Ant International Targets USDC Integration with AntChain with Regulatory Approval

- AntChain to Add USDC Following Regulatory Approval

- Stablecoin USDC May Expand Liquidations on Ant Network

- Ant International Seeks Stablecoin Licenses in Three Countries

Ant International, a subsidiary of Jack Ma's Ant Group, is preparing to integrate the USDC stablecoin into its proprietary blockchain, AntChain. The implementation is contingent on USDC's full regulatory compliance in the United States, according to statement released recently.

💥 Jack Ma is back through #blockchain !

With this initiative, Ant will have direct access to the second-largest dollar-backed stablecoin, strengthening its settlement and treasury infrastructure for international operations. In 2024, Ant's network handled over $1 trillion in cross-border transactions, supporting merchants and banks around the world.

Launched in 2020, AntChain already hosts digital assets issued by institutions such as JPMorgan, HSBC, and Standard Chartered. The integration of USDC will expand the network's portfolio, enabling tokenized settlements with greater efficiency and speed.

Circle, the issuer of USDC, is working to meet the requirements of the stablecoin bill approved by the U.S. Senate in June. Full compliance with these requirements will be essential for the partnership to move forward. Currently, dollar-pegged stablecoins move approximately $250 billion, and projections suggest this volume could exceed $2 trillion by 2028.

Ant International's initiative is also part of a regulatory expansion strategy. The company is seeking stablecoin operating licenses in Hong Kong, Singapore, and Luxembourg, which could pave the way for a potential IPO, with an estimated market valuation of between $8 billion and $24 billion.

Circle has expanded its presence in the sector, highlighting USDC as a tool for instant bank settlements. The company has partnered with providers such as OKEx and Stripe and applied for a national banking license in the US. USDC currently has a circulating supply of approximately $61 billion, second only to USDT.

The collaboration with Ant could position USDC in one of the largest payments ecosystems outside the US, reaching millions of users operating in more than 15 local currencies. So far, neither company has announced an official launch date or the parameters of the initial pilot.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP resilience vs. Bitcoin’s macro‑driven weakness: Impact on investor sentiment

Over $9 billion flees bitcoin and ether ETFs in four months

Gold: ING says geopolitical tensions boost demand for safe-haven assets

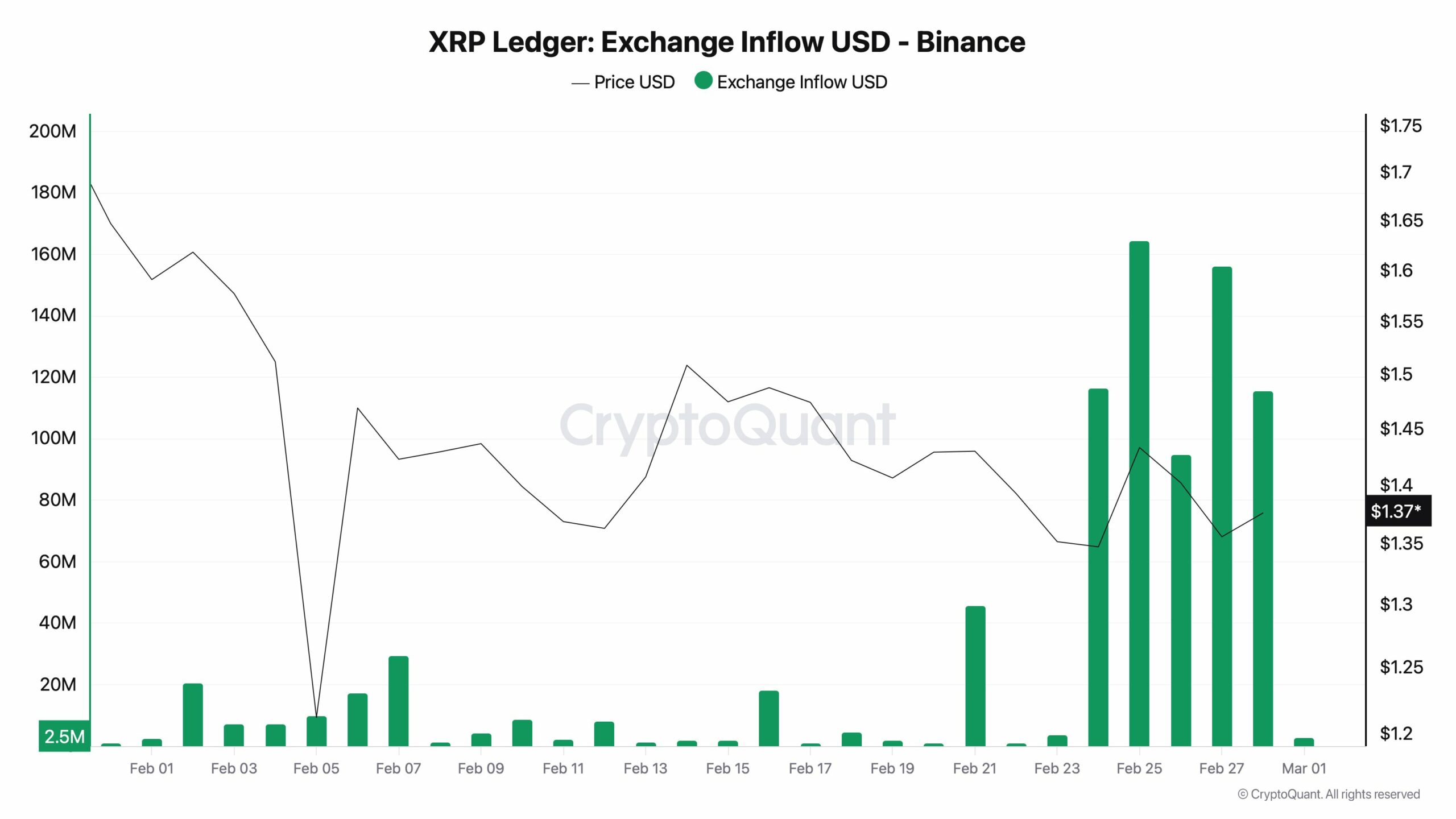

XRP Holds Crucial Support as On-Chain Data Hints at March Rally