Former "Hawk King" of the Federal Reserve: Expecting a 100 basis point rate cut is too naive, Powell won't clean up Trump's tariff mess

According to Odaily Planet Daily, the Trump administration's epic tariffs on most imported goods may be too much for the Federal Reserve to mitigate. Former "Hawk King" and ex-New York Fed Chairman Bill Dudley warned that market expectations of more than 100 basis points in rate cuts this year are "too naive," only a full-blown recession could make it possible. Inflation might surge to 5% in the next six months, and economic growth could halve to 1%, putting the Fed into a dilemma of "raising rates accelerates recession, cutting rates worsens inflation". Don't expect the Fed to save the U.S. economy dragged down by tariffs; now, the only question is: how deep will be the damage.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

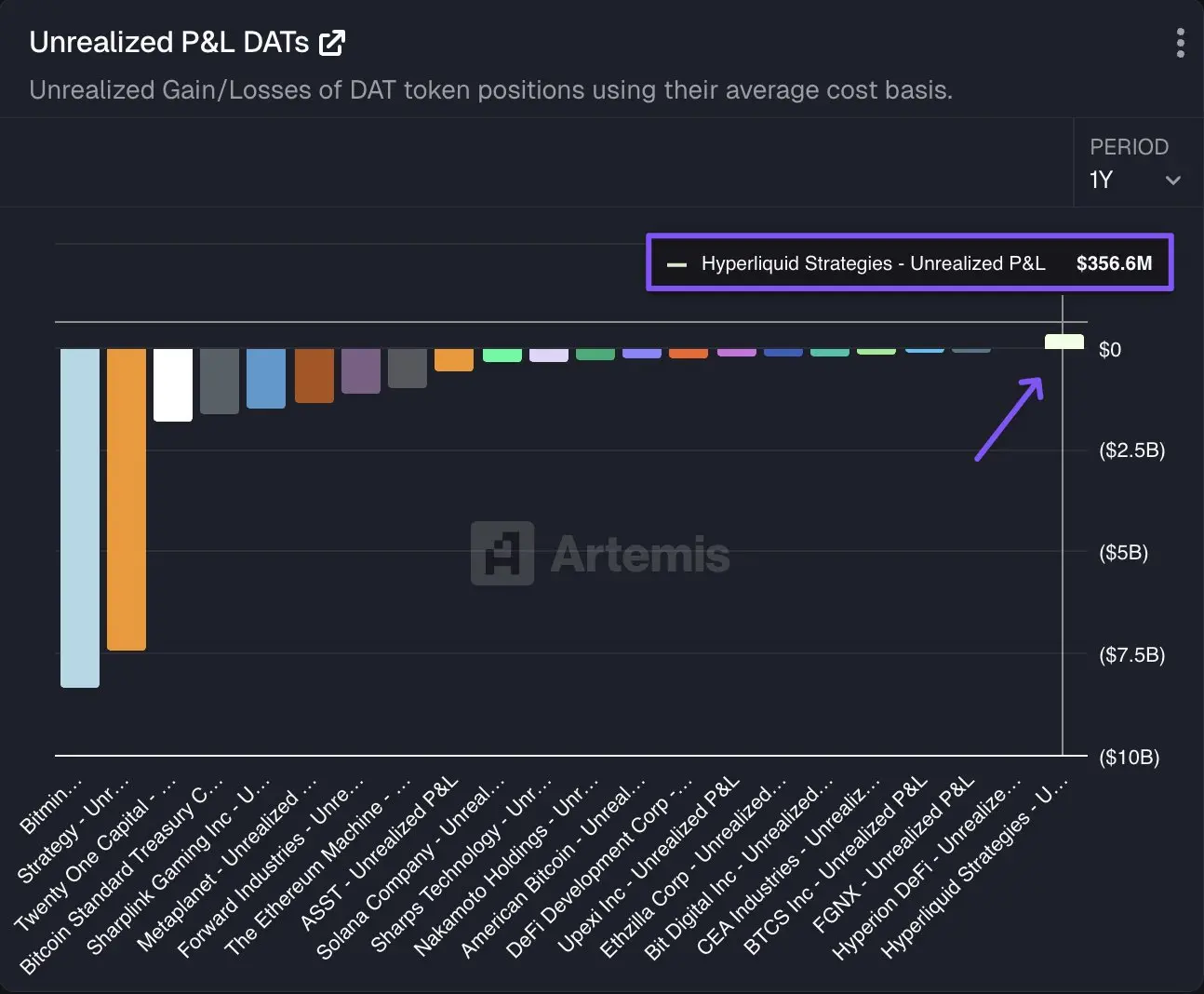

Artemis: Hyperliquid Strategies is the only profitable DAT, with a book profit of $356 million

The domestic gold jewelry price surpasses 1,600 yuan per gram