Here’s Why HBAR Traders Are Unaffected By Price Hitting 2-Month Low

Despite hitting a two-month low, HBAR traders remain optimistic, with key technical indicators pointing to a potential reversal if crucial support levels are maintained.

Hedera’s HBAR token has recently experienced a decline in price, hitting a two-month low after failing to end a month-long downtrend. Despite this, consistently bullish traders remain undeterred, holding on to their positions.

These traders continue to believe in HBAR’s potential for recovery despite the market’s current challenges.

HBAR Traders Remain Bullish

The funding rate for HBAR has remained positive overall, with only one dip into the negative zone, signaling continued confidence among traders. This steady bullish sentiment suggests that traders are convinced HBAR will eventually recover.

This sustained optimism is crucial for HBAR’s recovery. Traders are positioning themselves for a bounce, indicating that the recent price decline does not deter market participants. If this sentiment remains intact, it could fuel a reversal in the token’s price, helping it move past recent resistance levels.

HBAR Funding Rate. Source:

Coinglass

HBAR Funding Rate. Source:

Coinglass

On the technical side, the Relative Strength Index (RSI) for HBAR recently slipped into the negative zone but is now showing signs of a potential bounce back. This movement is typical of a market correction, and the RSI is currently indicating a reversal might be on the horizon.

If the bearish momentum continues, the RSI could enter the oversold zone, which is often a sign that a reversal is imminent. The RSI’s position is a key indicator that HBAR may soon experience a recovery. Historically, similar conditions in early April led to a price bounce.

HBAR RSI. Source:

TradingView

HBAR RSI. Source:

TradingView

HBAR Price Needs To Secure Support

Currently, HBAR is trading at $0.151, down 15.8% over the past week and under the resistance at $0.154. The altcoin is struggling to break free from its two-month low but is showing signs of recovery.

If the reversal indicators hold true, HBAR could bounce back from its current low. To solidify this recovery, HBAR would need to secure both $0.154 and $0.163 as support floors. Holding these levels would provide a strong foundation for further upward movement, signaling that the downtrend has ended.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

However, if geopolitical tensions worsen or broader market conditions negatively impact HBAR’s price, a further decline is possible. A breakdown below the $0.145 support level could push HBAR down to $0.139, invalidating the bullish outlook. This would mark a significant shift in the market sentiment and could lead to further price erosion for the token.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Up 37% Over the Last 6 Months, Does This Popular Networking Stock Still Have Room to Grow?

Ripple CEO Stuns XRP Army With Bombshell Statement for Banks

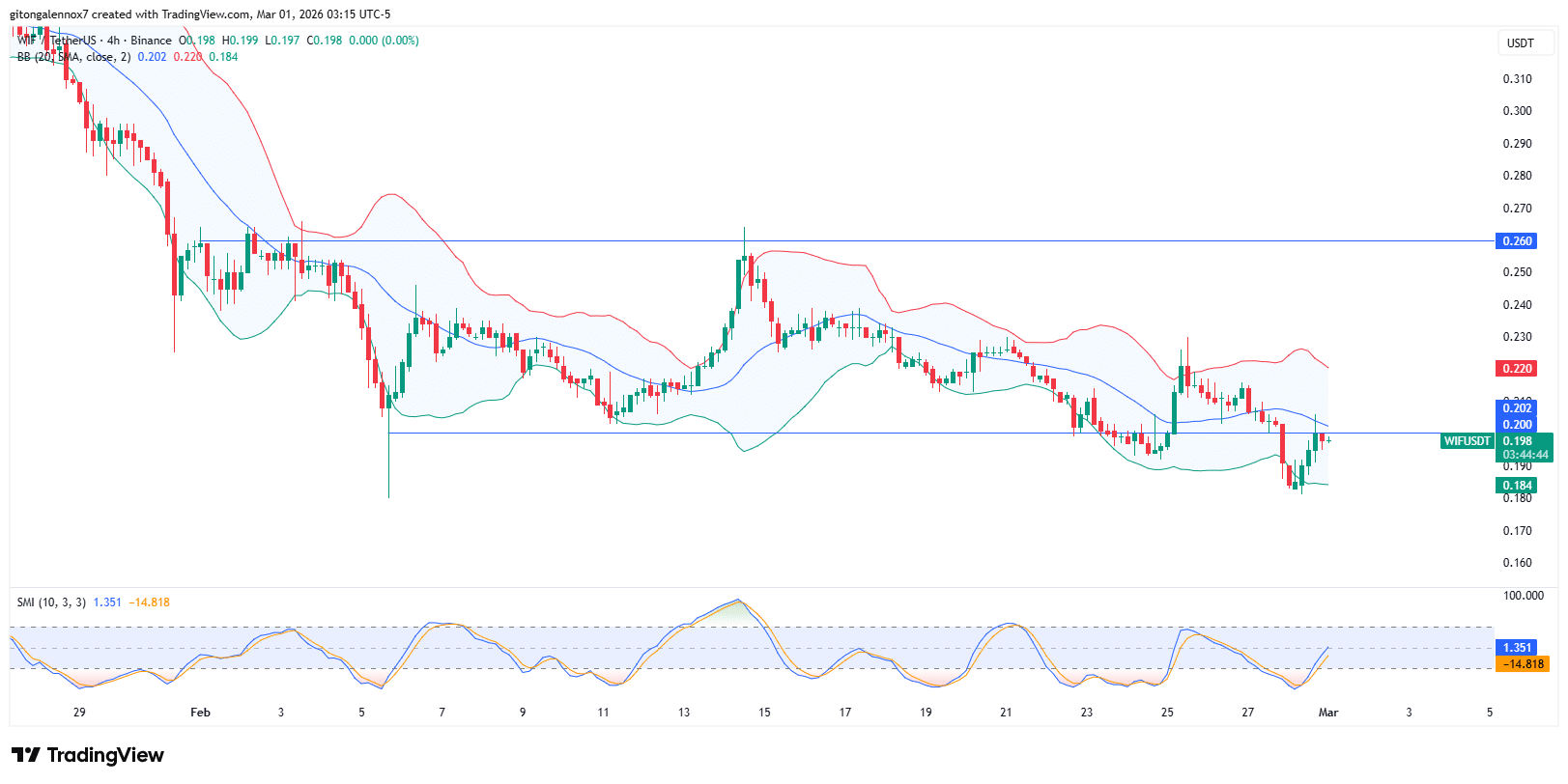

dogwifhat at $0.20: Reversal or further drop, what’s next for WIF?

"A sharp divide": Wall Street assesses the gains and losses as AI-fueled tech stocks tumble