AAVE surges 13% as buyback proposal approved by tokenholders

Aave’s (CRYPTO:AAVE) governance token, AAVE, experienced a 13% price rally on April 9 following the approval of a buyback proposal aimed at revamping the protocol’s tokenomics.

Over 99% of AAVE tokenholders supported the initiative, which allows the decentralised finance (DeFi) platform to purchase $4 million worth of AAVE tokens in the first month, with plans to extend the buyback to $1 million weekly for six months.

The buyback program is part of a broader overhaul proposed by the Aave Chan Initiative (ACI), led by Marc Zeller.

The initiative seeks to enhance liquidity, redistribute revenue, and introduce new governance structures such as the Aave Finance Committee (AFC).

The AFC will oversee treasury operations and execute buybacks to reduce circulating supply, potentially increasing token scarcity and value.

“This is a first step toward sustainably increasing AAVE acquisition from the open market and distributing it to the Ecosystem Reserve,” the proposal stated.

The move reflects a growing trend among DeFi protocols to implement buybacks as a mechanism to boost investor confidence and align tokenholder interests with protocol growth.

Aave remains one of the largest DeFi platforms, with over $17.5 billion in total value locked (TVL), according to DefiLlama.

The platform generates an annualised fee income of approximately $350 million, underscoring its strong financial position.

The buyback program is expected to leverage these revenues while maintaining long-term sustainability.

The proposal also introduces additional measures, including liquidity enhancements through an “Umbrella” safety system designed to prevent bank runs and protect users from bad debt.

The system strengthens liquidity commitments by requiring assets to remain in the protocol until maturity.

At the time of reporting, the Aave (AAVE) price was $139.06.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

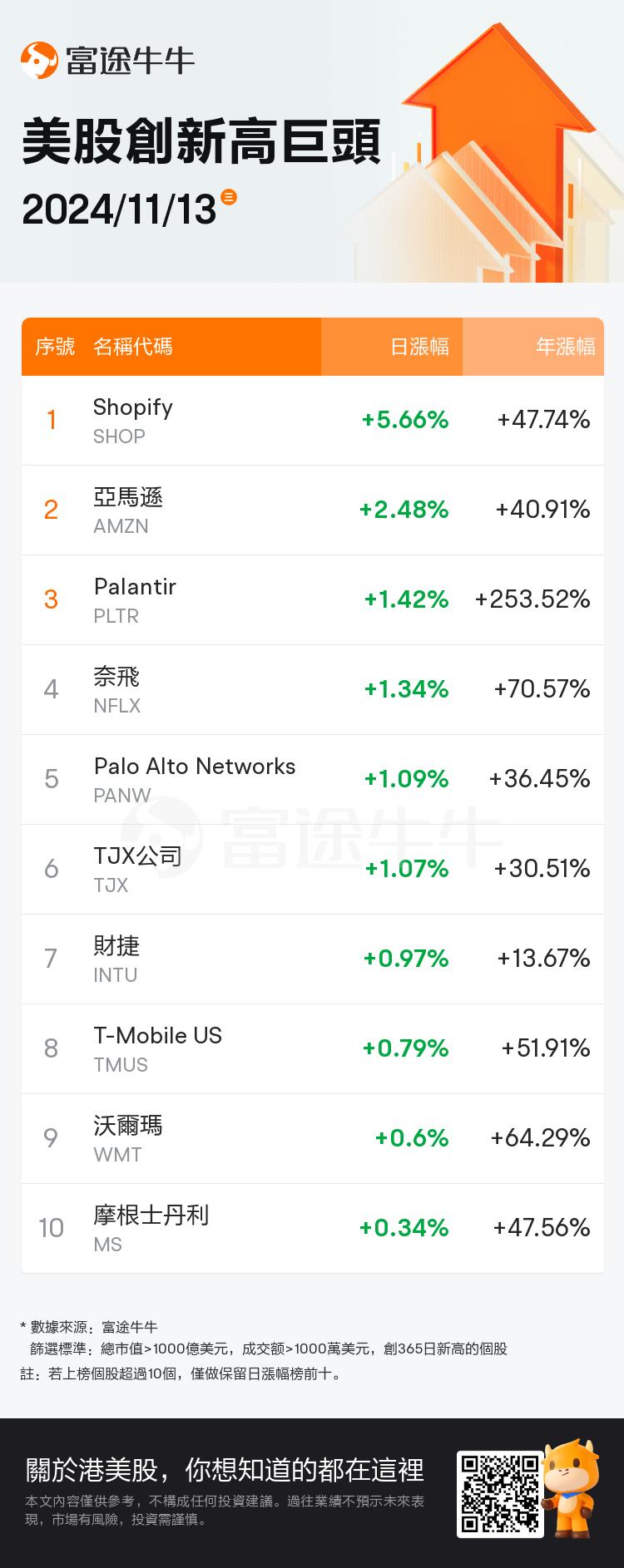

美股掘金 | 股价创历史新高!亚马逊年内暴涨40%;绩优股再度狂飙!Spotify携博彩巨头Flutter共创新高

Einride secures $113 million in an oversubscribed PIPE prior to SPAC merger

Pundit Says XRP Is About to Go Nuclear Based On Recent Ripple CEO Statement

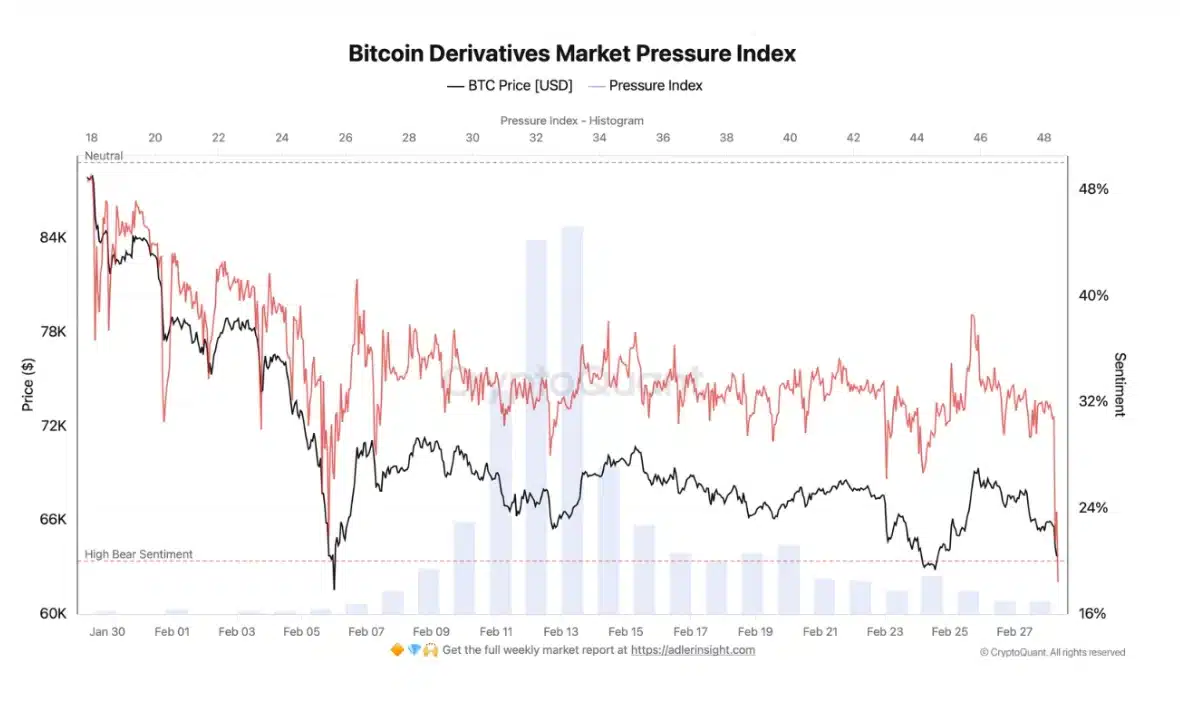

$1.8B in 60 minutes: How war headlines triggered historic leverage purge