Bitcoin Price Analysis: Is BTC Out of the Woods After 8% Correction?

Bitcoin has faced notable selling pressure at the $111K range, leading to a bearish rejection. Nevertheless, the price lacks sufficient bullish momentum and a deeper correction seems plausible in the mid-term.

Technical Analysis

The Daily Chart

Following its breakout above the previous all-time high at $109K and printing a new peak at $111K, Bitcoin met strong resistance that has sparked notable selling pressure. The failure to sustain momentum above this key psychological level has resulted in a bearish rejection, pushing the asset back below the $109K threshold.

This price action coincided with the sweep of buy-side liquidity resting above the previous swing high, allowing smart money to execute sell orders efficiently. As a result, the market has entered a corrective phase, now approaching the daily fair value gap (FVG) between $97K and $100K. This zone likely holds substantial demand, potentially acting as a support zone that could trigger a bullish reaction.

Should the price stabilize within this FVG, a rebound toward the $111K resistance becomes likely. Conversely, failure to hold this level could pave the way for further downside, with the next key support residing near the $95K region.

The 4-Hour Chart

On the 4-hour timeframe, intensified selling pressure at the $111K resistance has caused BTC to break below its previously maintained ascending price channel. The subsequent pullback toward the broken channel boundary near $108K has confirmed the bearish breakout and suggests weakening momentum.

Currently, the price is consolidating within a critical support-resistance band spanning from $100K to $108K. As long as Bitcoin remains within this range, short-term volatility is expected. However, a decisive breakout, either above $108K or below $100K, will likely set the tone for the next significant move, with either a bullish recovery or an extended correction unfolding based on the breakout direction.

On-chain Analysis

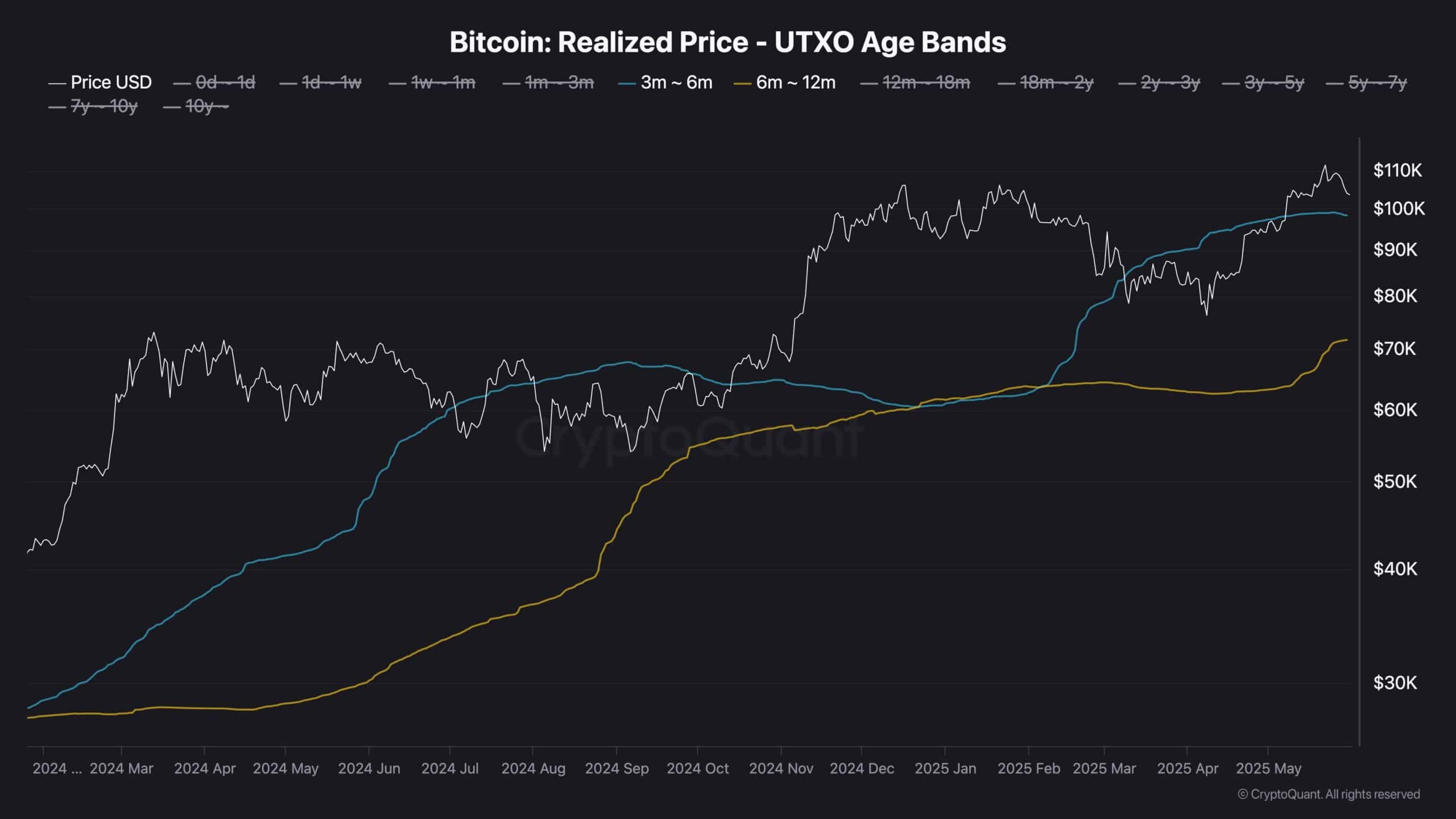

The Realized Price of mid-term holders has consistently functioned as a pivotal support or resistance zone, making it a valuable indicator for gauging broader market sentiment. This metric, representing the average on-chain acquisition cost of UTXOs held by long-term investors, often aligns with key turning points in Bitcoin’s price cycle.

Currently, Bitcoin remains positioned above the Realized Price of the 3–6 month holder cohort, a signal that this group remains in profit and has not faced significant stress. However, recent selling pressure and a rejection from the $111K level have dragged the price closer to the Realized Price of the 3–6 month holder range, which resides around the $98K zone.

This places the $98K–$100K area in the spotlight as a crucial support region. A firm reaction from this zone would confirm continued confidence from mid-term holders and may act as the launchpad for a renewed bullish leg, potentially propelling Bitcoin to fresh all-time highs. Failure to hold this support, however, could shift market sentiment and open the door to deeper corrections.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster Introduces Shield Mode: A Protected High-Performance Transaction Mode for On-Chain Traders

Shield Mode is not just a standalone feature upgrade, but rather a part of Aster's larger vision.

Assessing How COAI's Abrupt Price Decline Influences Technology and Security Shares: Shifts in Sector Risk and Changes in Investor Sentiment After the Crash

- COAI index's 88% 2025 collapse exposed fragility of speculative crypto AI assets due to governance failures and regulatory uncertainty. - Institutional investors shifted capital to cybersecurity (e.g., CrowdStrike) and AI infrastructure (Nvidia) as post-crash safe havens. - Divergent investor psychology emerged: 60% retail optimism vs. 41% institutional skepticism toward AI valuations. - U.S. AI Action Plan and cybersecurity policies accelerated capital reallocation to secure-by-design infrastructure and

Ripple celebrates milestones – while XRP struggles below USD 2

MicroStrategy retains its place in the Nasdaq-100 despite Bitcoin dominance