BTC volatility over the past week is slightly above yearly average: K33

There are signs of cautious optimism in the crypto markets for now

This is a segment from the Empire newsletter. To read full editions, subscribe .

When looking at data throughout the market, it’s fairly easy to find some bright spots right now.

For example, BTC volatility offers a “sharp contrast” to that of equities, according to K33.

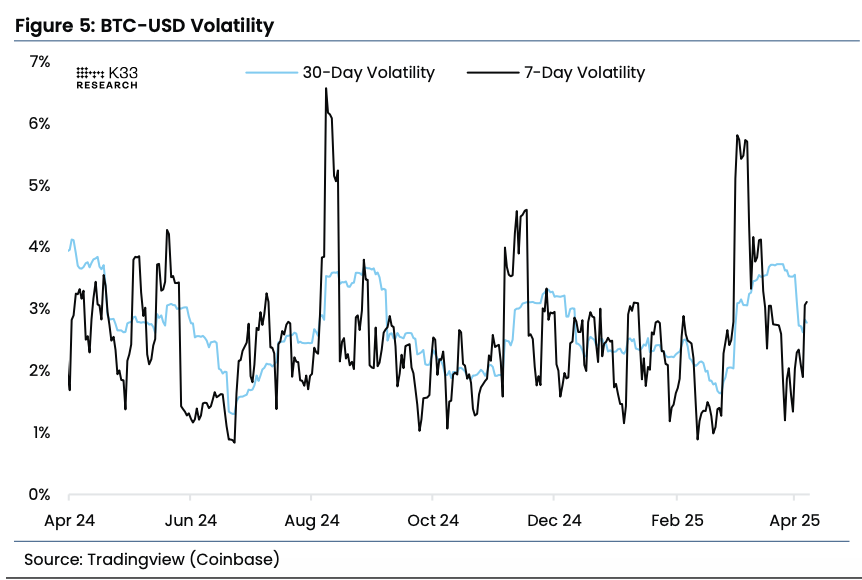

“Following its massive sell-off, the SP 500 recorded its largest one-week volatility since April 2020, whereas BTC’s 7-day volatility of 3.1% sits moderately above its 1-year average 7-day volatility level of 2.5%,” analysts wrote.

“This orderly and relatively regular 7-day volatility of BTC amidst the broad market chaos is an unusual sight to behold, as steep movements in equities tend to be mirrored by even sharper BTC moves.”

Source: K33

Source: K33

This supports another piece of data you all know I’m fond of: CME trader sentiment. As of last week, traders were holding on to their defensive positions, but seemed relatively unfazed by what was happening in equity markets.

“CME yields are starting to show a mild uptrend over recent weeks, indicative of slightly improved market sentiment. However, current premiums remain soft at 6.3%, reflecting cautious positioning, while open interest remains flat at 11-month lows. VolatilityShares outflows largely offset inflows from active market participants, as the futures-based ETF now holds 43,930 BTC – its lowest level since July 2024,” the analysts wrote.

The real test will be looking at this same data in a week to ensure it’s holding up, given that volatility has taken us on some wild rides so far this week. My read right now is that cautious positioning without panic is a good sign. Though, after this week (and, yes, it’s only Wednesday), I’m not sure that’ll still be the case.

Get the news in your inbox. Explore Blockworks newsletters:

- Blockworks Daily : The newsletter that helps thousands of investors understand crypto and the markets, by Byron Gilliam.

- Empire : Start your morning with the top news and analysis to inform your day in crypto.

- Forward Guidance : Reporting and analysis on the growing intersection of crypto and macroeconomics, policy and finance.

- 0xResearch : Alpha directly in your inbox. Market highlights, data, degen trade ideas, governance updates, token performance and more.

- Lightspeed : Built for Solana investors, developers and community members. The latest from one of crypto’s hottest networks.

- The Drop : For crypto collectors and traders, covering apps, games, memes and more.

- Supply Shock : Tracking Bitcoin’s rise from internet plaything worth less than a penny to global phenomenon disrupting money as we know it.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From yen rate hikes to mining farms shutting down, why is bitcoin still falling?

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The Economist: The Real Threat of Cryptocurrency to Traditional Banks

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

Grayscale's Top 10 Crypto Predictions: Key Trends for 2026 You Can't Miss

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.

From Yen Interest Rate Hike to Mining Farm Shutdown, Why Is Bitcoin Still Falling

The market is down again, but this may not be a good buying opportunity this time.