- Bitcoin is firmly placed above the $83K level, reflecting unstinting bullish pressure as it makes consistent strides towards the pivotal $91,300 resistance level.

- A series of consecutive, strong bullish candles highlights relentless market demand and ongoing buyer control with minimal or no selling pressure to be observed.

- Momentum indicators like a construction RSI and bullish MACD crossover continue to indicate accelerating upside potential based on rising buying momentum and mounting confidence in the market.

Bitcoin currently trades at $87,999 on Binance, demonstrating steady bullish momentum. Price action confirms recovery from March lows near $78,000. A breakout above the $83,000 resistance further supports continued upside movement.

Technical Chart Insights from TradingView

Bitcoin’s price shows consistent bullish candles between March 17 and March 25. Price holds above $83,000 with small-bodied candles and minimal selling pressure. The volume indicator reveals growing participation, strengthening bullish confidence.

Source: TradingView

The RSI stands at 53.65, reflecting moderate bullish momentum with room for upward movement. MACD shows a bullish crossover, supported by rising green histogram bars. Candlestick patterns form higher lows, indicating persistent demand with controlled price expansion.

The price approaches the key $91,300 resistance level, marked on the chart. This level represents previous rejection points from January and February. The breakout zone between $83,000 and $88,000 now acts as support for further upside potential.

Key Resistance and Market Analyst Projections

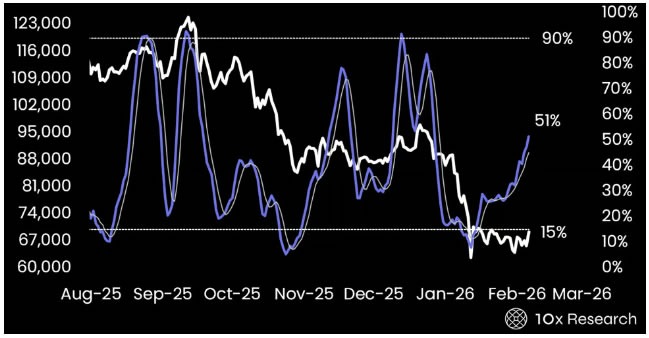

According to CrypNuevo, $91,300 stands as the key resistance level in the current market structure. This matches rejection zones seen during January and February trading periods. A confirmed break above this level could lead to stronger bullish continuation.

CrypNuevo reports strong buying pressure following the 1-week 50 EMA bounce. The support zone between $78,000 and $83,000 acted as an accumulation area. He also notes minimal downward corrections as buyers maintain control.

Source: CrypNuevo

Additional insights from CrypNuevo show steady upward momentum supported by a clear bullish market structure. Recent short candle wicks reflect controlled buying pressure with little rejection. The market now focuses on breaking the $91,300 resistance to push toward higher levels.

Bitcoin continues to build on its strong bullish momentum , backed by sustained and rising trading volume. Buyers are demonstrating dominance across key support zones, steadily pushing price action toward the critical $91,300 resistance level.

According to CrypNuevo, the overall market structure remains firmly bullish, supporting further price increases as technical indicators, positive sentiment, and strong accumulation conditions all remain favorable for continued upside movement.