US Senate All-Night Showdown on Trump’s Mega Bill Includes Crypto Tax Push

2025/07/04 03:05

2025/07/04 03:05The US Senate is locked in an all-night marathon as lawmakers debate President Donald Trump’s sweeping tax and spending package, with discussions stretching beyond 17 hours and expected to continue into early Tuesday morning in Washington, D.C.

Dubbed the “One Big Beautiful Bill Act,” the legislation has sparked a frenzy of proposed amendments in what is known as a vote-a-rama—a rapid-fire voting process that allows senators to add last-minute changes. Trump is pushing for the bill’s final passage by Friday, July 4.

The House narrowly passed the bill in May with a razor-thin margin of 215-214 votes. With the Republicans holding only a slim majority in the Senate, the outcome remains unpredictable.

Among the proposed amendments is a crypto-focused push from Republican Senator Cynthia Lummis, who aims to overhaul what she describes as the “unfair tax treatment” of digital assets .

For years, miners and stakers have been taxed TWICE. Once when they receive block rewards, and again when they sell it.

It’s time to stop this unfair tax treatment and ensure America is the world’s Bitcoin and Crypto Superpower. 🇺🇸

— Senator Cynthia Lummis June 30, 2025

Her amendment proposes tax exemptions for crypto transactions under $300, capped at a total of $5,000 annually, including stablecoins. It would also exclude most crypto lending agreements from taxation and defer taxes on airdrops, mining, and staking rewards until the assets are sold.

Additionally, the amendment seeks to extend the 30-day wash sale rule to crypto, effectively banning investors from selling digital assets at a loss and repurchasing similar ones within 30 days to claim tax benefits.

Earlier on Monday, senators blocked a Democrat-backed amendment seeking to ban government officials and their families from owning or promoting digital assets, including memecoins, NFTs, and stablecoins.

Additionally, Senator Adam Schiff introduced the Curbing Officials’ Income and Nondisclosure (COIN) Act. This bill seeks to restrict White House officials and their families from participating in cryptocurrency-related activities.

Senator Lummis opposed the measure, acknowledging its ethical intentions but warning it would harm US innovation and competitiveness.

Meanwhile, Elon Musk, who previously served under Trump as a cost-cutting czar before falling out with the former president, reignited tensions on Monday by threatening to launch a new political party if the bill passes.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AI Tailwind or Growth Test? CrowdStrike’s Earnings Could Ignite Cyber’s Next Surge

Analysts lift Circle's price target as oil spike and rate outlook buoy stablecoin trade

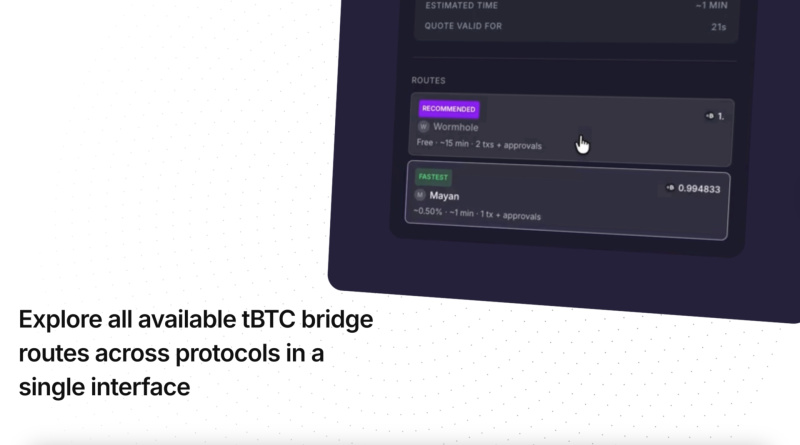

Threshold Launches All-in-One Bitcoin Liquidity App