President Donald Trump is set to announce new U.S. tariffs on the country’s global trading partners on Wednesday afternoon and bitcoin is trending upward on the news.

The digital asset saw a modest 1.93% gain over the past 24 hours, bringing its price to $86,478.86 at the time of reporting, according to Coinmarketcap. Despite this short-term uptick, BTC remains slightly down 0.31% over the past seven days.

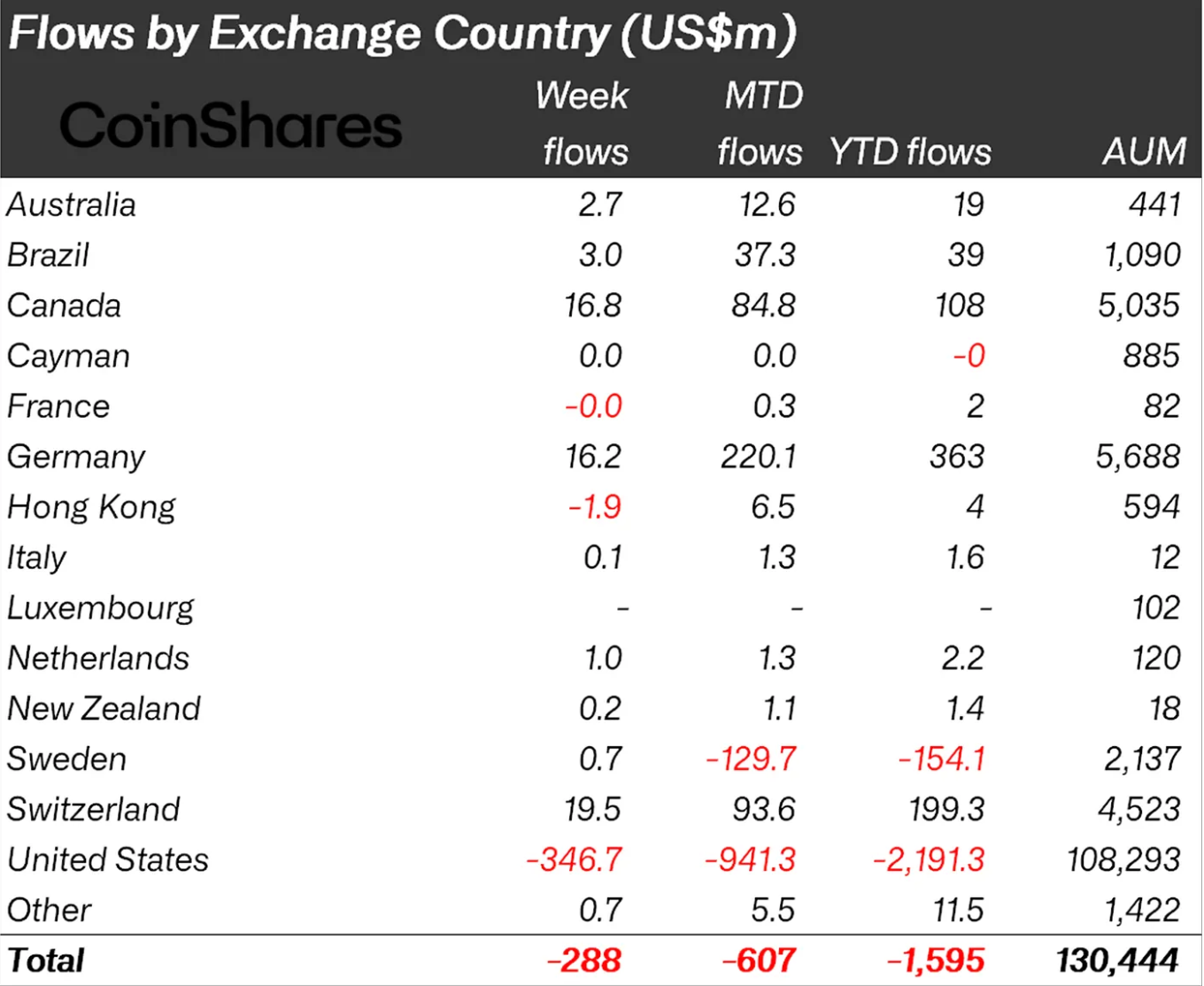

( BTC price / Tradingview)

Bitcoin’s 24-hour price range fluctuated between $83,939.88 and $86,521.54, showing resilience after recent market fluctuations. Trading volume increased by 8.53%, reaching $28.77 billion, indicating renewed market activity ahead of Trump’s trade announcement. Meanwhile, BTC’s market capitalization rose by 1.98% to $1.71 trillion.

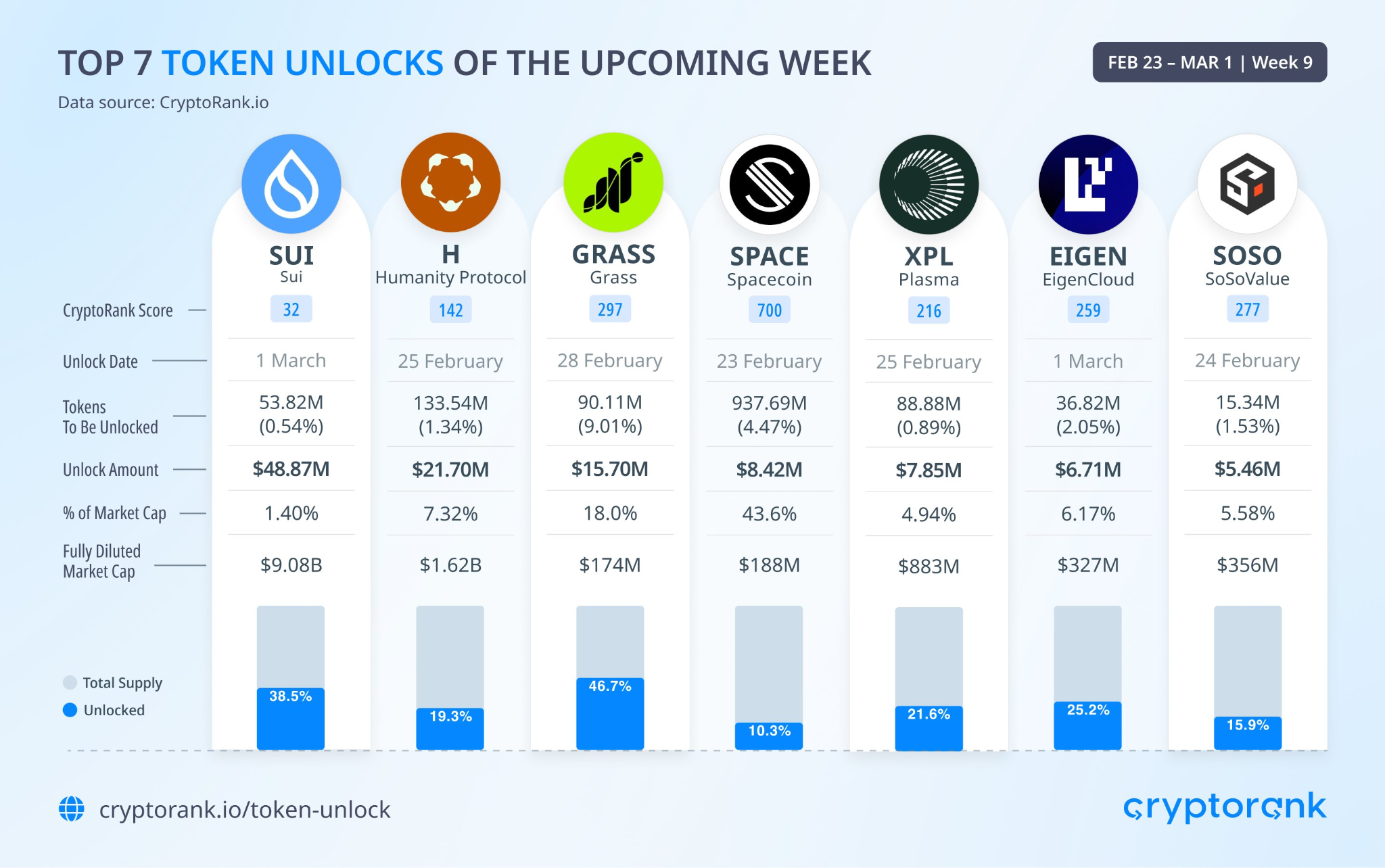

Despite ongoing uncertainty, BTC dominance continued its upward trajectory, climbing 0.64% to 62.92%, highlighting its strength against altcoins. Additionally, BTC futures open interest surged 4.31% to $56.53 billion, reflecting heightened investor engagement.

( BTC dominance / Trading View)

Short sellers found themselves on the losing end once again, as $12.93 million in liquidations occurred over the past 24 hours, $12.91 million of which were short positions. This indicates that many traders incorrectly bet on a BTC decline, forcing them to exit their positions.

Trump has dubbed April 2nd “Liberation Day” in the U.S. and is set to kick off a trade war with the country’s global trading partners when he officially announces new sweeping tariffs on Wednesday afternoon at 4 p.m. eastern standard time.

The move could bolster bitcoin’s price as tariffs may weaken the U.S. dollar, driving investors to safe-haven assets such as gold and BTC.

While bitcoin remains somewhat volatile, today’s tariff decision could act as a catalyst for BTC’s next move. If markets perceive Trump’s trade policies as disruptive to traditional financial stability, bitcoin could break higher toward the $90,000 mark in the near term. But if the announcement fails to shake global markets, BTC may continue consolidating within its current range.