Alleged Hack of DeGods CEO Frank’s Wallet After Exit Sparks Debate

Just days after stepping down, DeGods founder Frank allegedly lost 16 NFTs in a hack. Now, the crypto world is split: was it real—or a calculated exit?

The sale of 16 DeGods NFTs from the Solana wallet of former DeGods CEO Rohun Vora, popularly known as Frank DeGods, has sparked intense debate within the crypto community.

The unexpected move has led to speculation about his motives and timing. Notably, the bulk sale occurred just three days after Frank officially announced his resignation as CEO of DeGods.

Frank’s Resignation and the Sudden Sale of 16 NFTs

Frank DeGods, the founder of DeGods, announced his resignation as CEO via his X account on May 12, 2025. He shared that he would step down from leadership after three years of dedication.

“I dedicated 3 years of sleepless nights trying to make DeGods & y00ts a success. I’m proud of the work I did. I’m excited to hand the resign to the team and watch them cook. maybe we’ll look back at this fixation on ‘frank degods’ as the thing that was holding us back,” he said on X.

Just days after the resignation announcement, Frank’s Solana wallet was compromised, leading to the sale of 16 DeGods NFTs on the Magic Eden platform.

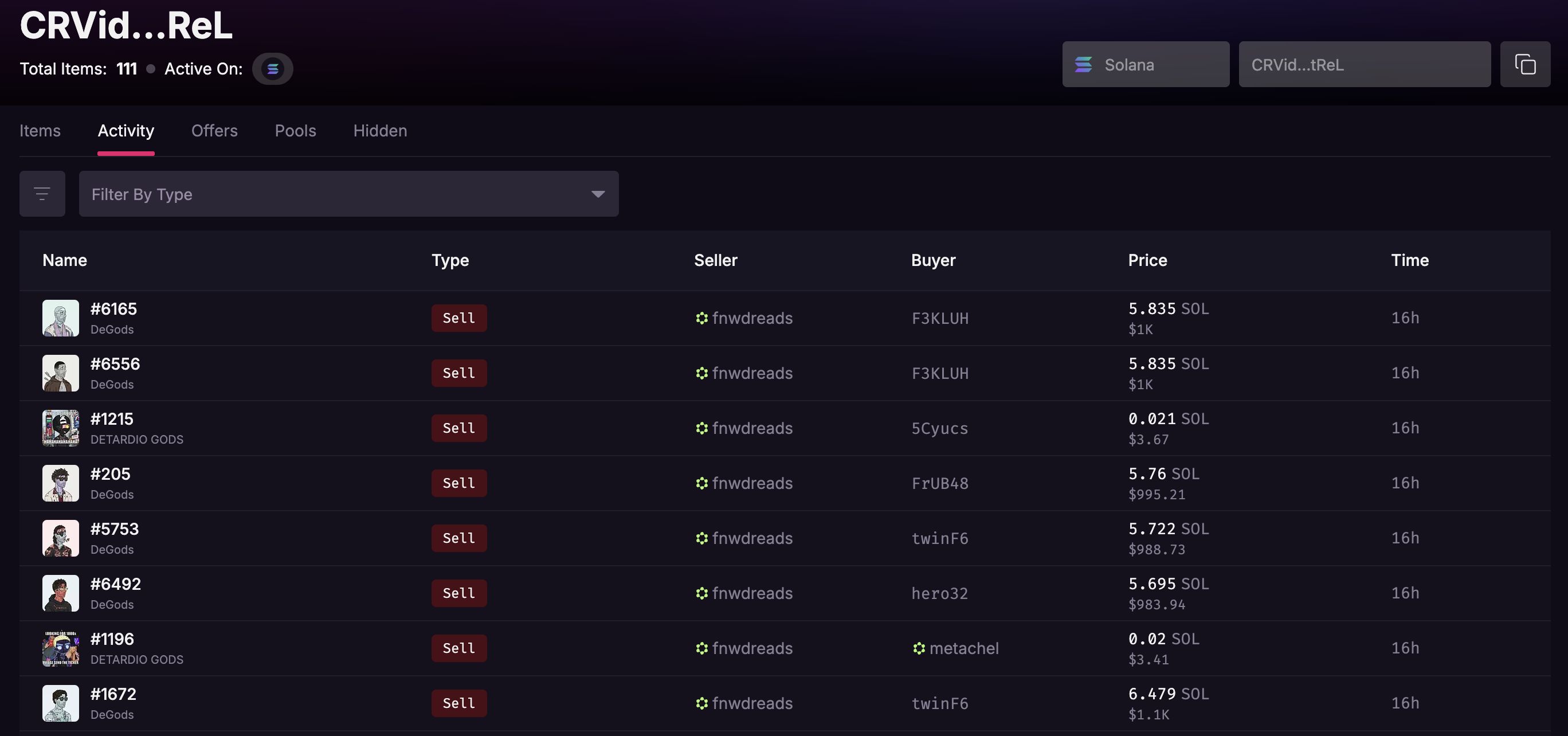

List of Frank’s NFTs Sold on Magic Eden. Source:

Magic Eden

List of Frank’s NFTs Sold on Magic Eden. Source:

Magic Eden

According to a Discord chat allegedly from the DeGods team, Frank’s account was hacked. The laptop he used for transactions was compromised, allowing the hacker to earn over 108 SOL, equivalent to nearly $19,000, from the stolen NFTs.

A Hack or Did Frank Sell the NFTs Himself?

Frank and the team insist this was a hack. However, the crypto community remains divided, with some believing the claim and others questioning its motives.

“I’m not seeing any other assets stolen. So the hacker was kind enough to only sell his degods and nothing else?” an X user questioned.

Another X user claimed that the timing of the sale is suspicious. Meanwhile, other users suggested the incident might be a staged move to allow Frank to exit the project without backlash.

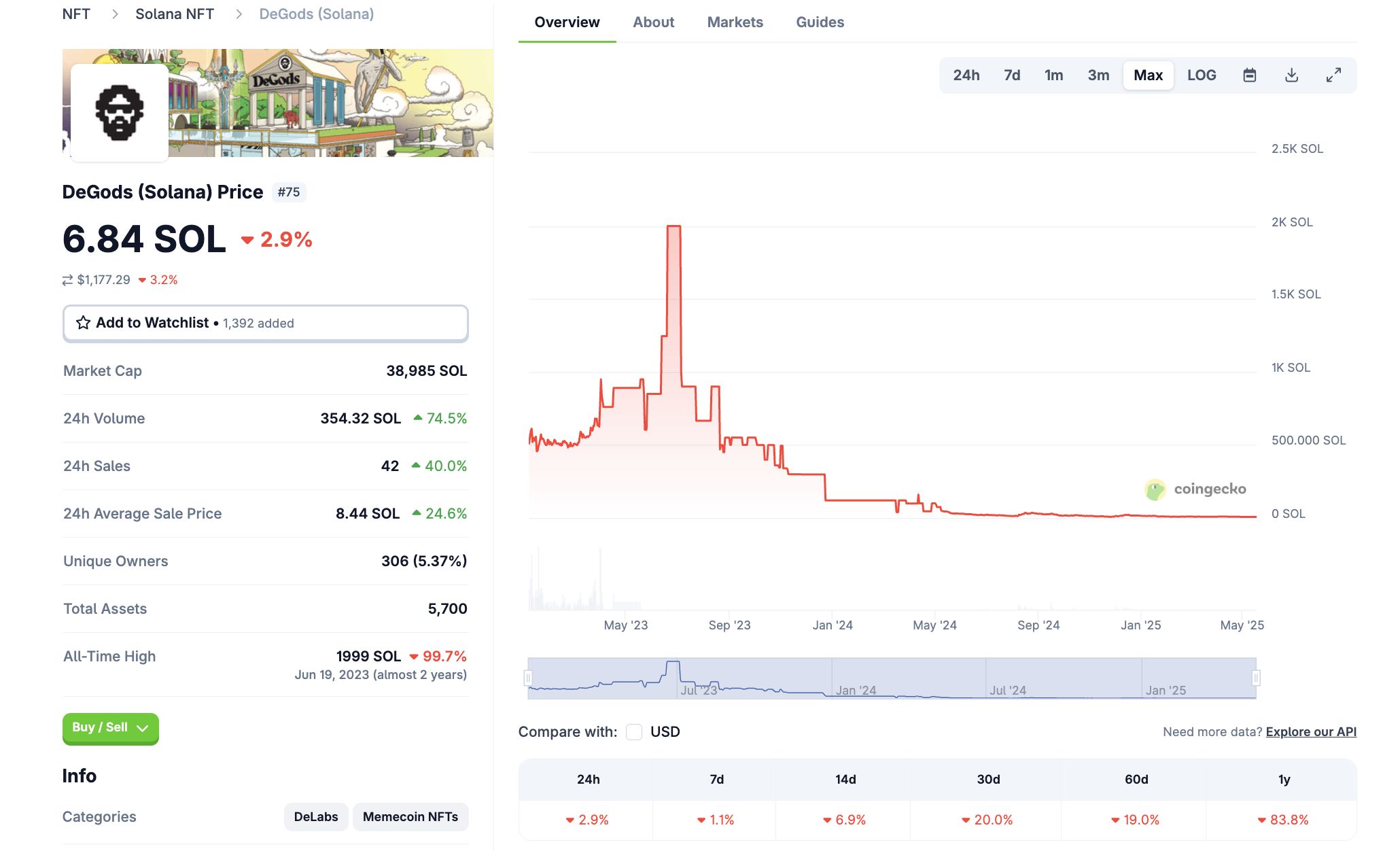

These suspicions aren’t baseless. The timing of the hack, immediately following Frank’s resignation, raises questions about intent. Additionally, DeGods’ value has significantly declined from its peak of over $37,000 to just $1,000.

Some speculate Frank may have chosen this moment to “cash out” before the NFT’s value drops further. However, no concrete evidence supports these accusations, and Frank maintains he was the victim of a cyberattack.

DeGods NFT Performance on Solana. Source:

CoinGecko

DeGods NFT Performance on Solana. Source:

CoinGecko

This decline reflects broader NFT market sentiment, which has cooled significantly since the 2021-2022 boom.

Moreover, DeGods has faced controversy before, particularly with its decision to migrate from Solana to Ethereum and later return to Solana, alienating parts of its community. These choices and a lack of innovation and market pressures have eroded DeGods’ former prominence.

Whether genuine or orchestrated, Frank’s hack has amplified uncertainty, leaving investors questioning the project’s recovery potential.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Safe Bulkers at the Capital Link Forum: Steering Dry Bulk Operations Amid Changing Macro Trends

Vitalik Buterin Urges Ethereum to Broaden Its Mission Beyond Finance

Global investors pull back from top AI stocks amid rising concerns over oil supply

Geopolitical Disruptions in Commodity Markets: Evaluating the Effects on the Broader Economic Cycle