SHIB Price: Will Shiba Inu Price Crash to Zero?

Shiba Inu (SHIB) , once considered one of the most promising meme coins, is now facing intense selling pressure and a prolonged downtrend. After hitting impressive highs, SHIB has gradually lost momentum, slipping into a bearish phase. Currently trading at $0.00001215, SHIB price is struggling to maintain key support levels, raising concerns among investors.

With the market sentiment turning negative, many are asking: Will Shiba Inu price crash to zero , or is a major recovery still possible? Let's analyze SHIB’s technical indicators, support zones, and potential breakout scenarios to determine whether the meme coin can still stage a comeback.

Shiba Inu Price Prediction: Is Shiba Inu in a Bear Market?

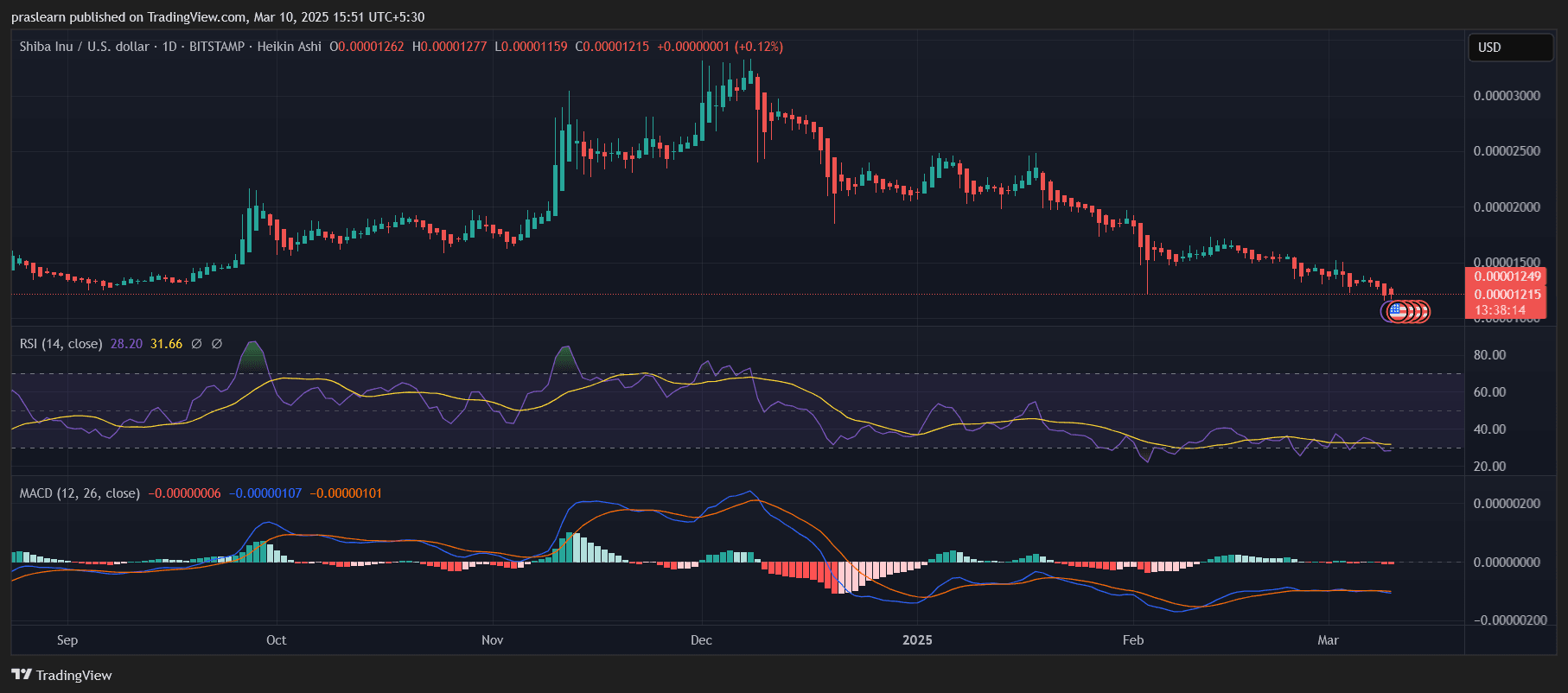

SHIB/USD Daily Chart- TradingView

SHIB/USD Daily Chart- TradingView

SHIB’s price action suggests that it has entered a strong bearish cycle, with consecutive lower highs and lower lows on the daily chart. Since peaking at $0.000032, SHIB has steadily lost ground, now hovering near multi-month lows.

The consistent downtrend structure signals that buyers are not stepping in with enough volume, allowing sellers to dominate. If this trend continues, SHIB could face even steeper declines, increasing the risk of a long-term downtrend.

Is Shiba Inu Oversold? Can It Stage a Rebound?

A crucial factor to watch is Shiba Inu’s Relative Strength Index (RSI), which indicates whether an asset is overbought or oversold.

- SHIB’s RSI is currently at 28.20, meaning it has entered oversold territory (below 30). This suggests that selling pressure is extreme, and a possible relief rally could be near.

- Historically, whenever SHIB’s RSI dipped below 30, a short-term bounce followed. However, these rebounds have been weak, failing to sustain an uptrend.

Although an oversold RSI increases the probability of a short-term rally, it does not guarantee a long-term recovery, especially if the broader market remains bearish.

What Does the MACD Indicator Say About SHIB’s Trend?

The Moving Average Convergence Divergence (MACD) indicator helps assess momentum strength and trend direction.

- SHIB’s MACD is currently in negative territory, confirming that bearish momentum remains dominant.

- There are no signs of a bullish crossover, meaning that downward pressure is still strong.

For a bullish trend reversal, SHIB’s MACD line must cross above the signal line, which has not happened yet. Until this occurs, the bearish trend is expected to continue.

Where Are the Key Support and Resistance Levels?

Shiba Inu is now at a make-or-break level, with critical support zones being tested.

- Key support: SHIB’s strongest support is at $0.00001200 . If SHIB falls below this, it could decline toward $0.00001000 or even $0.00000850, putting it at risk of a much deeper crash.

- Resistance levels: If SHIB price manages to bounce, the first major resistance is at $0.00001450. A break above $0.00001600 would confirm a bullish trend reversal.

At present, SHIB price is closer to breaking support than attempting a recovery, suggesting that further downside is more likely unless buyers step in with significant volume.

Shiba Inu Price Prediction: Will Shiba Inu Drop to Zero or Recover?

The biggest concern for investors is whether SHIB will continue falling or manage to stage a comeback.

- If SHIB breaks below $0.00001200, the decline could accelerate. Without strong buying support, the next major target could be $0.00001000, and failing to hold that level could trigger a free fall toward $0.00000850 or lower.

- A relief rally is possible, but it might be short-lived. The RSI indicates oversold conditions, but unless the MACD turns bullish, any bounce could be temporary and met with resistance.

- Long-term survival depends on market sentiment and adoption. Unlike Bitcoin and Ethereum, meme coins like SHIB rely heavily on hype, speculation, and community-driven catalysts. If SHIB fails to regain excitement, it could remain in a prolonged downtrend.

Should You Hold, Buy, or Sell Shiba Inu?

Shiba Inu is at a critical decision point . If it fails to hold $0.00001200, a major crash could occur, taking it down another 20-30%. The RSI suggests a possible bounce, but with a weak MACD and bearish price structure, SHIB’s downtrend remains intact.

For short-term traders, buying at key support zones could offer quick gains if a relief rally happens. However, for long-term holders, it is crucial to wait for bullish confirmations, such as MACD crossovers and higher highs, before expecting a sustained uptrend.

If Shiba Inu does not show strong bullish momentum soon, its price could continue bleeding downward—potentially toward zero in the worst-case scenario.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Michael Burry Is 'Out' If GameStop Buys 'Any Version' of Bed Bath & Beyond

비트코인·XRP 횡보 국면…투자자 시선은 인프라형 기회로 이동

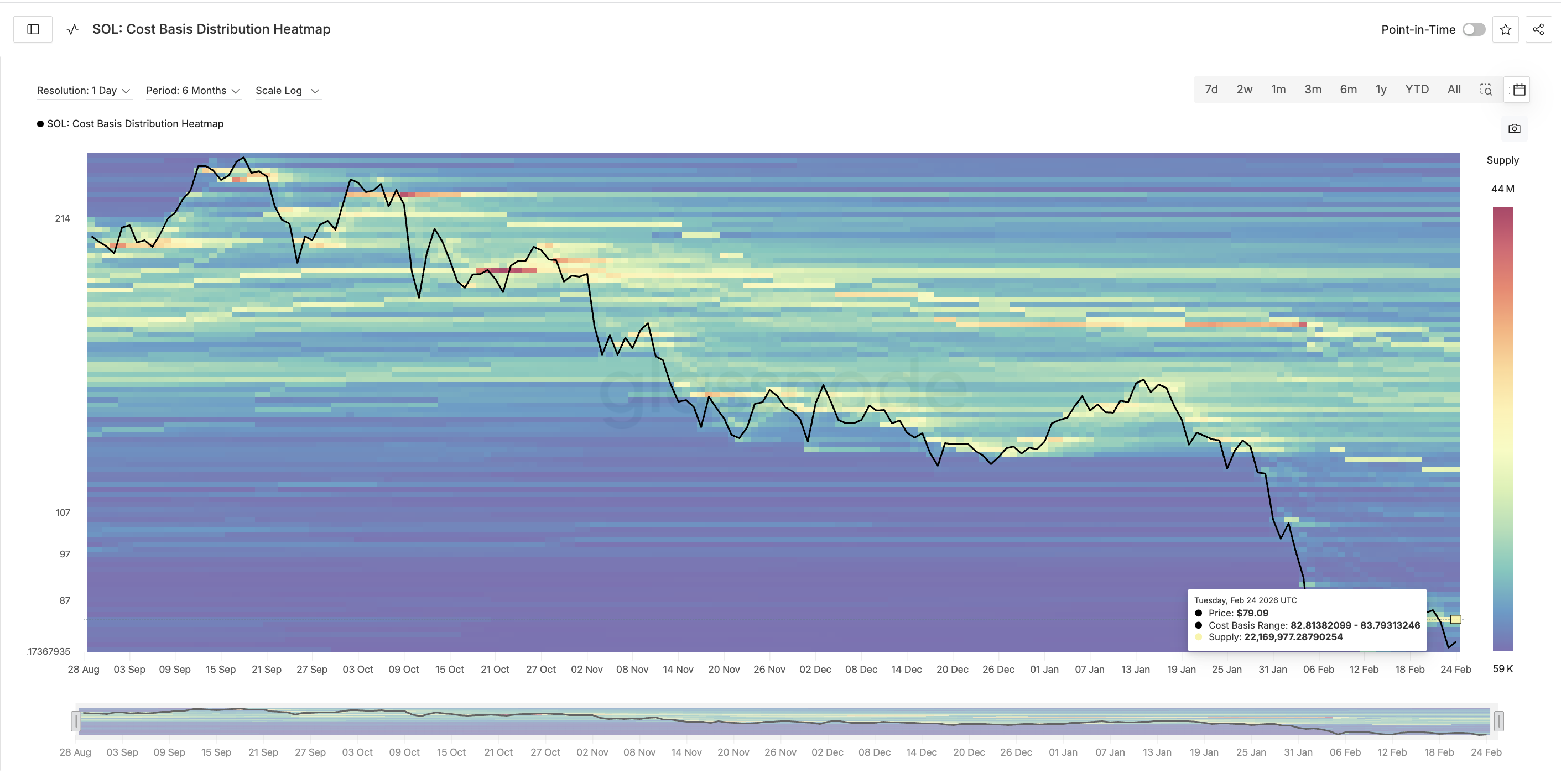

Why Solana’s 9% Price Bounce Is Failing to Convince Its Strongest Holders

XRP’s 20% Bearish Bait Keeps Trapping Traders — Charts Reveal the Next Risk Zone