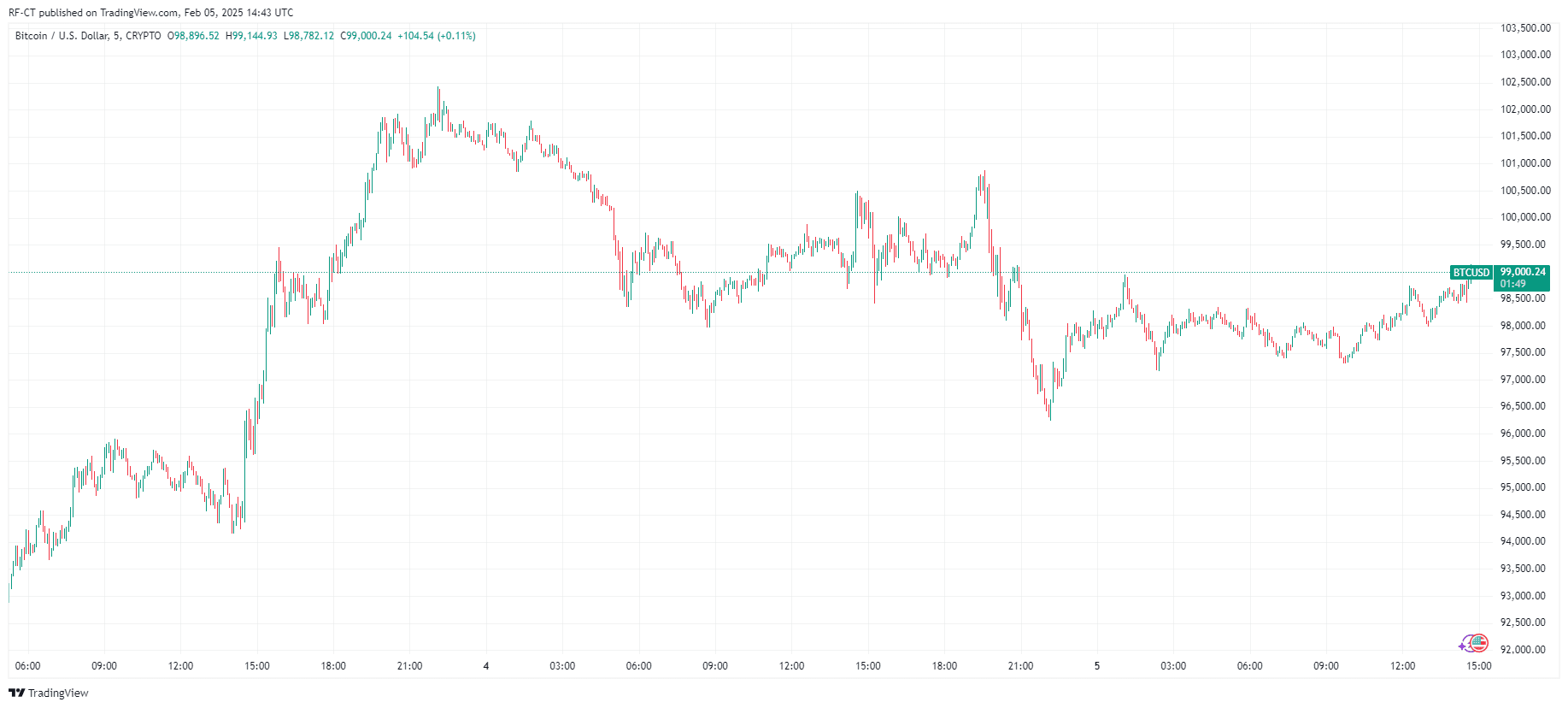

As of February 5, 2025, Bitcoin is trading around $98,000, having recently dipped below the 2025 average withdrawal price of $100,356. This decline raises concerns about potential further downside if the price remains below this key level.

Despite the current consolidation between $91,500 and $106,500, technical indicators suggest a significant breakout may be imminent. The tightening Bollinger Bands indicate that a major price movement could occur in the coming days or weeks.

Analysts have varying predictions for Bitcoin's price by the end of 2025. Some forecasts suggest that Bitcoin could reach $150,000, driven by increased institutional adoption and favorable regulatory developments. More optimistic projections estimate prices approaching $200,000, contingent on sustained bullish momentum and macroeconomic factors.

In summary, while Bitcoin is currently experiencing a consolidation phase, technical indicators and market analyses point toward a potential breakout. Long-term forecasts remain bullish, with expectations of significant price appreciation by the end of 2025.

By TradingView - BTCUSD_2025-02-05 (5D)

By TradingView - BTCUSD_2025-02-05 (5D)

The US government's evolving stance on crypto is evident through these regulatory and financial initiatives. From stablecoin regulations to a Bitcoin Reserve evaluation, the landscape is shifting toward a structured framework for crypto integration. As these discussions unfold, the future of digital assets in the US economy will depend on how these policies are implemented.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?

Crucial Alert: ZRO Leads This Week’s $100M+ Token Unlocks – What Investors Must Know