Why Are Bitcoin and Altcoins No Longer Responding to Donald Trump’s Tariff Threats? Here Are Expert Opinions

While Bitcoin, Ethereum, XRP and Solana finished the day with slight increases today, the US's renegotiation with some of its foreign trade partners did not affect the crypto market much.

However, according to analysts, despite these positive developments, cryptocurrencies are still stuck in a narrow price range.

Bitcoin, for example, has traded largely between $107,000 and $110,000 in recent weeks. It’s up only 1.5% in the last 30 days, but it’s still close to its all-time high. Ethereum has been trading sideways at $2,500 for about a month, while Solana has also been stable around $150.

The decline in cryptocurrencies following the “retaliatory tariffs” announced by US President Donald Trump in April contrasts with the recent stability. Some investors are struggling to understand why the market remains resilient despite Trump’s latest tariff threats. But analysts say this is not surprising.

Experts say investors are less responsive to the US’s three-time postponement of negotiation deadlines and are more inclined to position themselves against macroeconomic uncertainty, allowing crypto assets to remain elevated despite the uncertainty.

Trump sent official letters on Monday to 14 countries, including Japan, South Korea and Thailand, warning them that he would impose aggressive tariffs. The tariffs, ranging from 25% to 40%, are expected to go into effect on August 1. However, a possible delay is also on the agenda.

Options analyst Bret Kenwell said investors believe Trump will delay the Aug. 1 tax cuts, which has even become the subject of a memecoin called “Trump Always Chickens Out.”

“If there is confidence that negotiations will continue or the deadline will be extended, the market may continue to ignore such headlines,” Kenwell said. He also noted that any pullbacks would be viewed as buying opportunities for investors, which could pull prices back into the current range.

Greg Magadini, director of derivatives at Amberdata, said investors have become accustomed to Trump’s volatile trade negotiations and are now more resilient to such macro developments.

Magadini also noted that institutional investors have been hedging their exposure to BlackRock’s iShares Bitcoin Trust ETF (IBIT) over the past seven months with options trading. Under this strategy, investors buy into the IBIT ETF, sell call options on it to generate income, and buy protective put options to reduce risk.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why “Time Traveler” Says XRP Is About to Explode

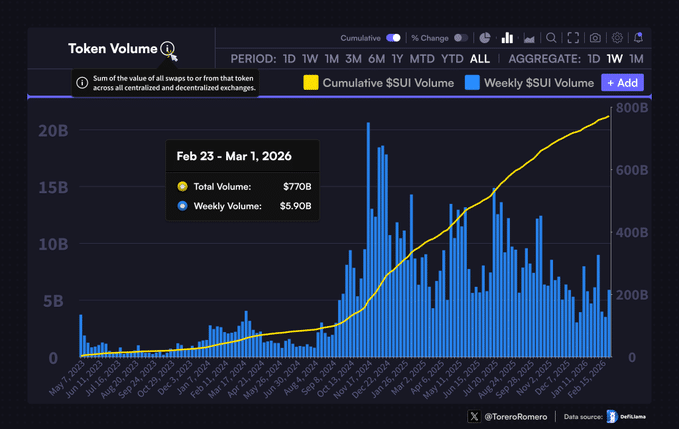

SUI compresses below $1.30, but $2.55 breakout is still possible – How?

After the bombings against Iran, Kalshi makes a decision that divides the community