Polymarket Bets 91% on Solana ETF Approval After VanEck’s VSOL DTCC Listing

VanEck’s Solana ETF VSOL is now registered with the DTCC, taking a significant step toward potential approval in 2025. Analysts are increasingly confident about its success, with expectations for Solana's broader financial adoption rising.

VanEck’s proposed spot Solana ETF (exchange-traded fund) is officially registered with the DTCC (Depository Trust & Clearing Corporation) under the ticker VSOL. This marks a major step toward potential regulatory approval.

The listing signals increasing momentum behind institutional adoption of Solana and pushes the product closer to trading on US exchanges.

VanEck’s VSOL ETF Moves Closer to Approval After DTCC Listing

The DTCC listing, under the “active and pre-launch” category, confirms that the fund is eligible for future electronic trading and clearing pending approval from the US SEC (Securities and Exchange Commission).

It is imperative to note that VanEck’s VSOL cannot yet be created or redeemed. However, the firm views the listing as a key part of the launch process, though it does not guarantee approval.

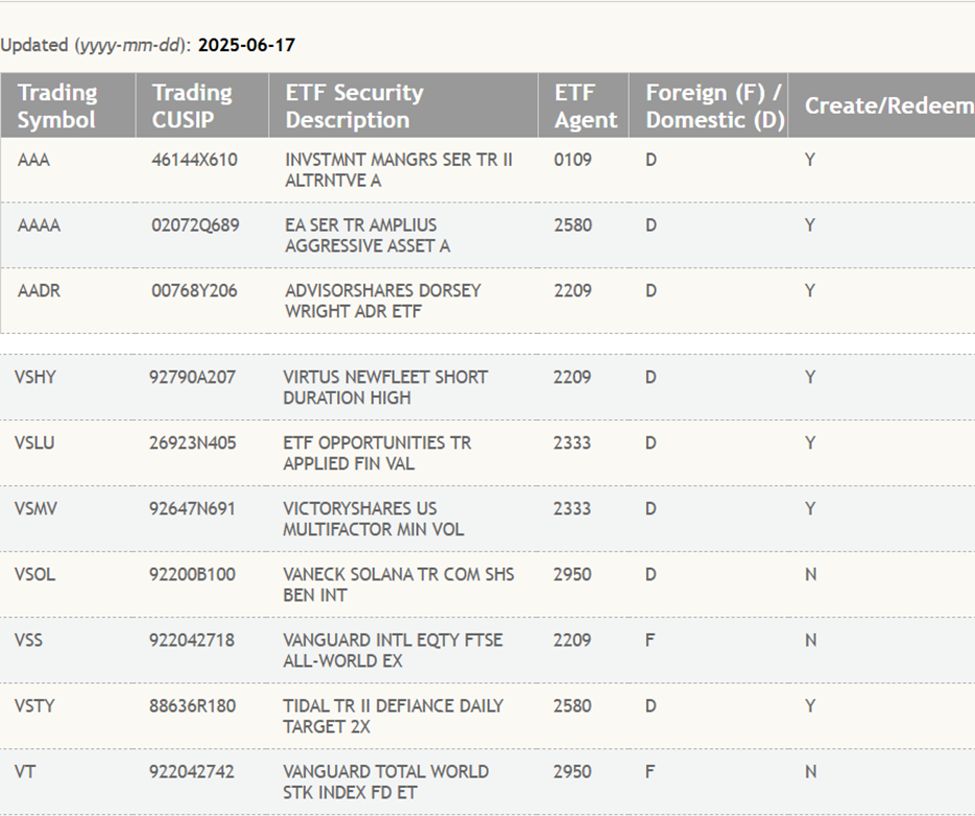

VanEck’s VSOL Solana ETF on DTCC List. Source:

DTCC List of ETFs Active and Pre-Launch

VanEck’s VSOL Solana ETF on DTCC List. Source:

DTCC List of ETFs Active and Pre-Launch

Bloomberg ETF analysts James Seyffart and Eric Balchunas estimate that the SEC could soon approve the fund, among other things. However, this forecast is contingent on filings progressing smoothly.

“SEC is engaging on S-1 for Solana Staking ETFs and that’s a *very* positive sign. Still, timelines for approvals are less certain IMO,” Seyffart noted in a post.

Indeed, this registration comes shortly after the SEC instructed issuers to submit amended S-1 filings for their Solana ETFs. Analysts say this signifies ongoing engagement between regulators and fund managers.

Several firms, including Bitwise, CoinShares, and Franklin Templeton, have entered the race to offer Solana-based ETFs. However, the SEC has delayed a decision on Franklin Templeton’s Solana ETF.

SEC DELAYS FRANKLIN SPOT SOLANA ETF

— Phoenix » PhoenixNews.io (@PhoenixNewsIO) June 17, 2025

VanEck has previously introduced Bitcoin and Ethereum futures ETFs and multiple global digital asset funds. It aims to offer regulated exposure to next-generation blockchain networks like Solana.

SEC Engagement and Polymarket Odds Signal Growing Confidence in Solana ETF

While the SEC has already approved spot ETFs for Bitcoin and Ethereum, Solana remains waiting. However, optimism is growing.

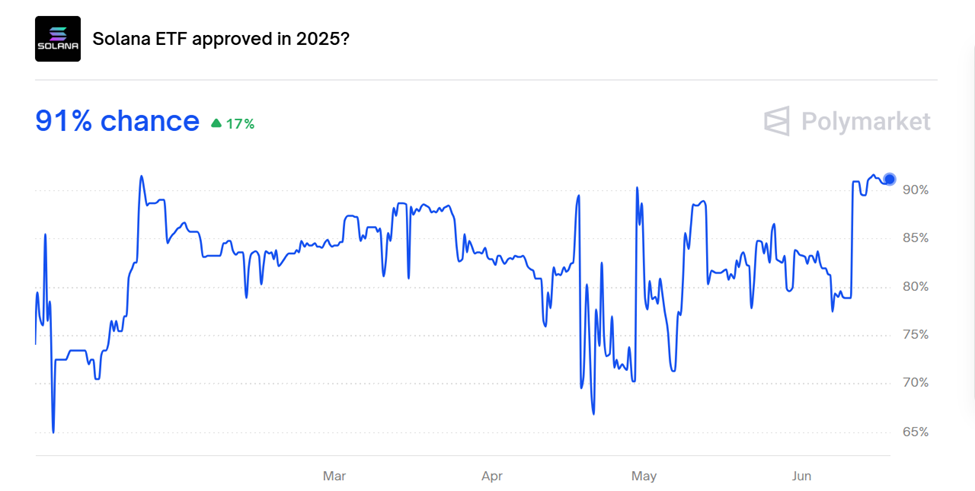

On the decentralized prediction platform Polymarket, traders now assign a 91% probability that a Solana spot ETF will be approved in 2025.

Solana ETF Approval Odds. Source:

Polymarket

Solana ETF Approval Odds. Source:

Polymarket

The DTCC’s recognition of VSOL follows a trend of growing institutional readiness. Earlier this year, the organization also listed futures-based Solana ETFs, SOLZ and SOLT, though those remain in redeemable-only status.

Beyond ETFs, DTCC has signaled deeper interest in blockchain infrastructure, including plans to launch a stablecoin and tokenized collateral platform.

Solana’s high transaction throughput, active developer ecosystem, and growing DeFi and NFT use cases have positioned it as a credible contender for mainstream financial products.

The SEC’s willingness to engage spot Solana ETFs and its approval of Solana’s futures on the CME suggest the network could soon become the third crypto to gain full ETF status in the US.

Though VanEck has not set an official trading date for VSOL, the appearance on DTCC’s list is a major milestone. If approved, VSOL could catalyze further ETF innovation, potentially including staking-enabled products or multi-asset crypto baskets.

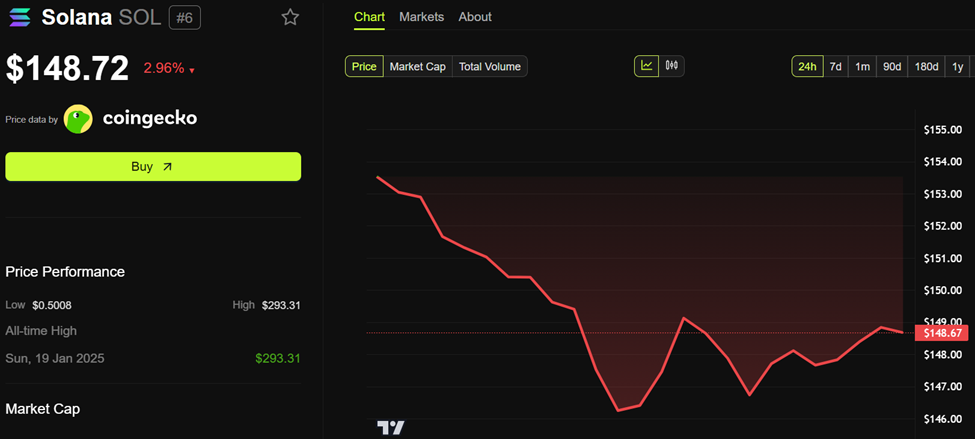

Solana (SOL) Price Performance. Source:

BeInCrypto

Solana (SOL) Price Performance. Source:

BeInCrypto

The move could also drive a Solana price surge. However, despite the DTCC listing, SOL was trading for $148.72 as of this writing, down nearly 3% in the last 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UCB's 2025 Outlook: What Has Been Factored In and What Lies Ahead?

Ecovyst’s Q4: Outperforms, Yet Updated Guidance Narrows Expectation Gap

Bitcoin shorts are stacking! Is the CLARITY deadline about to crash the market?

ThomasLloyd's SPAC Gamble: Creating the Foundational Layer for AI Energy Infrastructure